The past two decades have seen a large increase in foreign bank entry across the globe, a trend that has been especially strong in the transition countries of Central and Eastern Europe and in Latin America. The effects of foreign bank participation on lending to small and medium enterprises (SMEs) have been a controversial issue among academics and policy makers alike. Critical issues in this debate have been different clienteles and lending techniques of domestic and foreign banks. Most prominently, Mian (2006) shows that clients of foreign banks in Pakistan are of larger size, more transparent, in larger cities and more likely to be foreign-owned, inferring from that the lending techniques foreign banks apply. This analysis, however, confounds two effects – differences in clientele and differences in lending techniques. Do foreign banks use different lending techniques because they have different clienteles or do they use different lending techniques even for the same customers of domestic banks? In recent work with my Tilburg colleagues Vasso Ioannidou and Larissa Schäfer, we use data from the Bolivian credit registry and focus on a sample of firms that borrow from domestic and foreign banks in the same month to isolate the effects of different lending techniques of banks of different ownership (Beck, Ioannidou and Schäfer, 2012).

Theory and previous empirical work are ambiguous on the effect of foreign bank entry on SME lending. On the one hand, some theories suggests that, given their hierarchical organizational structure, foreign and large banks tend to lend to large and transparent firms relying on “hard” information, whereas domestic and small banks, given their decentralized structure, are better equipped to extend loans to small and opaque firms based on “soft” information (Stein (2002)). On the other hand, Berger and Udell (2006) argue that only differentiating between transactional and relationship lending is oversimplified. Large foreign banks may be able to overcome their informational disadvantage with the help of alternative transactional lending technologies, which are better suited for small and opaque firms. Using cross-country bank survey data, De la Torre et al. (2010) and Beck et al. (2011) provide evidence from bank surveys that foreign banks are as suitable as domestic banks in serving small businesses but apply transaction-based rather than relationship-based lending techniques.

In our analysis, we use loan-level data from the Bolivian credit registry for the period between January 1998 and December 2003. For each loan, we have information on the origination and maturity dates, contract terms, and ex post performance. For each borrower, we have information about their industry, physical location, legal structure, bank lending relationships, and whether they have been delinquent or defaulted on another loan in the recent past. In order to understand whether differences in contract terms between domestic and foreign bank loans are solely due to their different clienteles or also due to the use of different lending technologies, we eliminate the firm-composition effect by comparing the contract terms of domestic and foreign bank loans to the same firm in the same month. To this end, we restrict our analysis to a sub-sample of loans to firms that receive a new loan from at least one foreign and one domestic bank in the same month. The restriction results in a sub-sample of 5,137 loans to 287 firms, constituting 25% of the total lending amount in Bolivia over this period. All loans are in US dollars

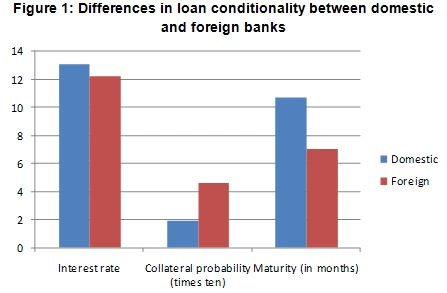

Exploring variation in loan contract terms for a sample of borrowers that borrow from both a domestic and a foreign bank in the same month, we find:

- Foreign banks charge loan interest rates that are on average between 89 and 107 basis points lower than the interest rates of domestic banks, which constitutes a 9% discount relative to the interest rate of domestic bank loans in the sample.

- Foreign bank loans are, on average, 27 percentage points more likely to have collateral – a large effect given that only 33% of all loan contracts in our sample include collateral – and have maturities that are up to 33% shorter than domestic bank loans, which, at the average maturity of nine months, implies a difference of two to three months.

- Domestic banks base their loan pricing on the length of their relationship with the borrower, especially in the case of smaller firms, while foreign banks have a more transaction-based pricing approach, relying on borrower ratings and collateral, especially for larger firms.

Our findings are consistent with significant differences between foreign and domestic banks in how they cater to enterprise borrowers. While foreign banks rely more on collateral and shorter maturity as disciplining tools and hard information as input for the loan pricing, domestic banks rely more on relationship and soft information as lending technologies, but compensate with higher interest rates.

If foreign and domestic banks set their loan conditions and price their loans in an optimal way, then we should not observe any differences in arrears, i.e., borrowers should be as likely to repay loans given to them by a domestic or a foreign bank in the same month. We find, however, that foreign bank loans are more likely to fall into arrears than domestic bank loans. This effect is, however, stronger among uncollateralized and higher-maturity loans, which gives support to the risk mitigation techniques of foreign banks to grant shorter maturities and ask for better collateral.

In summary, this research provides micro-insights into variation in lending techniques across banks with domestic and foreign ownership, by holding constant the sample of borrowers. Our results also allow an assessment of the effects of foreign bank entry as a function of the informational and contractual frameworks of countries. As foreign banks depend more on collateral and credit ratings, our results suggest that foreign banks will not be able to lend to SMEs in countries where collateral rights cannot be effectively created and enforced and in markets with little information available about enterprises.

References

Beck, Thorsten, Asli Demirgüç-Kunt, and María Soledad Martínez Pería. 2011. Bank Financing for SMEs: Evidence Across Countries and Bank Ownership Types. Journal of Financial Services Research 39: 35-54.

Berger, Allen N., and Gregory F. Udell, 2006, A More Complete Conceptual Framework for SME Finance, Journal of Banking & Finance 30: 2945-66.

De la Torre, Augusto, María Soledad Martínez Pería, and Sergio L. Schmukler. 2010. Bank Involvement with SMEs: Beyond Relationship Lending. Journal of Money, Credit and Banking 34: 2280-93.

Mian, Atif. 2006. Distance Constraints: The Limits of Foreign Lending in Poor Economies. Journal of Finance 61: 1465-1505.

Stein, Jeremy C. 2002. Information Production and Capital Allocation: Decentralized versus Hierarchical Firms. Journal of Finance 57: 1891-1921.

Join the Conversation