With millions around the globe feeling the impact of the financial crisis and slower economic growth and job losses, it is important to understand regulatory and policy constraints on entrepreneurs wanting to start a formal business. Entrepreneurial activity is the basis of sustainable economic growth, and the first step for entrepreneurs joining or transitioning to the formal sector is the registration of their business at the registrar of companies. For evidence of the economic power of entrepreneurship we need look no further than the United States, where young firms have been shown to be an important source of net job creation, relative to incumbent firms (Haltiwanger, et al.).

To measure entrepreneurial activity, we’ve constructed with support from the Kauffman Foundation the World Bank Group Entrepreneurship Snapshots (WBGES) – a cross-country, time-series dataset on new firm registration in 112 countries. The main variable of interest is “Entry Density”, defined as the number of newly registered limited liability firms as a percentage of the working age population (in thousands). We employ annual figures from 2004 to 2009 collected directly from Registrars of Companies and other government statistical offices worldwide. Like the Doing Business report, the units of measurement are private, formal sector companies with limited liability.

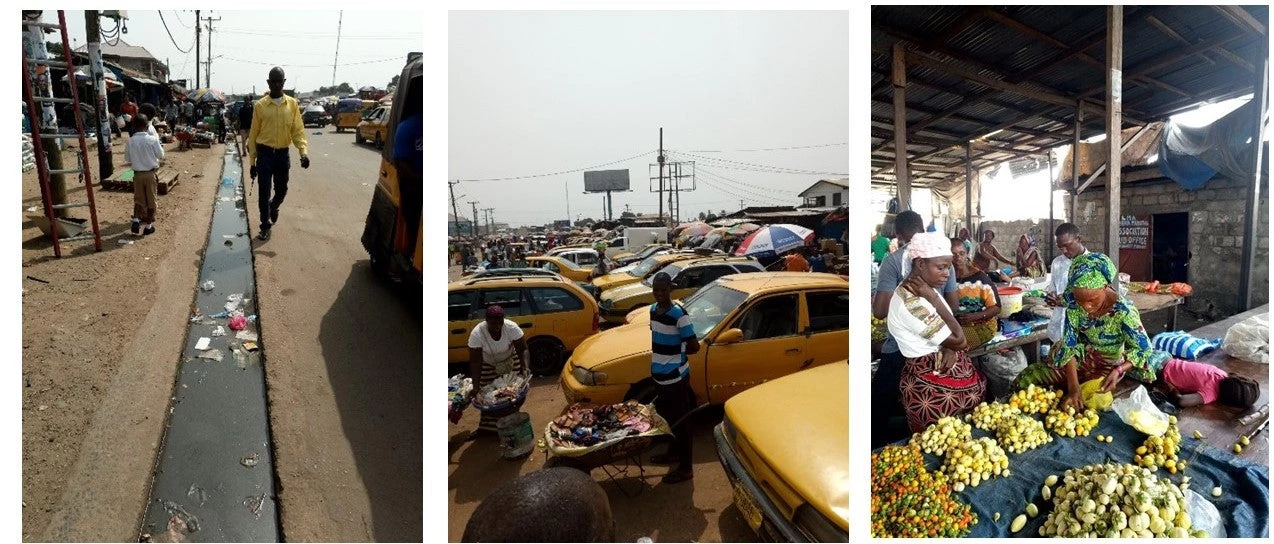

The data show significant disparities across regions, ranging from an entry density of 0.58 in Sub-Saharan African countries to 3.89 in high-income countries. In other words, there are on average about four limited-liability firms registered annually per 1,000 working age individuals in high-income countries, as compared to less than one firm per 1,000 individuals in developing countries. This translates roughly to an average of 55,000 newly registered limited-liability firms per year in high-income countries, relative to about 35,000 in Latin America, 14,000 in South Asia, and 9,000 in Sub-Saharan Africa.

A forthcoming study (with Inessa Love) shows that dynamic business registration occurs in countries that provide entrepreneurs with a stable political climate, greater financial depth, reduced red tape, and modernized business registries. These results can both guide effective policymaking and deliver new capabilities for identifying the impact of reforms.

The WBGES dataset also offers valuable insight on the impact of the crisis on entrepreneurship and provides guidance for fostering entrepreneurship in recovering economies. The data show that nearly all countries experienced a sharp drop in new business registration during the crisis. Only 20% of countries experienced growth in new business entry between 2008 and 2009 compared with 74% between 2006 and 2007. In general, the speed and intensity by which the crisis impacted new firm registration varied by income-level. Richer countries that were more exposed to the worldwide financial crisis experienced economically meaningful drops in new business density in both 2008 and 2009.At the same time, low-income countries, which were not as affected by the crisis and introduced a large number of registration modernization reforms, did not experience much change in new firm registration. For instance, the number of new firms registering in Spain dropped from 145,593 in 2007 to 79,759 in 2009, a 45% fall. In comparison, Burkina Faso introduced one-stop-shop registration (as part of a larger private sector reform package) and new firm registrations increased from 581 in 2007 to 610 in 2009.

We can show that countries that were hit harder by the financial crisis also had larger shocks to new firm registration using an index from Didier and Calderon (2009) that measures the crisis-related turbulence of 65 countries (a lower number indicates that the country was more affected by the crisis). For example, Brazil and Morocco, two countries that were relatively unaffected by the crisis, did not experience decreases in new firm registration. On the other hand, Bulgaria and Ireland were among those most affected by the near collapse of their financial markets and were subject to sharp drops in new firm registration.

Finally, we find those countries with more developed financial markets and where entrepreneurs depend more on banks for start-up capital had comparatively larger contractions in new business registration during the crisis. These results appear to run counter to the positive benefits that we expect from financial development (see Demirguc-Kunt and Maksimovic, 1996). Yet, at the same time, greater financial development is associated with higher entry in expansionary times and offers more benefits than risks to entrepreneurs. And future datasets can show whether greater financial development is also associated with more rapid economic recovery.

Resources:

Access the entrepreneurship database.

Read the working paper that explains the survey.

Further Reading:

Demirguc-Kunt, A., T. Beck, and V. Maksimovic, 2005. Financial and legal constraints to firm growth: Does firm size matter? Journal of Finance, 60:1, 137-177.

Didier, T. and C. Calderon, 2009. Severity of the Crisis and its Transmission Channels. LCR Crisis Briefs Series, World Bank.

Haltiwanger, J., R. Jarmin, and J. Miranda, 2009. Jobs created from business startups in the United States. Kauffman Foundation, January 2009.

Klapper, L., L. Laeven, and R. Rajan, 2006. Entry regulation as a barrier to entrepreneurship. Journal of Financial Economics, 82: 3, 591-629.

Klapper, L. and I. Love, 2010. The Impact of the Financial Crisis on New Firm Registration, World Bank working paper.

Klapper, L., Amit, R., Guillen. R., 2010. “Entrepreneurship and Firm Formation Across Countries”, NBER Volume on International Differences in Entrepreneurship, Joshua Lerner and Antoinette Schoar, eds., University of Chicago Press: Chicago.

Join the Conversation