China has been the fastest growing country in the world over the past two decades and as it gains economic clout, it is worthwhile to envision where the country is going and how it has gotten to where it is today.

China has been the fastest growing country in the world over the past two decades and as it gains economic clout, it is worthwhile to envision where the country is going and how it has gotten to where it is today.

In 1990, while China was home to 20 percent of the world’s population, it commanded a mere 1.6 percent of global GDP. Now it is the world’s second largest economy and produces 8.6 percent of global GDP (in 2009). Even after that extraordinary leap forward, the country still has the advantage of backwardness and it has the potential to have another 20 years of rapid transformation.

China’s average annual trade growth rate measured in current US dollars between 1990 and 2010 was an astonishing 17.6 percent. At the start of that period, China’s exports represented a mere 1.3 percent of global exports. Now China is the largest exporter of goods in the world with 8.4 percent of the global share.

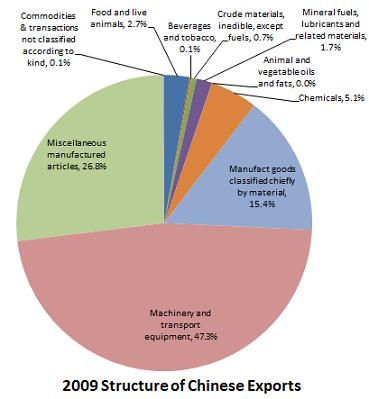

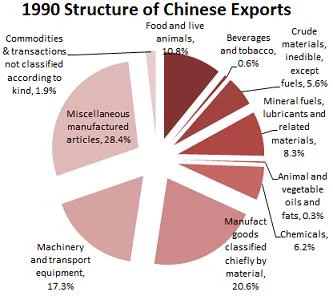

Behind this growth, there has been a dramatic structural transformation—in particular, rapid urbanization and industrialization. At the start of economic reforms in the 1980s, China was primarily agrarian. Even in 1990, 73.6 percent of its population lived in rural areas, and primary products comprised 27.1 percent of gross domestic product. The shares declined to 27.1 percent and 11.3 percent respectively in 2009. A similar change also occurred in the composition of China’s exports. In 1990 primary products comprised an important share of merchandise exports. Now, almost all of China’s exports are manufactures (see chart).

Figures 4(a) and (b): The structural transformation of China’s exports—1990 and 2009

Accompanying the change in the composition of China’s exports is the accumulation of foreign reserves. In 1990, China’s foreign reserves were $11.1 billion, barely enough to cover 2.5 months’ imports, but its reserves are now nearly $ 3 trillion--the largest in the world.

I remain bullish about the next 20 years because China still has considerable scope for catching up:

First, China’s per capita income is 21 percent of US per capita income in 2008 measured in purchasing power parity, based on Maddison’s estimation1 .The income gap between China and the U.S. indicates that there still exists a large technological gap between China and the industrialized high-income countries. China can still enjoy the advantage of backwardness before closing up the gap.

Second, Maddison’s estimation shows that China’s current status relative to the US is similar to Japan’s in 1951, Korea ‘s in 1977 and Taiwan, China’s in 1975. The annual GDP growth rate in Japan between 1951-1971 was 9.2 percent, 7.6 percent in Korea between 1977-1997, and 8.3 percent in Taiwan, China between 1975-1995. China’s development strategy after the reform in 1979 is similar to that of Japan, Korea and Taiwan, China. China has the potential to achieve another 20 years of 8 percent growth. By that time, China’s per capita income measured in purchasing power parity may reach about 50 percent of U.S.’ per capita income. (Note that Japan’s per capita income measured in purchasing power parity was 65.6 percent of the U.S. in 1971, while Korea’s was 50.2 percent in 1997, and Taiwan’s was 54.2 percent in 1995). Measured by purchasing power parity, China’s economic size may then be twice as large as the US; and measured by market exchange rates, China may be about the same size as the US.

Of course the road ahead will be bumpy and China faces a number of challenges.

The first such challenge relates to the two-speed recovery we are seeing from the global financial crisis. High-income countries are still beset with high unemployment rates and large excess capacities in housing and manufacturing sectors, which repress private consumption and investment. There is a possibility that the high-income countries may enter into an extended period of slow growth.

Given the inevitable slowdown in the exports to high-income countries in the coming years and the need to reduce trade surplus, it is only prudent and pragmatic to consider ways to rebalance China’s economy towards domestic demand and to focus on reducing income disparities within the country. Yet this must be balanced by continued strong growth in investment. The latter is critical for industrial upgrading, sustainable increase of per capita income, as well as developing “green economy” sectors and investing in environmental protection.

China’s 12th five year plan presented at last month’s National People’s Congress is designed to advance economic restructuring and sustain growth at a time when an aging population and rapid urbanization will make it challenging to maintain social harmony. Measures in the plan include: creating more than 45 million jobs in urban areas; allowing pension schemes to cover all rural residents and 357 million residents, and; construction and renovation of 36 million apartments for low-income families.

The 12th five year plan also aspires to keep the nation’s total population at below 1.39 billion, to have value-added output of emerging strategic industries account for 8% of GDP, and to turn coastal regions from the “world’s factory” into hubs of R & D and high end manufacturing and service sector activities.

For me, the bottom line is that the country has the potential of maintaining an 8 percent annual growth rate for another two decades. The latest 5-year plan, meanwhile, aims for GDP to grow by 7% annually on average. I may be more optimistic than many prognosticators, but so far China has tended to exceed the expectations of many.

1These national data used are taken from Angus Maddison’s Historical Statistics of the World Economy: 1-2008 AD.

Note: I have adapated this post from a speech I delivered on March 23 in Hong Kong, titled ‘China and the Global Economy.’

Join the Conversation