The post orginally appeared on All About Finance.

The facts are in. 50 percent of adults worldwide have an account at a formal financial institution. 21 percent of women save using a formal account. 16 percent of adults in Sub-Saharan Africa use mobile money. These are just a few of the thousands of data points now available in the Global Financial Inclusion (Global Findex) database, the first of its kind to measure people’s use of financial products across economies and over time.

Thankfully, researchers and policymakers no longer have to rely on a patchwork of incompatible household surveys and aggregated central bank data for a comprehensive view of the financial inclusion landscape. The publically accessible Global Findex provides comparable individual-level data that facilitate detailed analyses of how adults save, borrow, make payments, and manage risk in 148 economies. The data are based on more than 150,000 interviews with adults representing over 97 percent of the world’s population and was carried by Gallup Inc. as a component of its 2011 World Poll.

The banked

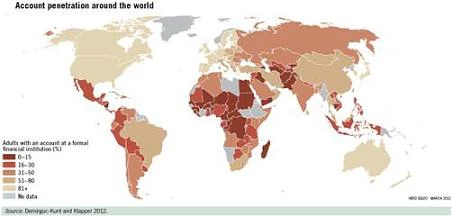

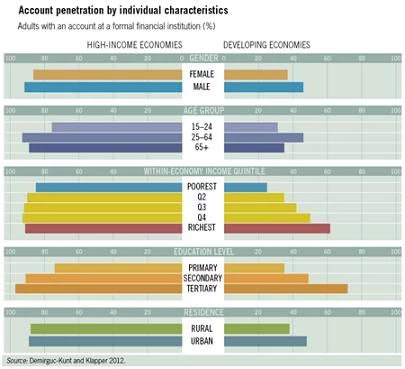

With over 40 indicators, each sliceable by gender, age, education, income, and rural or urban residence, one can easily get lost in the nuance. But let’s start with the broad strokes. The data reveal sharp disparities in the use of financial services across regions (see Map), economies and individual characteristics: 89 percent of adults in high-income economies have a formal account, compared to 41 percent of adults in developing economies and 23 percent of adults living below $2 per day. Worldwide, 55 percent of men have a formal account, compared to 47 percent of women. And in developing economies, the richest 20 percent of adults are more than twice as likely to have an account as the poorest, on average.

Why do people open and maintain bank accounts? We know that some adults use their account to receive wages, while others are mainly interested in having a safe place to save. Still others set up an account to facilitate the receipt of remittances from family members living elsewhere. The Global Findex provides hard data on these diverse uses of formal accounts. Worldwide, only 43 percent of account holders report saving at a financial institution, though about 50 percent do in East Asia and the Pacific economies. The use of accounts to receive wage payments is most common in Europe and Central Asia where 61 percent of account holders report this practice. Account holders in Sub-Saharan Africa are the most likely to use their account to receive remittances, with 38 percent reporting so.

From time to time we all need to borrow money. We might want to buy a house, invest in an education, or pay for a wedding. Some borrowers rely heavily on the formal financial sector for their credit needs. Globally, 9 percent of adults report having originated a new loan from a formal financial institution in the past 12 months—14 percent of adults in high-income economies and 8 percent in developing economies. In addition, about half of adults in high-income economies report having a credit card, which might serve as an alternative to short-term loans.

The unbanked

Why do over 2.5 billion adults not have an account at a formal financial institution? We asked them. Well, many of them—enough to be confident we can generalize to this entire group. 65 percent of the unbanked cite a lack of money as a reason for not having a formal account, including 30 percent who cite this as the only reason (multiple responses were allowed). Excessive cost, a family member already having an account, and distance to a bank were also each cited by over 20 percent of the unbanked. 30 percent of non-account-holders in Sub-Saharan Africa cited insufficient documentation and 31 percent of the unbanked in Eastern Europe and Central Asia reported lack of trust as a barrier to having an account.

It has been well documented that those outside the formal financial system often use sophisticated methods to manage their daily finances and save for the future. So, what are these methods and how common are they? In Sub-Saharan Africa, 16 percent of adults report having used a mobile phone to pay bills or send or receive money in the past 12 months. Of these money mobile users, over 50 percent are otherwise unbanked.

Community-based savings clubs are also a common alternative to formal banking. Worldwide, 15 percent of savers report having saved in the past 12 months using a savings club or person outside the family. Again, this rate is highest in Sub-Saharan Africa where 48 percent of savers – and 19 percent of all adults – report using a community-based method to save.

When adults cannot or chose not to rely on the formal financial sector for credit needs, they often turn to their family and friends. In the developing world as a whole, 23 percent of adults report having borrowed money from family or friends in the past 12 months. In all regions (excluding high-income economies), this is most the commonly reported source of borrowing.

A big step

All policy discussions should be rooted in sound data, and the ongoing debates in the world of financial inclusion – whether about the sustainability of mobile money or the spread of bank agents – are no exception. The Global Findex database facilitates a deeper and more nuanced understanding of the financial behavior of adults worldwide. With the release of future rounds, the data can be used to evaluate the expansion of bank agents and mobile money, as well as the impacts of other country-level financial inclusion reforms. The complete database, report, and survey in 15 languages are available at http://www.worldbank.org/globalfindex.

For further reading and the reference citation for the Global Findex, see: Demirguc-Kunt, A., and L. Klapper. 2012. “Measuring Financial Inclusion: The Global Findex Database.” Policy Research Working Paper 6025, World Bank, Washington, DC.

Join the Conversation