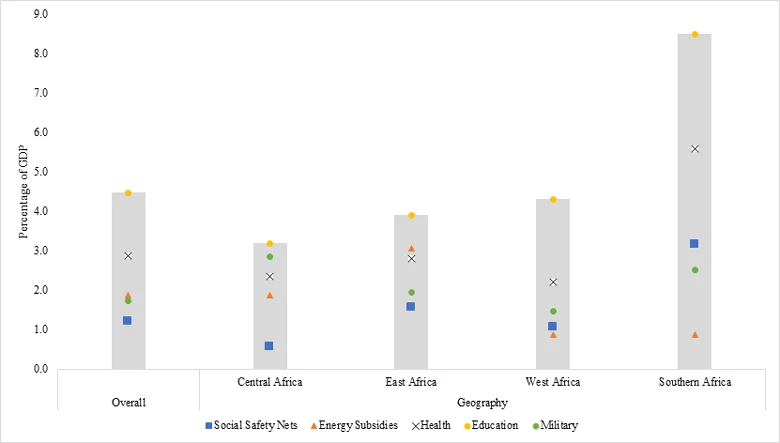

Expanding the coverage of safety net programs in Africa represents a serious fiscal challenge. While there is substantial variation across countries, on average governments in Africa spend about 1.3% of gross domestic product (GDP) on social safety nets (see figure). This is lower than the spending on other sectors such as energy, health care, education, and, in some cases, the military. Crucially, this level of spending is inadequate to face the high chronic poverty rates and vulnerability to shocks households face in Africa.

Governments who want to bring these programs to scale to protect the poor and vulnerable will need a multipronged approach on the fiscal side. In our chapter “Harnessing Resources to Expand and Sustain Social Safety Nets,” we outline three major pathways to bring sustainable fiscal systems to support social safety nets in Africa: spend better, manage fiscal policy better, and expand funding strategies.

Figure 1. Spending Is Lower on Social Safety Nets Than on Other Sectors

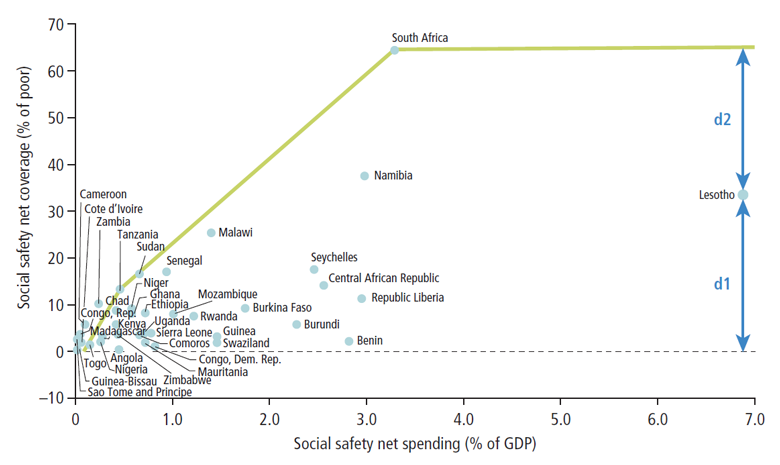

Countries need to make better use of existing resources. How? Through better administration, and by (re)focusing spending on intended beneficiaries and goals. While data on administrative costs is limited, estimates suggest that administrative costs represent an average 17% of safety net program spending. Our estimates of efficiency suggest that most countries can significantly improve their effectiveness by increasing their coverage of the poor while maintaining their current level of spending (Figure 2). If well implemented, investments in technological upgrades (for example, electronic payments and biometric identification) as well as program integration (such as using same processes for multiple programs and adopting integrated management information systems) have shown to yield significant efficiency improvements by cutting costs. These tools can also help in making sure programs get to intended beneficiaries. Whether these are the poor, the elderly or children, reliable tools for selecting and monitoring beneficiaries will avoid leakage and thus maximize the effectiveness of spending.

Figure 2: Most Countries Are not at Their Effectiveness Frontier

The second critical area to finance expanding safety nets (and other social programs too!) is the need for countries to improve fiscal capacity to finance safety nets. Strengthening fiscal systems is the most sustainable option for financing social safety nets at scale. Given the uncertainties in the global macroeconomic and political environment, the rising costs of borrowing, and the unpredictability of external financing, stable domestic fiscal systems are needed. Reforming tax systems is a widely recognized imperative in Africa. Innovative research points to the potential impact that behavioral nudging mechanisms can have on increasing tax compliance across the globe, including in Africa. Technological progress can also offer new opportunities for the collection of tax revenue in this context. It will allow governments will be able to track and tax earnings and incomes without the need for payroll-based systems. The impressive innovations in digital payments and e-commerce across the world, but especially in Africa and Asia, over the last 15 years offers a potential new source of contribution collection with minimal transaction costs

However, greater efficiency and fiscal policy reforms are unlikely to meet the financing needed to take social safety nets to scale in Africa. Hence, to realize their goals of expanding safety nets (and other social policy agendas), governments will also need to seek alternative funding sources. Development partner financing is an obvious option that already plays an important role in financing social protection spending. It is particularly strategic in financing initial investments in the sector, for instance, in establishing the building blocks for delivery. It can also be a catalyst for gathering domestic resources for social protection.

But other financing options are also available. For example, a few countries have used social impact bonds, by which socially motivated investors provide upfront funding for a development program and are paid a return by development partners or governments if pre-agreed outcomes are met.

![]() Flexible financing strategies are necessary and available to respond to shocks and crises efficiently and in a timely manner. Contingency or reserve funds could be established to finance relief, rehabilitation, reconstruction, and prevention activities to address emergencies. Risk transfer mechanisms, which are financial or insurance instruments, are another option to insure against shocks.

Flexible financing strategies are necessary and available to respond to shocks and crises efficiently and in a timely manner. Contingency or reserve funds could be established to finance relief, rehabilitation, reconstruction, and prevention activities to address emergencies. Risk transfer mechanisms, which are financial or insurance instruments, are another option to insure against shocks.

Money is not everything, but it is a key part of realizing the goal of bringing safety nets to more of the poor and vulnerable in Africa. Each government in Africa will need to find a financing mix that is appropriate for the country context to ensure that social safety nets are funded sustainably and available in times of crises.

This blog post is based on “Harnessing Resources to Expand and Sustain Social Safety Nets,” Chapter 5 of the 2018 regional study, Realizing the Full Potential of Social Safety Nets in Africa.”

Blogs based on previous chapters include:

Chapter 1: Social safety nets in Africa: Everywhere and growing, but going where?

Chapter 2: Safety nets boost consumption levels of the poorest across Africa

Chapter 3: The politics of safety nets: Don’t shy away

Chapter 4: But the cash transfer program was designed by experts, why doesn’t it work?

Join the Conversation