Who would have thought, 20 years ago, that a poor African country would become a powerhouse of global innovation in Information and Communication Technology (ICT)? Definitely not me! As student on a long road trip through Africa in 1990, I often struggled to make expensive calls home to Europe. Making an international call typically involved finding an Indian-African merchant, who was one of the few people with a phone that could connect you to other parts of the world, in theory. In practice, I often waited for at least an hour and, when I was lucky enough to get through, paid the equivalent of what today would be about 600 Shillings per minute.

Who would have thought, 20 years ago, that a poor African country would become a powerhouse of global innovation in Information and Communication Technology (ICT)? Definitely not me! As student on a long road trip through Africa in 1990, I often struggled to make expensive calls home to Europe. Making an international call typically involved finding an Indian-African merchant, who was one of the few people with a phone that could connect you to other parts of the world, in theory. In practice, I often waited for at least an hour and, when I was lucky enough to get through, paid the equivalent of what today would be about 600 Shillings per minute.

Now zoom back to today and look at the abundance of mobile devices, even in the poorest parts of Africa, and incredibly low calling rates. This year Kenyans could call the US from their cell phones for as little as 3 Shillings per minute! Something extremely remarkable must have happened. In describing the transformation of the telecom industry over the last 10-15 years in Africa, especially in Kenya, the term “revolution” is not an exaggeration.

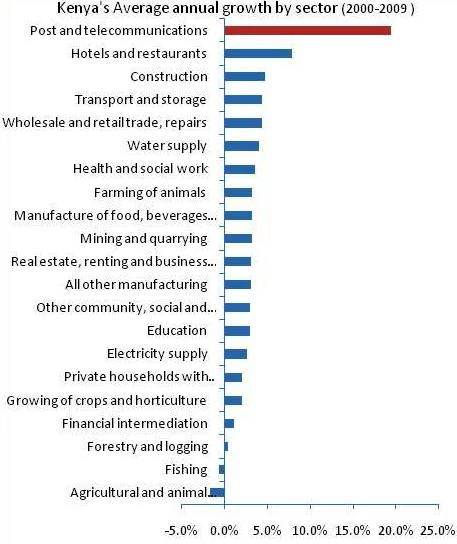

Since 2000, the Kenyan ICT sector has grown on average 20 percent each year, outperforming every other sector by a wide margin (the second best performer was hotels and restaurants which grew at 8 percent). The ICT sector has been driving growth in Kenya: without it, instead of the 3.7 percent average growth it achieved, the economy would have seen lackluster growth of 2.8 percent (barely enough to keep up with population growth).

Figure: Telecommunications outperformed all other sectors

Source: World Bank estimates based on KNBS data

Even this year, when Kenya’s economy has been navigating through great turbulence with almost 20 percent inflation and a 10 percent current account deficit, the ICT sector has continued to perform strongly. Kenya now boasts more than 25 million phone connections, which is more than there are adults in the country! The Internet is spreading equally fast. By the end of the year, Kenya will likely have some 15 million internet users.

Other developing countries–particularly in Asia—have undergone similar transformations, but what sets Kenya apart is mobile money, one of the most remarkable innovations of the last decade. Mobile money, which allows cash to travel as fast as a text message, is not a mere extension of banking: it is a new form of banking (much in the same way as cell phones truly revolutionized the way we used and thought about phones). Unlike mobile banking, mobile money does not necessarily need a banking infrastructure. Mobile money has achieved in Kenya what decade-long experiments with micro-savings have failed to achieve across the world: rapid financial inclusion for large parts of the population. The essential difference is the low-cost transaction platform that mobile money provides. In 2006, before the advent of mobile money, only 20 percent of Kenyan adults had access to financial services. Today, just four years after its introduction, more than 80 percent of Kenyans are connected to the financial system.

The revolution has only started: now that almost everyone in Kenya has a phone (increasingly connected to the internet), many more innovations will emerge—think Ushahidi—because information is the hardest currency in the 21st century and is now available to everyone at low cost.

What are the lessons of Kenya’s ICT revolution for the broader economy of Kenya and for other countries? First, this revolution is not just for the young tech-savvy programmers that huddle at iHub. ICT is no longer a niche sector of the economy. It has become mainstream and affects virtually every actor and every sector of the economy. It’s misleading to talk about a so-called “new economy” because it has in fact changed the way the old economy is operating. Over the next years, the biggest innovations will probably come from the incubation of technology in “traditional” sectors. The financial sector is already in the midst of this transformation, with mobile money as the most visible sign.

Second, the “ICT revolution” can be an inspiration for other sectors of Kenya’s economy. Over the last months, calling rates fell so low that some observers even argued that the regulator should step in (people calling for higher prices is not a common occurrence in Kenya). What a contrast to other economic sectors! As textbook economics will tell you, it is innovation and competition, not sanctions and controls, that lead to lower prices for most Kenyans. Third, the mobile revolution can become a game changer for the poor. Mobile money presents an unparalleled opportunity to deliver a basic suite of modern financial services to “unbanked” billions across the world. Storing money safely and securely, even very small amounts, has empowered Kenyan women especially, giving them an independent place to store and manage their funds. It has improved personal security because people don’t have to physically carry cash anymore.

It is amazing to observe– in just a few years – how the mobile phone has morphed from a luxury tool into a household item and become one of the most powerful weapons in the fight against poverty. Kenyans should take pride in this development because they remain at the forefront of ICT innovation globally. There are some 35 million mobile money users in the world today: one in two is a Kenyan. Mobile money took-off in Kenya thanks to a combination of strong leadership and vision in business and government. And this won’t be the last time that an African country is a world market leader and an exporter of innovation!

Part of this article draws on an article with Michael Joseph and Philana Mugyenyi (Mobile money: A game changer for financial inclusion) in McKinsey’s What Matters.

Join the Conversation