The events in Europe come as a reminder of the tremendous changes that have taken place worldwide over the past decade. Economic power is shifting from West to East, and from North to South. The big loser has been Europe, while emerging markets, especially in Asia, have reaped the lion’s share of the benefits. A decade ago, the possibility that China would come to the rescue of a bankrupt EU-country would have sounded outlandish-- no less inconceivable than saying that Nigeria could bail out China 20 years from today!

Some African countries may feel a sense of Schadenfreude as they witness the challenges faced by former colonial powers. European policy makers are no longer in any position to lecture their African counterparts. In fact, if you look at the quality of macroeconomic management over past years, many European countries could learn a lot from Africa, especially on how to handle fiscal deficits and debts. If Kenya was a member of the EU, its debt levels would be among the lowest in the union.

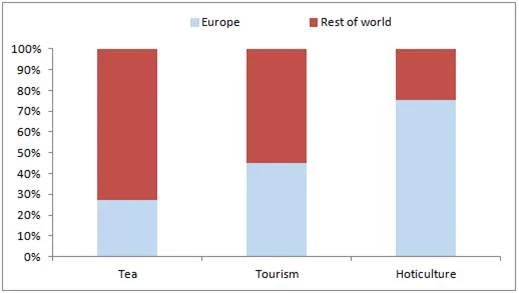

In reality though, Europe’s economic woes will create additional challenges for Kenya’s economy in 2012, a defining year for both this country and the Euro-zone. How are Kenya’s economic prospects connected to economic performance on the old continent? There are several transmission mechanisms, including uncertainty in global capital markets, which contributed to the volatility of the Kenyan Shilling. But the key link is trade. Kenya has a structural weakness in exports, especially in manufacturing, which is mainly due to infrastructure constraints, notably the poor performance of the port of Mombasa. This weakness could hurt Kenya during times of global crisis because it still depends too much on traditional exports such as the “big three”: tea, tourism and horticulture. Together they make up more than a third of Kenya’s total exports, and generate around US$ 3 billion in foreign exchange. They are also an important source of employment. But while Kenya has started to look East to sell its products (a charter flight from Korea landed at JKIA for the first time last week), it still depends on the North to a large extent. About a third of Kenya’s exports are sold in Europe (see figure).

Figure: Europe remains a key trading partner for Kenya’s top exports

Source: World Bank estimates based on Kenya Tourism board and Central Bank data

If Europe experienced a full-blown recession and its citizens were short on cash, where would they cut costs? Holidays and flowers would be very likely candidates, thus, hitting Kenya in particular.

Kenya did weather a global financial crisis in 2009, so why could it not manage this one too? There are two main differences compared to 2008/09. First, as many other African countries, Kenya has depleted most of its buffers. The fiscal space (to stimulate demand) has shrunk as public debt increased from below 40 percent (2008), to over 55 percent of GDP by the fall of last year. Since the exchange rate stabilized, total debt levels declined to about 50 percent of GDP, but they are still above the government’s target of 45 percent. Second, a recession in Europe would happen when inflation is still be high in Kenya, which reduces the degrees of freedom for policy makers to react. Last year, prices already increased from 5 percent (January 2011) to almost 20 percent at end-2011. Higher inflation has been the main driver of the recent hike in interest rates, which have reached 18 percent (compared to from 8.75 percent when the global financial crisis started).

In the past, Kenya has shown its strength in the face of adversity. Even though many will be preoccupied by politics, Kenya could use the opportunity of a strong growth momentum in the East Africa Community (EAC) to further strengthen trade links with its neighbors and the world. With the continued implementation of the constitution, the country would sow the seeds of social and economic transformation. Then Kenya can reach higher growth in 2012 than last year, making it one of the African countries that will be the exception in what promises to be a very difficult year for the world economy.

Join the Conversation