Time to review costly tax exceptions in Madagascar

Time to review costly tax exceptions in Madagascar

As the Malagasy government finalizes its “Plan émergence” to generate high, sustainable and more inclusive growth, it faces a crucial question: how will it finance the associated scaling up of priority investments and social spending while preserving fiscal sustainability? Measures currently envisioned by authorities include efforts to accelerate the digitalization of tax declaration and payments, improve tax administrations and reduce tax delinquency. However, these efforts will likely be insufficient to deliver a rise in the tax-to-GDP ratio amounting to 1 percentage point of GDP per year, as currently planned by the government.

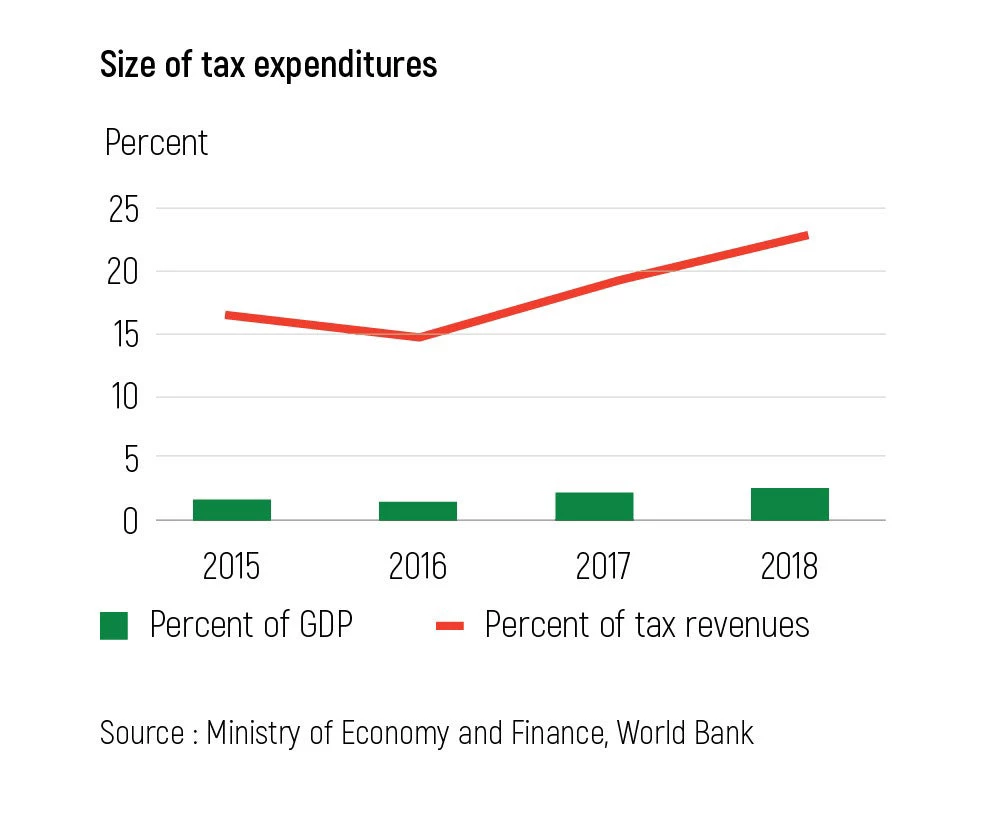

A more ambitious strategy to increase domestic resource mobilization will therefore be needed, and this must include a thorough review of tax abatements and preferential tax regimes, which reduce tax revenues by nearly a quarter every year. For a country such as Madagascar, whose tax revenue collection capacity ranks among the lowest in the world, this is a very large concession. To put numbers in perspective, the total amount of tax expenditures in 2018 was equivalent to the cost of constructing 3,375 primary school buildings or two for each single municipality.

What are the main tax expenditures in Madagascar?

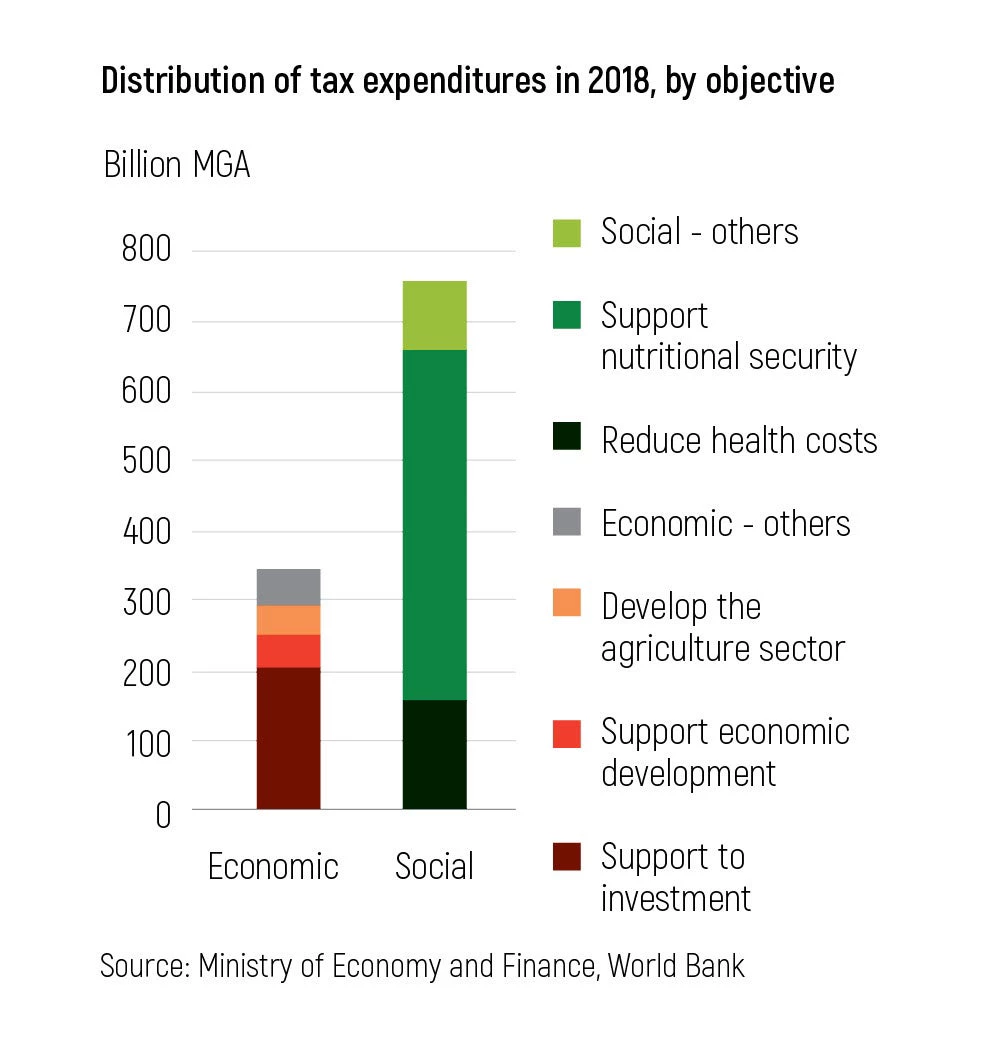

Up to 447 tax expenditures were identified in 2018, amounting to MGA 1,099.3 billion, or to 2.7% of GDP. Exemptions on local sales and importations of rice made up 45.3% of tax expenditures that year, followed by drug sales and imports (13.2%), and exemptions granted to mining activities (12.8%; Figure 2). The list of tax expenditures also includes many ad hoc exemptions to privileged beneficiaries, and often opens the door for tax fraud and abuses. For instance, some enterprises abusively record themselves as free export processing enterprises and some importers make fraudulent declarations to benefit from duty free imports of rice and other staples. Tax expenditures have rarely been undone, irrespective of changes in economic circumstances and policy priorities.

Are tax expenditures delivering on their socio-economic objectives?

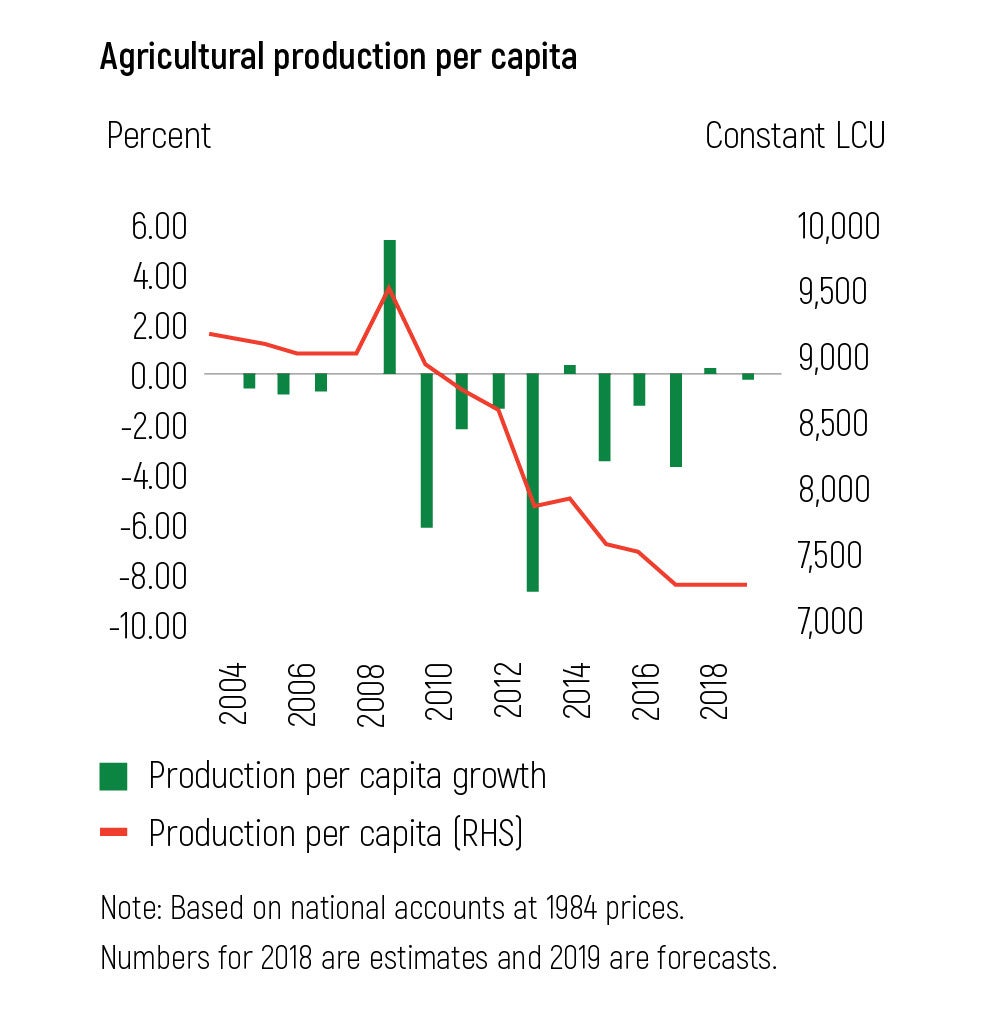

Nobody can objectively answer that question given that assessments of the actual impacts of tax expenditures against their socio-economic targets are non-existent, or very scarce. Circumstances justifying the creation of tax incentives also evolve over time, which require periodic reviews. The case of the exemption of VAT and import duty on rice, which is by far the most important source of tax expenditures, is a notable illustration. The price of international rice has been cut by more than a third since the tax exemption was established 10 years ago, but the impact of the measure on consumers and on the domestic rice sector in this evolving context has not been transparently evaluated. Such analysis could reveal that reconsidering part of the tax exemptions in the rice sector could help incentivize local producers to increase their commercial supplies and invest in higher-yielding production methods, provided market access and value chains are improved concurrently. This could help boost income and food security for the poorest, while freeing important fiscal resources to invest in connectivity and resilience. In fact, 83% of households in the agricultural sector are involved in rice production, but only 20% of it is currently commercialized, and domestic production per capita is significantly lower today than it was 10 years ago (Figure 3).

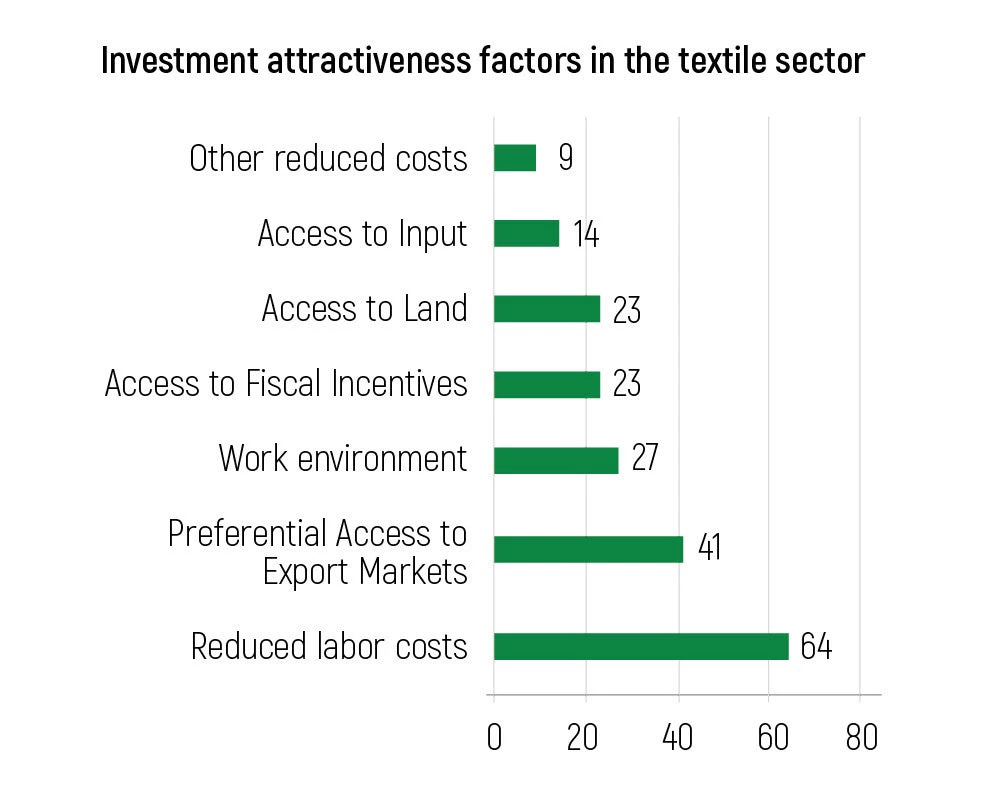

Similarly, evidence of the net benefit of tax incentives in the context of export processing zones is limited. Businesses operating in exports sectors in Madagascar generally mention the availability and affordability of inputs and preferential access to export markets as key factors determining their investment decisions, well ahead of tax incentives (Figure 4). Evidence from other countries suggest that tax incentives cannot compensate alone for an unfavorable business environment and a lack of infrastructure and work only if complemented by ambitious structural reforms to improve investment climates and address infrastructure gaps.

What should be done to improve the effectiveness of tax expenditures?

The examples above call for the improvement in the management of tax expenditures with the objective of increasing their effectiveness and preventing needed fiscal revenues from being diverted away from priority investments. A more systematic and transparent cost-benefit analysis could help identify measures that are ineffective and that could absorb resources that could be better invested in roads, schools, and health services.

The [October 2019 edition of the Madagascar Economic Update – Fall edition 2019] presents some key principles to improve tax expenditures management, which offer the advantage of facilitating tax administration, reducing the opportunities for fraud and abuse, and promoting an equitable treatment of private operators. The principles are also presented below:

Simplicity. The tax policy should remain simple, with all tax regulations integrated into the general tax code.

Cost-benefit analysis. Any new decision to grant an exemption should be supported by a positive cost-benefit analysis. Additionally, periodic reviews to assess the achievement of the objectives set should be conducted.

Transparency. Any tax expenditure should be legally grounded in the tax legislation, costs and benefits should be assessed, and communicated ex ante and ex post. The eligibility criteria and granting process should be clearly defined.

Time limit. Temporary tax expenditures should be preferred to permanent ones.

Join the Conversation