Kenya is again in the middle of an economic storm.

The combined impact of the drought in North Eastern Kenya, high food and fuel prices and a weakening currency, has led some to question the soundness of economic policies. In addition, the quality of Kenya’s institutions remains questionable and the country continues to have a poor reputation in fighting corruption. Is Kenya yet again in the middle of a fundamental crisis? I beg to differ. Despite valid concerns, Kenya’s fundamentals remain strong and have actually improved over the last years. If the government stays focused on implementing the constitution, upgrading infrastructure and intensifying the fight against corruption, there is nothing to stop this country from reaching its true potential.

Kenya already has a lot going for it: a well educated work-force, a vibrant service sector, and a good coastal location with a port in Mombasa that is a natural gateway for East Africa. If Kenya used these endowments wisely, it could easily reach 6 percent average growth and become a Middle Income Country – US$ 1,000 in annual income per capita – at the end of this decade. In the past, the country has reached this modest growth target occasionally, but has never sustained it over a longer period of time. Since the 1970s, Kenya’s economy has not seen growth above five percent for more than four consecutive years.

Kenyans have the future in their own hands. International shocks matter, but it is domestic factors which have held the country back, such as the post-election violence in 2008, the inefficiencies in the Port of Mombasa and unequal opportunities in the agriculture sector. Continuous high growth would propel Kenya to Middle Income status soon. Slow and uneven growth would result in another lost decade. If growth fails to rise above the average of the last ten years (3.7 percent) Kenyans would have to wait until 2037 to reach middle income status.

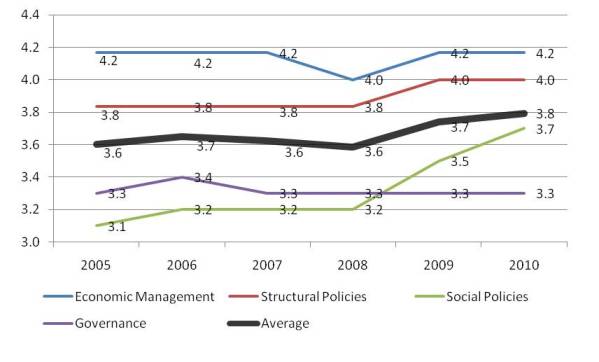

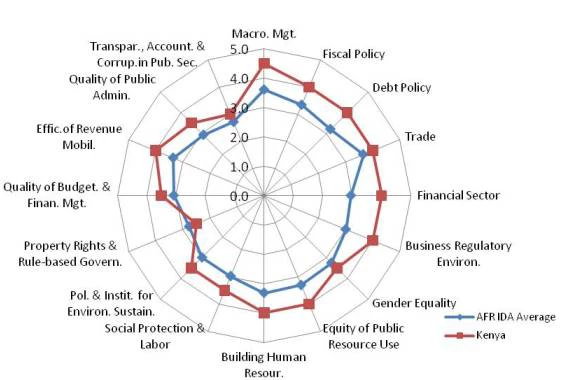

So how can Kenya turn the tide in these turbulent times? One way to assess the performance and fundamentals of Kenya is the Country Policy and Institutional Assessment (CPIA). This little- known tool of the World Bank is actually one of the most comprehensive and thorough rating exercises of countries’ policies and institutions in the world. Every year the World Bank rates developing countries on 16 criteria covering four broad areas that shape their development prospects: macroeconomic stability, structural policies, social and environmental policies, and governance. The resulting ratings – on a scale of 1 to 6 – largely determine the way the Bank allocates its soft loans and grants. The latest rating exercise has just been completed for 2010 and there are three important conclusions for Kenya.

- With a rating of 3.8, Kenya is performing well. Among low-income countries in Africa, only Ghana has a higher rating at 3.9. Kenya is on par with Tanzania, Uganda and Rwanda.

- Kenya’s performance has been improving continuously since 2008. After stagnating from 2005 to 2007 and declining in 2008, Kenya has made headway in recent years improving its average rating from 3.6 to 3.8 (a substantial improvement by CPIA standards!).

- These improvements are uneven. For example, Kenya continues to be rated highly on macroeconomic policies and it has improved notably in social policies. The weakest area remains governance, even though Kenya ranks above the international average even in this category. This is mainly on account of its moderate-to-strong performance in mobilizing revenues, the quality of its public service, and public financial management. However, there has been no improvement in the rule of law, which remains Kenya’s “Achilles Heel.”

Fig. 1 Kenya’s Policy and Institutional ratings are strong in most areas (click on figure to see it larger)

Fig. 2 Kenya has been improving, except in Governance (click on figure to see it larger)

Today, there are reasons to hope that the judicial system - which has been made responsible for the prevailing impunity – could be significantly reformed. Through a rigorous (and public) selection process, the government has selected a new group of judges. Without a credible justice sector, investment will remain low. However, if Kenya starts to tackle its perennial governance problems, the country, like its long-distance runners, will take off.

* This blog is also being published as part of a weekly column with Marcelo Giugale in Kenya’s Saturday Nation.

Join the Conversation