The recent global financial crisis has highlighted the impact of credit markets on the real economy, in particular on employment. While an extensive literature exists on how finance can affect corporate investment and overall economic growth, comparatively little is known about the effect of finance on labor market outcomes.

In a recent paper, entitled “Access to Finance and Job Growth: Firm-Level Evidence across Developing Countries” Meghana Ayyagari, Pedro Juarros, Sandeep Singh and I use comprehensive firm-level data across a large set of developing countries to analyze the impact of access to finance on job growth and the heterogeneity in this relationship across firm size.[1] In particular, we study the differential impact of access to finance on MSMEs’ ability to create jobs relative to that of larger firms.

Establishing a causal effect from access to finance to employment growth is complicated, since the variables measuring a firm’s access to finance may also reflect its demand for labor. Moreover, there are potentially many factors that could drive both firm employment growth and access to finance. We alleviate these identification concerns using a number of empirical strategies. First, we consider an exogenous shock to the supply of credit in the form of the introduction of a credit bureau. We use a difference-in-difference approach in estimating the impact of the introduction of credit bureaus on employment growth, by comparing countries which introduced credit bureaus and countries which did not, and years pre- and post-credit bureau introduction. Second, we use propensity score matching (PSM) to more closely match the treatment and control group of countries and re-estimate the difference-in-difference specification. Finally, we identify credit supply effects using industry measures of external finance dependence interacted with the credit bureau reform variable. If increased access to finance from the introduction of credit bureaus affects job growth, then we should expect to see larger effects for firms in industries that are more dependent on external finance.

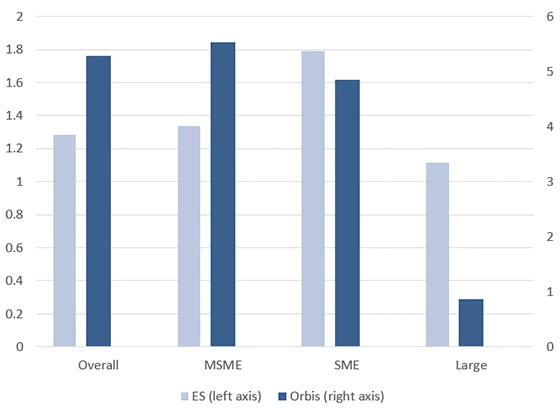

We find a strong positive relationship between access to finance and job growth. Overall, firms with access to a loan exhibit employment growth between 1 to 3 percentage points larger than firms with no access to finance across the two databases (Figure 1). These results are robust to controlling for firm fixed effects. When identifying the relationship using the introduction of credit bureaus (CB) as an exogenous shock to the supply of credit, we find that the introduction of CBs increases employment growth by over 5 percentage points compared to countries where CBs do not exist (Figure 2), a result that holds when estimated with the matched sample. This effect is particularly large for firms in industries that are more dependent on external finance.

We also find the association between finance and job growth to be stronger among MSMEs than among large firms. MSME firms with access to a loan have between a 1 to 4 percentage point larger employment growth than MSMEs without a loan across the two databases. This difference in job growth among MSMEs with and without access to finance is at least three times larger than the differential among large firms with and without a loan. In our largest database, the introduction of CBs elicits a job growth response among MSMEs that is over six times larger than that among large firms. Finally, MSMEs in industries with high dependence on external finance respond to the introduction of CBs with job growth rates that are almost two times larger than those of large firms in similar industries.

Figure 1: Job growth and access to finance: percentage point growth in employment for firms with access to finance compared to firms with no access

Figure 2: Job growth and credit bureau reform: percentage point growth in employment by firms in countries that experienced an exogenous credit supply shock from introduction of credit bureaus compared to firms in countries with no credit

________________________

[1] We use two complementary sources of firm level data: cross-country World Bank Enterprise Surveys that include information on 52,231 firms operating in 70 developing countries; and Bureau Van Dijk’s Orbis database on over 1 million firms operating across 29 developing countries. Both databases include large and small, and listed and unlisted firms. While the Enterprise Surveys provide data across a larger number of countries, the panel dimension in the Orbis database allows us to control for unobserved heterogeneity at the firm level, using firm fixed effects.

Join the Conversation