The unprecedented scope and intensity of the ongoing global financial crisis has underscored the too-important-to-fail (TITF) problem associated with systemically important financial institutions (SIFIs). Ahead of the crisis, implicit government backing permitted these institutions to take on greater risks without being adequately subjected to market discipline, and to enjoy a competitive funding advantage over systemically less important institutions. When the crisis broke, their scale, complexity, and interconnectedness, which had made them difficult to manage and supervise, also proved too significant to permit them to fail. The large-scale public support provided during the crisis has reinforced the moral hazard problem and allowed SIFIs to grow even more complex and larger.

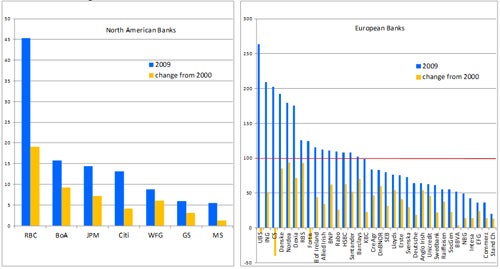

In a recent IMF Staff Position Note with my coauthors, Aditya Narain, Anna Ilyina, Jay Surti, and other IMF colleagues, we found that a regionally diverse group of 84 banks, which are sufficiently large or interconnected to be considered systemic at national, regional, or global levels, doubled their share of total global financial assets over the period 2000-09, to about a quarter (Figure 1). The assets of some of these banks exceed multiples of the size of their home economies (Figure 2). This importance, in turn, gives such banks greater influence over the regulatory and legislative process and a competitive advantage over systemically less important institutions, while making the rescue of such institutions, when they get into trouble, a very costly affair. In countries affected by the recent financial crisis, governments protected many of these institutions from failure by providing direct and indirect support to contain the damage to the broader economy (the direct support, excluding guarantees, is estimated at 6.4 percent of GDP on average in the most crisis-affected countries in end-2010).

If policies are not put into place to discourage the growth and added complexity of SIFIs, the TITF problem will get worse. Our analyses show that the largest financial institutions with universal and investment banking activities are among the most interconnected, and that more interconnected institutions had a higher likelihood of distress during the recent crisis than other financial institutions (reflecting, among other things, their reliance on more volatile funding sources and balance sheets more sensitive to mark-to-market accounting).

Figure 1. The Big Grow Bigger

Distribution of Global Financial Assets by Type of Institution (in percent)

Source: Otker-Robe, Narain, Ilyina, Surti (2011).

Figure 2. Big Banks Getting Too Big to Save?

Bank assets as a percent of domestic GDP

(Click the image for a larger version)

Source: Bankscope and WEO Databases

Initiatives to Address Faultlines in the Financial System

Since the onset of the global financial crisis, significant reforms have been considered at the national and international levels to address the major faultlines in the financial system and to safeguard future financial stability. These efforts have aimed to promote a less leveraged, less risky financial system that supports strong and sustainable economic growth, with the goal of reducing the likelihood that creditors of failing institutions will be bailed out at taxpayer expense in any future crisis scenario.

These initiatives focused first on improving existing bank regulations to strengthen capital and liquidity buffers in order to help individual banks better withstand shocks. To make banks less likely to fail, the Basel Committee on Bank Supervision (BCBS) adopted a framework with more robust capital buffers consisting of higher and better-quality capital with improved loss absorption, better recognition of counterparty/market risks (for the trading book and complex securitizations), a simple capital-to-asset ratio to limit excessive leverage, tighter liquidity standards for short-term and longer-term funding and liquidity, and capital buffers over and above the new higher minimum requirements.

While helpful, these broad-based measures are not sufficient to address the externalities and distortions that SIFIs generate, and to ensure that no financial institution is considered so systemically important on the basis of its size, complexity, interconnectedness, or essential services that it cannot be let to fail. A range of proposals have been put forward seeking to make failures of SIFIs less likely, or less devastating when they occur, to eliminate the moral hazard that nurtures risk-taking, to restore a level playing field, and to spare governments and taxpayers the costs of future bailouts. Some proposals provide a direct way of dealing with the TITF problem (e.g., by limiting firms’ ability to become systemic through restrictions on their size, structure, and scope of activities), but could be difficult to implement and adopt on a globally consistent basis. Others attempt to lower the probability of failures through even stricter regulatory and supervisory rules for SIFIs, or to enhance their resolvability as a way to reduce the cost or impact of their failures.

A Policy Framework to Deal with the TITF Problem

We believe that the elements of an adequate policy framework to deal with the TITF problem should contain the following four key elements: (i) significantly more loss-absorbing capital for SIFIs through more stringent capital requirements that are set commensurate with institutions’ contribution to systemic risk; (ii) intensive and proactive supervision consistent with the complexity and riskiness of the institutions in an ever-adapting and innovating private sector; (iii) increased transparency and disclosure requirements to enhance market discipline and the ability to better capture and price risks; and (iv) effective resolution regimes at national and global levels to make orderly resolution a credible option, with recovery and resolution plans (or “living wills”)1 and tools that enable creditors to share losses (e.g., through bail-inable debt that could be automatically converted into equity or written down when a bank comes under severe stress).

To reinforce these elements and limit the unintended consequences of tightening the grip on SIFIs, additional efforts are necessary. A better policing of the firewalls between regulated and unregulated segments of the financial sector and enhanced disclosure for the shadow banking system should help limit the possibility that systemic risks are simply shifted to entities subject to less monitoring or oversight. Effective cross-border arrangements for supervisory cooperation and information- and burden-sharing between home and host authorities are essential to facilitate resolution of cross-border groups and contain regulatory arbitrage. Realigning management incentives to match those of the banking group would attack the problem at its root, containing incentives for risk taking.

The Challenges of Implementation

We believe that work is progressing on these building blocks, but implementation would take some time as policymakers strive to finalize a number of remaining complex and important issues, including: institutionalizing international standards for intensive supervision of SIFIs and translating them into national practices; addressing data gaps to improve transparency; understanding shadow banks; achieving consensus on cross-border resolution and burden-sharing arrangements; the scope of application to identify SIFIs; and the ultimate level, composition, and coverage of a capital surcharge (except that capital instruments eligible to satisfy the surcharge are required to be predominantly common equity, with the level ranging from 1-3.5 percent, depending on a bank's systemic importance).

We, therefore, believe that credible action is needed in the interim. There is growing pressure at the national level to take immediate action to limit the risk posed by these institutions, making it difficult to reach a consensus at the international level if disparate frameworks are locked in at the national level. Credible and visible policies are hence needed during the transition period to a more robust framework to address the TITF problem. Coordinated action could be taken in particular to require SIFIs to hold significantly more loss-absorbing capital than now envisaged, combined with enhanced supervision to limit their tendency to accumulate systemic risk. The need to do so has gained even greater urgency in the current environment of increased market uncertainty and deteriorating confidence in the condition of banks as hopes for quick economic recovery have largely faded and sovereign risks have grown.

Looking Ahead

Four years after the onset of the global financial crisis, much has been done to reform the financial system, but there is still much left to do. The current reforms are moving in the right direction, but further challenges are facing policymakers in their continuing journey, as they continue to fight fires along the way and strive to revive the economies battered by the crisis, while attempting to establish a financial architecture that would form the foundation of a more resilient, stable financial system.

Large, complex, integrated cross-border banking groups have been key players in this journey. Such groups are major components of the global financial system in many ways, providing efficiency gains associated with the scale and diversification of their operations, but also with a great capacity to transmit distress to the broader financial system and the economy. It is with the objective of safeguarding potential efficiency gains and ensuring their sustainability for the good of the economies where they operate that one should be looking at measures that would reduce their likelihood of failure, or make such failures less painful and catastrophic when they occur.

Addressing the moral hazard risks such institutions pose, given their TITF status, and restoring market discipline are the only way forward, to ensure that no institution is too important to fail. A variety of measures and proposals have been put on the table to deal with them, some triggering no appetite (e.g., breaking up SIFIs into smaller, more manageable institutions with narrower functions), while others have been swallowed with a bitter after-taste (e.g., higher capital and liquidity buffers). Some still face many challenges to being effectively implemented in a fragile economic environment and the threat of the shadows undermining their success. Nonetheless, swallowing the bitter medicine is the only road to recovery, and to develop better immunity to further viruses, especially in an environment where the doctors to fix the patients are in short supply and the appetite for the bitter medicine is further diminishing.

Further Reading:

See I. Otker-Robe, A. Narain, A. Ilyina, and Jay Surti (2011), “The Too-Important-to-Fail Conundrum: Impossible to Ignore and Difficult to Resolve,” IMF Staff Discussion Note 11/12 (May 27)

___________

1 Living wills, as applied to financial institutions, provide a guide for the resolution authority [undertaker] to handle the bank [the deceased] in a way that will stem any contagious effects across the broader financial system [population]. Globally active SIFIs are now required to have such wills to improve their resolvability. Jointly developed by SIFIs and regulators, they can help prepare individual institutions for contingencies and provide the authorities with essential information on an institution’s assets and liabilities, commitments, exposures, and legal/operational structure that could facilitate both supervision and resolution efforts.

Join the Conversation