Bank regulation and supervision has become subject of vigorous debates during the global financial crisis. Many observers pointed out weaknesses in regulation and supervision in the run-up to the crisis (see, for example, Caprio, Demirguc-Kunt and Kane, 2010, Dan 2010, Levine 2010, and Barth, Caprio, and Levine 2012). The crisis prompted policymakers to consider changes in regulation and supervision. But much of the policy discussions focused on a small number of major (and mostly high-income) economies. And despite the high degree of interest in the global regulatory framework, there has been a surprising lack of consistent and up-to-date information on the national regulatory and supervisory approaches pursued in individual countries around the world during the crisis. This lack of information led to important gaps in understanding what works in regulation and supervision and what does not.

These gaps are now getting filled, with the publication of the World Bank’s 2011–12 Bank Regulation and Supervision Survey. To illustrate the richness of the dataset, we have just issued a paper that presents a detailed analysis of the new data.

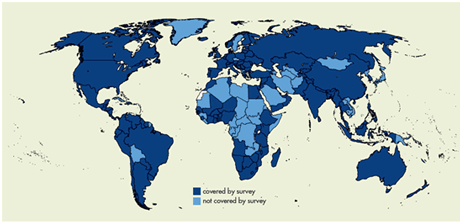

The dataset, released together with the 2013 Global Financial Development Report, is quite unique. It is the first dataset of its kind since the beginning of the global financial crisis. It is an updated and substantially expanded version of earlier surveys released by the World Bank in 2001, 2003, and 2007 and analyzed for example in Barth, Caprio, and Levine (2008). The current, fourth iteration of the survey makes publicly available detailed information for 143 jurisdictions (Figure 1). It contains some 300 questions that cover everything from rules for entry into banking to rules on capital and liquidity, depositor protection schemes, accounting and information disclosures, tools for dealing with problem institutions, and many other specific questions.

Figure 1. Geographical Distribution of the Countries in the 2011-12 Survey

Source: The World Bank’s 2011–12 Bank Regulation and Supervision Survey.

Good news: strong supervision, combined with private monitoring incentives, does work

Our paper uses the Bank Regulation and Supervision Survey to explore differences in regulation and supervision between crisis and non-crisis countries. We define crisis countries as those with full-fledged or borderline systemic banking crisis in 2007–09 (following the often used crisis dataset updated by Laeven and Valencia 2012).

Based on a series of univariate tests, we find significant differences between crisis and non-crisis countries. While these tests do not imply causality, they suggest that crisis countries had weaker regulatory and supervisory frameworks relative to the countries that avoided the direct impact of the crisis. The main differences are in the following four areas.

First, crisis countries tended to have significantly less stringent definitions of capital, and they gave banks more discretion in how they calculated capital requirements. The banks in the crisis countries tended to use more sophisticated approaches to measuring capital requirements, and they had lower actual capital ratios. This is in line with the notion that, in regulation and supervision, less can mean more. In this case, simpler, less complex regulations can actually achieve more in terms of safety and soundness.

Second, the analysis revealed that banks in crises countries faced fewer activity restrictions. They were much less restricted from engaging in non-bank activities such as insurance, investment banking, and real estate. While this finding does not necessarily indicate lack of restrictions per se are behind the crisis, it is consistent with the notion that weak incentives to monitor (see below) coupled with greater risk- taking opportunities can be a dangerous combination.

Third, crisis countries were also less likely to have in place non-performing loans and provisioning requirements and were more lax in the treatment of bad loans and loan losses. Also, regulators in crisis countries were less able to force corrective actions (such as recapitalization, creating greater provisions, and suspending bonuses or management fees) in distressed banks.

Fourth, even though crisis countries had stronger information disclosure requirements, the incentives for the private sector to monitor banks’ risks were relatively weaker in crisis countries. This is an important point: simply requiring banks to properly disclose their financial information does not help much if many of banks’ counterparts do not have strong incentives to use that information.

Bad news: still a long way to go on the regulation and supervision front

We also examined which aspects of regulation and supervision changed the most rapidly during the crisis. We did find evidence on a number of changes. In particular, capital ratios increased, primarily among non-crisis countries. Also, deposit insurance schemes became more generous, and many countries introduced reforms in areas of bank governance and bank resolution.

More generally, however, the main result from our analysis is that the regulatory responses to the crisis have been quite slow and in most areas, change has been gradual at best. The crisis did not trigger a major and sudden change in national regulatory and supervisory frameworks around the world, which most likely reflects both the complexity of issues at hand and the political economy of financial reforms. While some of the measures adopted in the crisis (such as improvements in resolution regimes in some countries) are encouraging, others (such as extension of blanket guarantees, and increase coverage of deposit insurance shchemes) are likely to be less so. The survey results suggest that there is substantial room for further improving the regulatory and supervisory frameworks as well as private incentives to monitor risk-taking.

And a word of thanks…

This is a good moment to stop and thank the many people who contributed to making the survey happen. The 2011–12 survey built from inputs from numerous bank regulation experts within the World Bank and outside. We have benefitted from important insights and encouragement from Jim Barth, Gerard Caprio, and Ross Levine, who organized the previous rounds of the survey. PKF (U.K.) and Auxilium helped with compiling and following up on the survey responses. The survey was financed in part with support from the U.K. Department for International Development. Last but not least, the survey would not have been possible without the many country officials answering the questionnaire, who have our deepest thanks for their answers to the survey.

References

Barth, James, Gerard Caprio, and Ross Levine. 2008. “Bank Regulations are Changing: For Better or Worse?” Comparative Economic Studies, 50(4), 537-563.

Barth, James, Gerard Caprio, and Ross Levine. 2012. Guardians of Finance: Making Regulators Work for Us, MIT Press.

Caprio, Gerard, Asli Demirgüç-Kunt, and Edward J. Kane. 2010. “The 2007 Meltdown in Structured Securitization: Searching for Lessons, not Scapegoats.” World Bank Research Observer 25 (1): 125-55.

Čihák, Martin, Asli Demirgüç-Kunt, Maria Soledad Martínez Pería, and Amin Mohseni. 2012. “Banking Regulation and Supervision around the World: Crisis Update.” Policy Research Working Paper 6286, World Bank, Washington, DC.

Dan, Kenneth, 2010. “The Subprime Crisis and Financial Regulation: International and Comparative Perspectives.” John M. Olin Law and Economics Working Paper No. 517.

Laeven, Luc and Fabián Valencia. 2012. Systemic Banking Crises Database: An Update, IMF Working Paper 12/163, International Monetary Fund, Washington, DC.

Levine, Ross, 2010. “An Autopsy of the U.S. Financial System: Accident, Suicide, or Negligent Homicide.” Journal of Financial Economic Policy 2(3), 196-213.

World Bank. 2012. Global Financial Development Report 2013: Rethinking the Role of the State in Finance, World Bank, Washington DC.

Join the Conversation