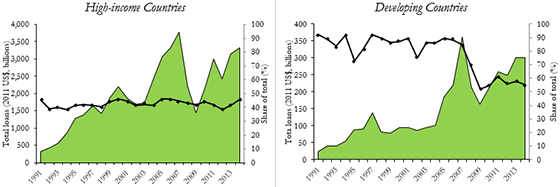

Global banks had rapidly expanded their lending activities abroad before the global financial crisis, during the 1990s and early 2000s. Between 1991 and 2007, the volume of syndicated loan issuances a year by nonfinancial corporations increased more than seven times in high-income countries and more than eight times in developing ones (figure 1). However, the global financial crisis (GFC) hit global banks in the developed world especially hard, which reacted by reducing their cross-border lending activities worldwide.

Figure 1. Issuance Activity in Syndicated Loan Markets, 1991–2014

Source: SDC Platinum.

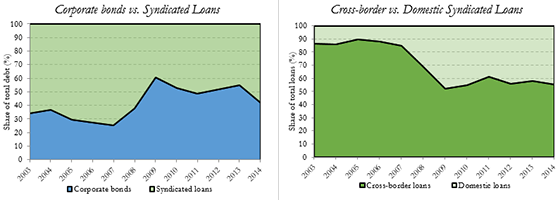

Chapter 3 in the Global Financial Development Report 2017/18: Bankers without borders documents how the difficulties in obtaining international bank credit after the GFC soon passed on to nonfinancial corporations across the globe, which reacted by changing their debt market composition. In high-income and developing countries, firms moved from cross-border syndicated loans toward bond markets. In developing countries, firms also switched to domestic banks (Figure 2). Importantly, these changes in debt market composition after the crisis took place both at the aggregate country level and within firms.

Figure 2. Composition of Debt Issuance in Developing countries, 2003–2014

Source: SDC Platinum.

These patterns imply that policy discussions would benefit from considering other key components of the global financial system, beyond the single focus on cross-border banking. Firms can better withstand market specific adverse shocks through their access to alternative sources of external finance. In this way, access to more complete markets may allow firms and countries to diversify their financing sources and reduce the risks associated with financial contagion. However, global financial markets are not perfectly integrated, and several frictions result in different markets providing different types of financing, even for the same firm (such as terms of maturity or currency denomination) (Cortina, Didier, and Schmukler, 2018). As a result, changes in debt market composition over time also expose firms and countries to new types of risks.

References

World Bank, 2017/2018. “Cross-border lending by international banks.” Chapter 3 in the Global Financial Development Report.

Cortina, J.J., Didier, T., Schmukler S.L., 2018. “Corporate Borrowing and Debt Maturity: Market Access and Crisis Effects.” Mimeo. World Bank.

Join the Conversation