Conventional wisdom has it that compensation in the financial industry is responsible for much of the credit crisis. For instance, Paul Krugman states that “reforming bankers’ compensation is the single best thing we can do to prevent another financial crisis a few years down the road.” Unfortunately, the facts are stubborn and they do not fit this conventional wisdom.

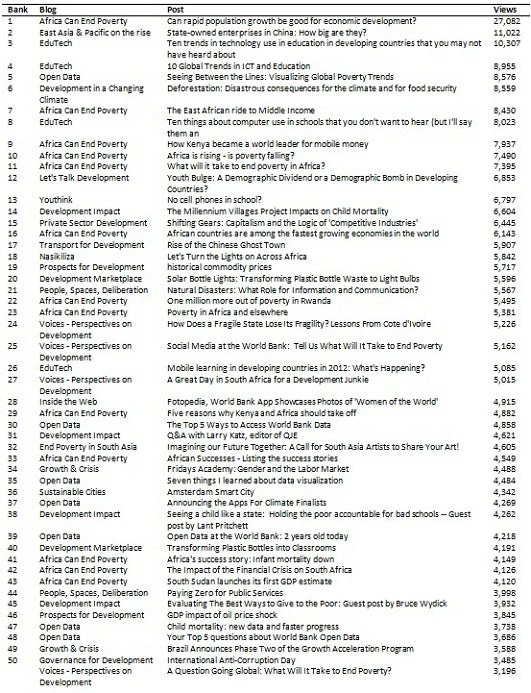

Rüdiger Fahlenbrach and I study the incentives of bank CEOs before the start of the crisis and how the performance of banks is related to these incentives in a paper published in the Journal of Financial Economics. Our sample includes 95 large banks for which we have detailed information on CEO compensation, option holdings, and equity holdings. The paper shows that the value of the shares held by CEOs in the companies they managed in 2006 was roughly ten times the value of their total annual compensation. Such large holdings dwarfed annual bonuses (see Table 1). Experts in governance would have argued before the crisis that the interests of these CEOs were well aligned with the interests of the shareholders because they had so much skin in the game. The CEOs of Lehman Brothers and Bear Stearns had equity holdings in their firms worth approximately one billion dollars in 2006. With such holdings, it would have made little sense for CEOs to take actions that knowingly decreased shareholder wealth.

Table 1 : Executive compensation and equity ownership at the end of fiscal year 2006

Our results show that there is no evidence that banks with a better alignment of CEOs’ interests with those of their shareholders—as measured by equity holdings—had higher stock returns during the crisis and some evidence that banks led by CEOs whose interests were better aligned with those of their shareholders had worse stock returns and a worse return on equity. In particular, whether our sample includes investment banks or not, stock return and accounting equity return performance are negatively related to bank CEOs’ dollar incentives, measured as the dollar change in a CEO’s wealth for a 1% change in the stock price. This effect is substantial and is not explained by a few banks where CEOs had extremely high ownership. An increase of one standard deviation in dollar incentives (which means better alignment of CEO incentives with shareholder interests) is associated with lower stock returns of 9.6%. Similarly, a bank’s accounting return on equity in 2008 is negatively related to its CEO’s holdings of shares in 2006—a one standard deviation increase in dollar incentives is associated with approximately a 10.5% lower return on equity. Though options have been blamed for leading to excessive risk-taking, there is no evidence in our sample that greater sensitivity of CEO pay to stock volatility led to worse stock returns during the credit crisis. These results imply that it cannot be the case that banks would have performed better during the crisis had the incentives of CEOs been better aligned with the interests of shareholders.

Many observers have blamed the crisis on the so-called bonus culture of banks. We also investigate this issue. The average base salary for the CEOs in our sample is $760,000 in 2006. On average, the base salary is less than 10% of a CEO’s compensation. Most of a CEO’s compensation is therefore incentive based. On average, a CEO’s cash bonus was 2.8 times his base salary. Bonuses tied to the achievement of goals in terms of accounting performance are paid both in cash and in shares. In 2006, on average, 40% of the bonus was paid in shares and 60% was paid in cash. Interestingly, the fraction of the bonus paid in equity was larger for better-performing banks. We investigate whether the performance of banks during the crisis is related to the size and composition of bonuses. When we control for bank characteristics, we find no evidence that banks that paid a higher cash bonus relative to the base salary in 2006 performed worse during the crisis.

Our analysis focuses on whether incentives created by compensation plans of CEOs help explain the performance of bank stocks during the crisis. The bottom line of our paper is that our evidence is inconsistent with the view that banks performed poorly because CEOs had poor incentives. On the contrary, CEOs had strong incentives to maximize shareholder wealth because they owned so much stock in their firms. If one were to conclude that shareholders had incentives to take more risk than was socially optimal for economic stability, then the problem was not compensation but the incentives of shareholders. Setting compensation within financial firms is extremely complicated because assessing performance in relation to the risks taken is difficult and because compensation decisions have to be made in the midst of what is often intense competition. Certainly, errors were made. However, more regulatory intervention in the pay process is unlikely to make the financial system safer, and it would seem that better tools than regulating compensation are available to make the financial system safer. The last time regulators attempted to address executive pay, limits on the tax deductibility of cash salaries were established. Unintended consequences involved a dramatic growth in option compensation, which is now viewed as part of the problem.

Join the Conversation