When a country’s banking sector becomes more linked to banks abroad, does it get more or less prone to a banking crisis? In other words, should cross-border banking linkages be welcomed? Or should they be approached with caution or perhaps even suppressed in some way?

The recent global financial crisis has illustrated quite dramatically that increased financial linkages across borders can have a ‘dark side’: they can make it easier for disruptions in one country to be transmitted to other countries and to mutate into systemic problems with global implications.

But financial cross-border linkages may also benefit economies in various ways. They can provide new funding and investment opportunities, contributing to rapid economic growth, as witnessed in many countries in the early part of the 2000s. The more ‘dense’ linkages also provide a greater diversity of funding options, so when there are funding problems in one jurisdiction, there are potentially many ‘safety valves’ in terms of alternative funding.

So, are cross-border banking connections good or bad for your financial sector’s health? In a recent paper, Sònia Muñoz, Ryan Scuzzarella, and I have focused in on this question, using a combination of theoretical simulations and new empirical evidence. Our answer, interestingly, depends on how connected your banking system already is—there is no simple one-to-one relationship between interconnectedness and the likelihood of crisis. Further, it also depends on whether the linkages are driven by banks’ liabilities or by their assets.

To arrive at these conclusions, we have used a combination of theoretical simulations and empirical estimates. In the theoretical part, we have generated a large number of possible alternative realizations of the global banking network, exposing these simulated networks to thousands of randomly generated shocks, calculating how a banking crisis in one country gets transmitted to other countries via cross-country banking linkages. In the empirical part, we have combined an extensive data set on banking crises around the world since the 1970s with updated data on cross-border banking linkages, and we have subjected the data to a range of parametric as well as non-parametric tests.

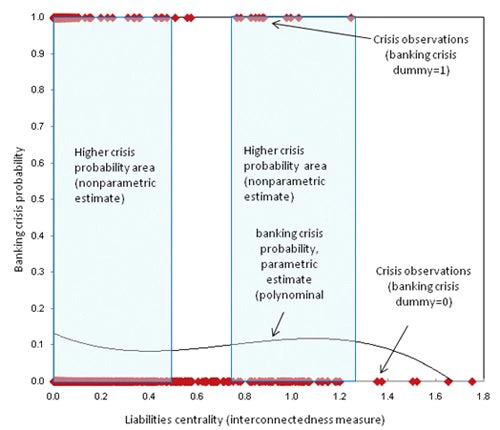

Interestingly, we have found an ‘M-shaped’ relationship between the financial stability of a country’s banking sector and its interconnectedness. This M- shaped relationship between crisis probability and interconnectedness occurred rather robustly across all our simulations, as well as in earlier theoretical results for a set of interconnected banks. When we plotted the empirical probability of a banking crisis on the vertical axis and the degree of interconnectedness on the horizontal axis, the estimated relationship indeed resembled the right part of letter M: down, up, and down again (see the estimated probability of crisis line in Figure 1). This means that for banking sectors that are not very connected to the global banking network, increases in interconnectedness are associated with a reduced probability of a banking crisis. Once interconnectedness reaches a certain value (which we estimate to be at about the 95th percentile of the distribution of countries in terms of interconnectedness) further increases in interconnectedness can increase the probability of a banking crisis. At an even higher point, when a country’s network of interlinkages becomes almost complete (that is, all or almost all nodes in the network are connected with each other), the probability of a crisis goes down again. In other words, when you grow your network of cross-border linkages to the extent that you become a true international financial center with a dense network of linkages, you actually become relatively more resilient to shocks: there are many ways in which shocks can come but also many ways in which they can be transmitted to others.

Another interesting insight of our paper is that it is important to distinguish whether the cross-border interlinkages are stemming primarily from banks’ asset side or from their liabilities side. We find that the impact of changes in interconnectedness on banking system fragility is more significant on the liabilities side than on the asset side. In other words, increasing interconnectedness on the liabilities (borrowing) side is more likely to be become detrimental to banking stability than increasing interconnectedness on the asset (creditor) side. Therefore, financial turmoil that originates in creditor countries and flows upstream via borrowing countries’ funding channels could be more devastating for financial stability. Figure 1 depicts the relationship found for the liabilities-side interconnectedness (referred to in the figure as “upstream interconnectedness); our paper contains a similar—but much less pronounced—chart for our measure of asset-side interconnectedness.

Our calculations suggest that up to a point, it may be beneficial for policies, regulations, and supervision to support greater interlinkages between the domestic banking sector and foreign banks. About 95 percent of the world’s countries are below that threshold. Above the threshold, the benefits of greater interlinkages are less clear. In fact, our calculations suggest that further growth in interlinkages can at that point become detrimental for banking stability. The calculations also indicate that the potential negative effects of interconnectedness can be compensated for by other factors (which can also be influenced by policies), such as greater capitalization of the banking sector. A fuller examination of the impacts of policies influencing financial interlinkages and financial stability is an important topic for further research.

Figure 1. Interconnectedness and Banking Crises

Note: The higher- and lower-crisis probability areas have been determined by a nonparametric estimate, which solves for a combination of thresholds that minimize the ratio of missed banking crises while ensuring that the ratio of predicted banking crises to total observations is not larger than the actual frequency of crises observations (7.4 percent in our sample). For a precise definition of liabilities centrality, see our paper.

Join the Conversation