In mid-September, the African Development Bank, the German Federal Ministry for Economic Cooperation and Development and the World Bank will launch Financing Africa: Through the Crisis and Beyond , a comprehensive review documenting current and new trends in Africa’s financial sector and taking into account Africa’s many different experiences. During the coming weeks and leading up to the formal launch of the book in Ethiopia on September 15, we will give a sneak peek of the book’s main findings and recommendations. In this first post, we’ll summarize our main messages. The book’s primary message is one of cautious hope. While the global crisis may have dented some of the progress Africa has made since the beginning of the 21st century, we felt the optimism and saw the positive trends on the continent sustaining its emerging economies. We observed deepening financial systems in many African countries, with more financial services, especially credit, provided to more enterprises and households. New players and new products, often enabled by new technologies, have helped broaden access to financial services, especially savings and payment products. We found innovative approaches to reaching out to previously unbanked parts of the population that go beyond cell phone based M-Pesa in Kenya and basic transaction accounts, such as Mzansi accounts in South Africa. We concluded that competition and innovation dominate more and more African financial systems and that for every failure there is now at least one success story. However, we noted too that the benefits of deeper, broader and cheaper finance have not been reaped yet. Finance in Africa still faces problems of scale and volatility. While the amount of liquidity in the system helps reduce volatility and fragility, it is at the very same time a sign of a limited capacity for intermediation.

Our observations and findings build on and extend substantially on the 2007 publication Making Finance Work for Africa, which drew attention to the opportunities and challenges of financial system development across Africa.[1]

A lot has happened since then, not the least the Global Financial Crisis that has affected the continent in an indirect but permanent way. While not affected directly and immediately, since the transmission mechanisms between the financial systems in Africa and the systems in the rest of the world were weak, there were significant knock-on effects via the real sector. In addition, there was a significant impact through reduced capital flows, especially lower portfolio flows, but also lower foreign direct investment (FDI), remittance flows and aid flows. As a result of the Global Financial Crisis, the center of economic and financial power in the world has switched to the South and East, which is also reflected in the replacement of the G7 by the G20 as the major international policy coordination body.

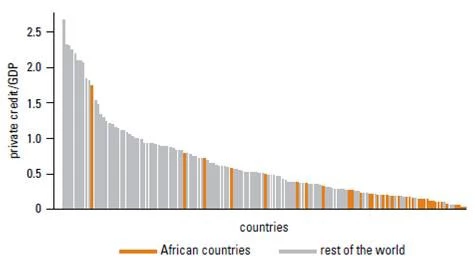

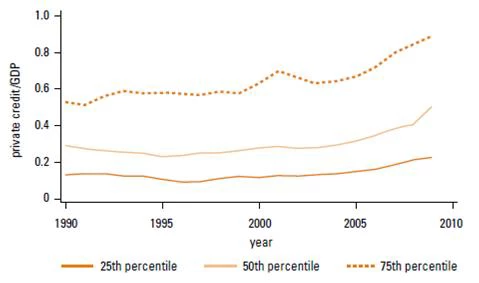

Today, Africa is confronted with significant challenges and opportunities. On the one hand, African financial systems are among the smallest in the world, as measured by a standard indicator, Private Credit to GDP (Figure 1), on the other hand, this standard indicator has shown an increasing trend across the continent, not only for the average country, but for 80 percent of all economies in Africa for which we have data (Figure 2).

[1]Unlike the previous publication, the current flagship includes coverage of North Africa.

Figure 1: Private Credit to GDP accross the World, 2009

Figure 2: Private Credit accross Africa, 1990-2009

Over the past four years, the transformational impact of technology on financial system deepening and broadening has become clear as well. With over 13 million clients in Kenya M-Pesa is the world’s most widely used telecom-led mobile money service. There has been an increasing trend towards regional integration within the continent over the past years, though this trend started well before 2007. South African, Nigerian, Moroccan and Kenyan banks are rapidly expanding their operations in the region.

The new environment offers new challenges but also new opportunities for financial sectors across the region, which we will discuss in more depth on this blog in the following weeks. We assess these challenges and opportunities across three dimensions: (i) expanding access to financial services for both households and enterprises, (ii) lengthening financial contracts and (iii) safeguarding financial systems for their users.

Across the three themes, we focus on three main messages.

Competition is the most important driver of financial innovation, and will help African financial systems deepen and broaden.

While in the industrialized countries of North America and Western Europe, financial innovation has gotten a bad name since the recent crisis, being associated with CDO, CDS and other three-letter abbreviations, financial innovation is more than that and comprises numerous new products, new processes and new organizational forms. Recent examples in Africa include (i) mobile banking, i.e. access to basic payment services through mobile phones, even without having to have a bank account, (ii) the use of psychometric assessments as a viable low-cost, automated screening tool to identify high-potential entrepreneurs, (iii) agricultural insurance based on easily verifiable rainfall data, and (iv) new players in the financial systems, such as micro-deposit taking institutions, and cooperation between formal and informal financial institutions. However, financial innovation can only happen in a competitive environment.

Competition, in this context, is broadly defined and encompasses an array of policies and actions. On the broadest level, it implies a financial system that is open to new types of financial service providers, even if they are nonfinancial corporations. It allows the adoption of new products and technologies. The example of cell phone–based payment systems across the continent is one of the most powerful illustrations in this category. Within the banking system, competition implies low entry barriers for new entrants, but also the necessary infrastructure to foster competition, such as credit registries that allow new entrants to draw on existing information. To achieve more competition in smaller financial systems, more emphasis has to be placed on regional integration. However, this might also mean more active government involvement by, for example, forcing banks to join a shared payment platform or contributing negative and positive information to credit registries. While it is important to stress that the focus on innovation and competition should not lead to the neglect of financial stability, there has been a tendency in many African countries to err too much on the side of stability.

There is a need to focus more on financial services rather than on the types of institutions that deliver these services.

While most of the analysis and policy recommendations focus traditionally on specific institutions or markets, we care primarily about the necessary financial services. Only secondarily should we be concerned about the institutions or markets that provide financial services. Africa’s financial systems are heavily bank-based, in line with their level of financial and economic development. Capital markets are small and—where they exist—mostly illiquid. Contractual savings institutions, such as insurance companies and private pension funds, are underdeveloped and often poorly managed and supervised. There is a need to diversify financial systems away from a heavily bank-dominated system, but it is also important to recognize that artificially creating certain components of the financial system without the necessary demand and infrastructure will have limited economic benefit.

Banks are and will continue for a long time to be the most important component of African finance, but if nonbanks are better at providing certain financial services, they should be allowed to do so. If the small economies of Africa cannot sustain organized exchanges, the emphasis should be placed instead on alternative sources of equity finance, such as private equity funds. If the local economy is not sufficiently large to sustain certain segments of a financial system, then the importation of such services should be considered, e.g., in the form of regional stock exchanges and listing. One size does not fit all: smaller and low-income countries are less able than larger and middle-income countries to sustain a large and diversified financial system and might have to rely more heavily on international integration.

There is a need for increased attention on the users of financial services.

While the focus has been on supply-side constraints, partly driven by data availability, a more prominent focus of analysis and policy should be on the users of financial services—both current and potential. Turning unbanked enterprises and households into a bankable population and ultimately banked customers involves more than pushing financial institutions down-market. Achieving such a change requires financial literacy, that is, knowledge about products and the capability to make good financial decisions among households and enterprises. It also means that nonfinancial constraints must be addressed, such as, most prominently, in agriculture. It includes a stronger emphasis on equity financing for often overleveraged enterprises. It also includes a consumer protection framework, which includes (i) consumer disclosure that is clear, simple, easy to understand, and comparable; (ii) prohibitions on business practices that are unfair, abusive, or deceptive; and (iii) efficient and easy to use recourse mechanisms.

One size does not fit all

Throughout the book, we stress commonalities and differences across the continent. While African economies and financial systems share many features, there are critical differences along notable dimensions.

Financial systems face different challenges in low- and middle-income countries across the continent. Basic financial services for commercial transactions and short-term credit characterize the financial systems of many low-income countries, where formal financial services are often limited to a small share of enterprises and households. Middle-income countries are characterized by a much larger outreach among banking systems to households and enterprises, a larger variety of financial services and products, and a diversification of financial institutions and markets. Size matters: even among low-income countries, larger economies are able to sustain larger and more diversified financial systems. There are also important geographical differences. North African financial systems are dominated by government-owned financial institutions to a much larger extent than systems in sub-Saharan Africa, where many systems are weighted toward foreign-owned banks. Even there, though, governments are preponderant in other segments of the financial system, such as the pension sector and the bond market. However, there are also important differences in the challenges that financial systems in densely populated economies, such as Rwanda and Uganda, face from systems in countries with more dispersed populations, such as Ethiopia or Tanzania.

There is an important distinction between common law and civil code countries. Common law countries typically have a more flexible legal and regulatory framework that offers more room for innovation, while civil code countries rely more steadily on written codes and often take longer to adjust the legislative and regulatory framework to new developments. Finally, postconflict countries and economies with abundant natural resources face their own unique set of challenges in achieving financial deepening and broadening. So, while many challenges and opportunities are similar across the continent, the policy implications differ according to country circumstances. We will return to this theme during the coming weeks.

Join the Conversation