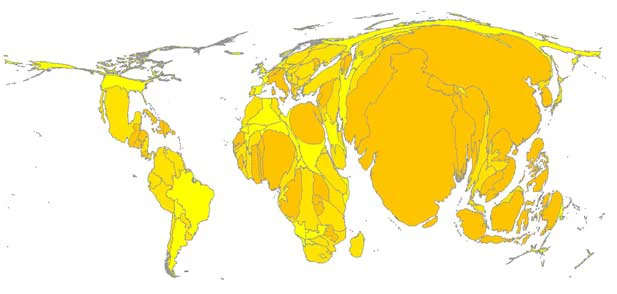

Financial inclusion is a logical choice for the report’s theme. Access to financial services is crucial for reducing poverty and boosting shared prosperity, as demonstrated by recently available data and evidence showcased in the report. At the same time, real-world financial systems are far from inclusive. Globally, 2.5 billion people—more than a half of the world’s adult population—have no bank accounts, lacking efficient mechanisms to save money and pay bills. A vast majority of the “unbanked” live in the developing world (figure 1).

The report comes at a propitious time, because financial inclusion has become a subject of heightened interest. Over 50 countries have recently committed to formal targets and goals for financial inclusion. And last month, during the World Bank-IMF Annual Meetings, President Jim Yong Kim put the issue into spotlight by calling for universal financial access for all working-age adults by 2020.

Global Financial Development Report 2014 is the most comprehensive study yet on financial inclusion. The report highlights new evidence on policies that improve—and those that undermine—access to finance. The report can be used to chart a road map towards greater financial inclusion. Similarly to the first Global Financial Development Report, it seeks to avoid simplistic views and instead develops a nuanced approach to financial sector policy, based on a synthesis of recent and new evidence.

The report emphasizes that people, especially the poor, benefit greatly from using basic payments, savings and insurance services. Achieving those benefits requires addressing market and government failures. For policymakers, it is important to provide an enabling environment of strong laws and regulations, good information, and healthy competition among financial service providers. In this way they can encourage the private sector embrace new technologies, such as mobile banking and biometric borrower identification; and also create new and innovative products such as commitment savings accounts or index insurance.

The report cautions that the objective should not be financial inclusion for inclusion’s sake. Without healthy competition and effective regulation, attempts to promote credit for all just lead to financial and economic instability, as we have seen in the recent crisis.

Pursuing financial inclusion responsibly requires educating consumers about finance. The report notes that classroom-based financial education for general population has little impact. It works better during key moments in one’s life, for example when starting a job or applying for a loan. People also learn better when messages are delivered though their social networks and engaging channels, such as soap operas.

The report is accompanied by several useful cross-country datasets, including an updated and extended version of the Global Financial Development Database, covering financial system characteristics for over 200 economies. The database fills key data gaps, and is a resource for country officials and others interested in measuring financial systems.

Figure 1: Where do the World's 2.5 Billion Unbanked Live?

Source: Calculations based on the Global Financial Inclusion (Global Findex) Database and World Development Indicators.

Note: The cartogram is for illustration purposes only. Country sizes are adjusted to reflect the estimated number of unbanked people, ages 15+. After adjusting for the number of the unbanked, for example, Mexico seems larger than the United States, Australia and Canada almost disappear from the map, and India appears larger than South America. The image was created with the help of the MapWindow 4 and ScapeToad software.

Join the Conversation