These days, job creation is a top priority for policymakers. What role do small and medium enterprises (SMEs) play in employment generation and economic recovery? Multi-billion dollar aid portfolios across countries are directed at fostering the growth of SMEs. However, there is little systematic research or data informing the various policies in support of SMEs, especially in developing countries. Moreover, the empirical evidence on the firm-size growth relationship has been mixed. Recent work of Haltiwanger, Jarmin, and Miranda (2010) in the U.S., suggests that (1) Startups and surviving young businesses are critical for job creation and contribute disproportionately to net growth and (2) There is no systematic relationship between firm size and growth after controlling for firm age. It is not clear whether these findings apply in developing countries where there are greater barriers to entrepreneurship, and where venture capital markets that finance young firms are not as well developed as in the US.

In a recent paper Meghana Ayyagari, Vojislav Maksimovic and I put together a database that presents consistent and comparable information on the contribution of SMEs and young firms to total employment, job creation, and growth across 99 developing economies. Our sample consists of 47,745 firms surveyed in the period 2006-2010. We then examine the relationship between firm size, age, employment, and productivity growth and how this varies with country income and find the following:

First, small and medium enterprises are the biggest contributors to employment across countries. But SMEs contribute more to employment in low-income countries than higher-income countries.

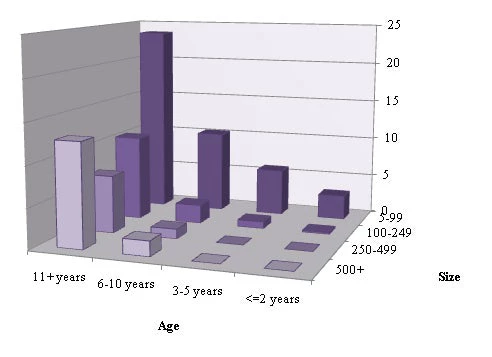

Figure 1. Median Employment Shares of Firms by Size and Age

Earlier work has also shown new firm entry to be much higher in high-income countries. Taken together, these findings suggest that higher income countries are characterized by high rates of entry and turnover of small firms rather than a large SME sector. Firms younger than two years represent a very small proportion of total employment in our overall sample. Across countries, firms that are both small and old (specifically firms that are over 10 years old and with 5-99 employees) have the largest proportional share of total employment compared to other size-age groupings.

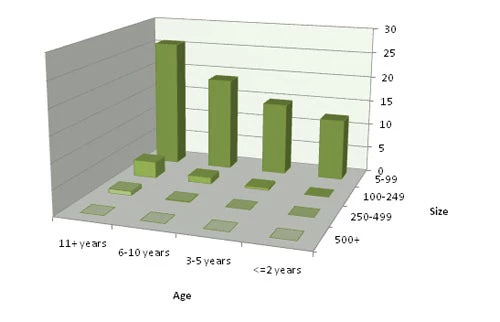

Second, not only do small firms and mature firms employ the largest number of people, they also generate the most new jobs across country income groups. In the median country in our sample, SMEs with 250 employees or fewer generate 86.01% of the jobs. Their contribution is higher (93.05%) in the countries that had a net positive job creation across all firms in the country.

Figure 2: Median Job Creation Shares of Firms by Size and Age

In countries with net job creation (81 countries)

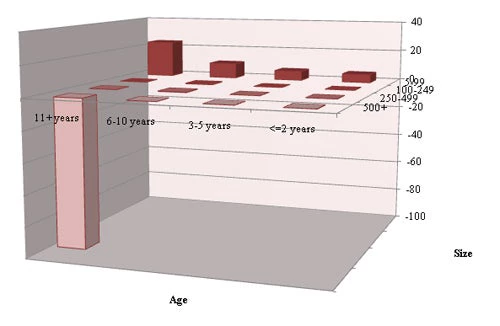

Even in countries that had an aggregate net job loss, we find SMEs with 250 employees or fewer to be substantial job creators (81.51%). Young firms less than two years old generate only 14% of net jobs in countries that had a net positive job creation and even lesser, only 5.39%, in countries that had a net job loss in our sample.

Figure 3: Median Job Creation Shares of Firms by Size and Age

In countries with net job losses (17 countries)

Third, small firms and young firms have the highest employment growth rates in regressions controlling for country, industry, and year fixed effects. However, small firms’ higher employment growth is not accompanied by higher sales or productivity growth. Large firms and young firms have higher productivity growth. Thus while SMEs employ a large share of workers and create most jobs, their contribution to productivity and growth is uncertain at best. Our results are robust to sub-sample analysis by country income group and by looking at countries with large versus small informal sectors.

While the cross-country database improves upon existing databases along several dimensions, our findings are subject to a number of caveats. Most importantly, enterprise surveys cover only the formal sector, excluding the informal firms. Hence our results do not speak to informal enterprises. In addition we also do not have data on microenterprises (less than 5 employees) in our sample. Second, we have data only on surviving firms, which probably overestimates the growth rates for very young firms given they tend to have higher failure rates.

Overall, our findings contrast with those studies using US data. In the US large mature firms have the largest share of employment; whereas, we find in our data that while large firms have a substantial employment share, the small mature firms have the largest share of employment in developing economies. On job creation, the US evidence suggests that small mature firms have net job losses; whereas, in developing countries we find that small mature firms have the largest share of job creation. Moreover, in countries that have had net job losses in the economy as a whole, it is only the small firms, especially small mature firms that have net job gains. Finally, in the US there is also no systematic relation between firm size and growth once age is controlled for. By contrast, in our sample of developing countries, we find that small firms are significant contributors to employment growth even after controlling for age. We find that the higher employment growth of small firms cannot be explained by the sizes of new firms but persists at all ages of firms.

With countries all around the world struggling to recover from the crisis, job creation policies are at the top of the agenda for policymakers. Our results caution that the challenge for policymakers is not only to create more jobs, but also to create better quality jobs to promote growth. Overall, our results show that while SMEs employ a large number of people and create more jobs than large firms, their contribution to productivity growth is not as high as that of large firms.

Growth and increases in productivity require a policy focus on the likely obstacles faced by SMEs, which range from lack of access to finance, the need for business training and literacy programs, as well as addressing other constraints such as taxes, regulations and corruption—all of which are the focus of an active research agenda. In addition, policies to improve entrepreneurship and innovation are likely to be important, since lack of dynamism is a distinguishing feature of developing countries and young firms tend to be productive and among the fastest growing. Finally, our results also suggest a need for greater focus on large, mature firms which have a notable share of employment and also have higher productivity growth compared to small firms.

References:

Ayyagari, M., A. Demirguc-Kunt and V. Maksimovic, 2011. “Small vs. Young Firms across the World: Contribution to Employment, Job Creation, and Growth.” World Bank Policy Research Working Paper.

Haltiwanger J., R. Jarmin, and J. Miranda, 2010. “Who Creates Jobs? Small vs. Large vs. Young." NBER Working Paper No 16300.

Klapper Leora F., and I. Love. 2010. The impact of the financial crisis on new firm registration. Policy Research Working Paper Series 5444, The World Bank.

Join the Conversation