The last decade has seen a tremendous transformation in the global financial sector. Globalization, innovations in communications technology and de-regulation have led to significant growth of financial institutions around the world. These trends had positive economic benefits in the form of increased productivity, increased capital flows, lower borrowing costs, and better price discovery and risk diversification. But the same trends have also lead to greater linkages across financial institutions around the world as well as an increase in exposure of these institutions to common sources of risk. The recent financial crisis has demonstrated that financial institutions around the world are highly inter-connected and that vulnerabilities in one market can easily spread to other markets outside of national boundaries.

In a recent paper my co-author Deniz Anginer and I examine whether the global trends described above have led to an increase in co-dependence in default risk of commercial banks around the world. The growing expansion of financial institutions beyond national boundaries over the past decade has resulted in these institutions competing in increasingly similar markets, exposing them to common sources of market and credit risk. During the same period, rapid development of new financial instruments has created new channels of inter-dependency across these institutions. Both increased interconnections and common exposure to risk makes the banking sector more vulnerable to economic, liquidity and information shocks.

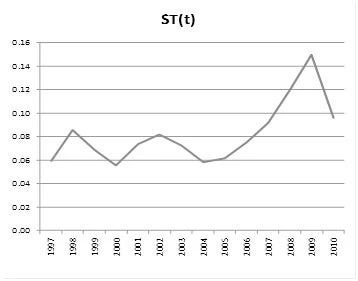

To empirically examine the claim that the global banking sector has become more interdependent and more fragile to shocks, we construct a default risk measure for all publicly traded banks using the Merton (1974) contingent claim model. We compute weekly time series of default probabilities for over 1,800 banks in over 60 countries and examine the evolution of the correlation structure of default risk over the 1998 – 2010 time period.

As we can see from the figure below, there was a substantial increase in co-dependence in the default risk of publicly traded banks starting around the beginning of 2004 leading up to the global financial crisis starting in the summer of 2007. Although we observe an overall trend towards convergence in default risk globally, this trend has been much stronger for North American and European banks, as the crisis also revealed. We also find that the increase in co-dependence has been higher for banks that are larger (with greater than US$50 billion in assets). We also examine variation in co-dependence across countries. We find that countries that are more integrated, have liberalized financial systems and weak banking supervision and greater safety net coverage have higher co-dependence in their banking sector.

Co-Dependence in Default Risk

Increased co-dependence in default risk in the banking sector has important implications for capital regulations. In the aftermath of the global financial crisis, there has been renewed interest in macro-prudential regulation and supervision of the financial system. There has also been a growing consensus to adjust capital requirements to better reflect an individual bank’s contribution to the risk of the financial system as a whole.

Hence it is important to see that leading up to the crisis there has indeed been a uniform increase in co-dependence across banks located in different national jurisdictions. Financial liberalization and greater financial safety net coverage contribute to this increase in fragility potentially by increasing both the opportunities and incentives to take on excessive risks. It is encouraging that that there is also some evidence that stronger bank supervision tends to reduce systemic bank risk in a given country. Nevertheless, our results call for coordination of bank regulation and supervision at a global level. This is especially true for larger banks which have grown more interconnected over the past decade.

Further Reading:

Anginer, Deniz and Asli Demirguc-Kunt, “Has the Global Banking System Become More Fragile Over Time?” World Bank Policy Research Working Paper, #5849.

Join the Conversation