If I told you that people respond to incentives you’d probably think I’m stating the obvious. But if I told you that a simple intervention raised the repayment rate among risky borrowers by more than threefold, you’d perhaps be more surprised.

Malawi—like many other Sub-Saharan African countries—suffers from limited access to formal credit, especially in rural areas. Part of the problem is that the typical microfinance loan is not well suited for agriculture. For example, lenders cannot schedule frequent repayments because farmers receive cash flows only after the harvest, several months after the loan is taken. Similarly, all farmers need cash at the same time to purchase inputs, so allowing some farmers to borrow only after others have repaid their loans would mean that some farmers would end up receiving credit when they do not need it.

In the absence of collateral or verifiable credit histories, lenders may use “dynamic incentives,” such as the promise of larger loans or the threat of future credit denial, or may participate in credit bureaus. However, both require that borrowers be identified with reasonable certainty. Identification is necessary in order to retrieve a current loan applicant’s past credit history from a credit database. Most developed countries have a unique identification system in the form of a social security number or government-issued photo identification. But in many of the world’s poorer countries, large segments of the population lack formal identification documents, and even for those who have them, there is often no national system for uniquely identifying individuals in a database. In these countries, lenders accept different forms of identification, such as a passport, a health insurance policy number or even a letter from the local village leader. Because documents can be falsified, and because individuals may simply use different types of identification when dealing with different lenders, it is extremely difficult to track a customer across multiple lenders, let alone within a single lender’s client base.

It is true that loan officers may know the borrowers, but the reality is that these officers are typically transferred between branches every few years, so institutional memory is lost. And because they commonly handle hundreds of loans per year, it is easy to see how mistakes in identification could be made. The response of many lenders to this situation has been to limit the supply of credit and increase its price, to the detriment of many creditworthy smallholder farmers who cannot finance crucial inputs such as fertilizer and improved seeds.

In a recent working paper, Jess Goldberg, Dean Yang and I implemented a field experiment to test a possible solution: biometric identification. In particular, we ask: “Can improvements in personal identification encourage borrowers to repay their loans and enable financial institutions to increase access to credit?” In collaboration with the Malawi Rural Finance Corporation (MRFC), a government-owned MFI that provides about half of the formal loans in rural areas, and Cheetah Paprika Limited (CP), a private agri‐business company, we randomly assigned more than 3,000 farmers who applied for agricultural input loans to grow paprika to either a comparison group or a treatment group. All borrowers received an in-kind “starter kit” that included extension services and a subsidized package of high-quality inputs (seeds, pesticides, fungicides, and fertilizer) in exchange for farmers’ commitment to sell the paprika crop to CP at harvest time. Both treatment and control groups were given a presentation on the importance of credit history in ensuring future access to credit. In addition, each farmer in the treatment group also had a fingerprint collected as part of the loan application and received an explanation that the fingerprint would be used to identify him or her on any future loan applications.

During July and August of 2008, farmers harvested the paprika crop and sold it to CP at predefined collection points. CP then transferred the proceeds from the sale to MRFC, who deducted the loan repayment and credited the remaining proceeds to the farmer’s savings account. This deduction of the proceeds for loan repayment essentially allowed MRFC to “seize” the paprika crop when farmers sold to CP.

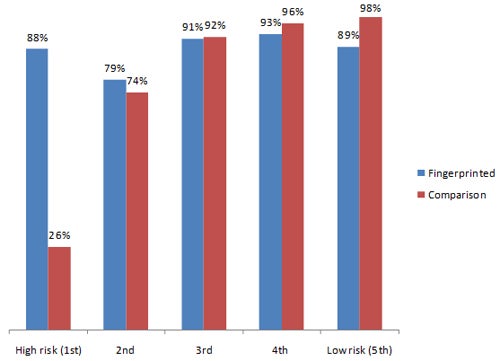

Using data on loan sizes and repayment rates, we find that for the subgroup of farmers with the highest ex ante default risk (based on a “predicted repayment” measure constructed from baseline characteristics) fingerprinting led to a threefold increase in the percentage of individuals who fully repaid their loans at maturity (Figure 1). By contrast, fingerprinting had no impact on farmers with low ex ante default risk. The higher repayment rate among riskier borrowers can be explained by the fact that riskier borrowers who were fingerprinted requested smaller loan sizes and devoted more land and other inputs to paprika, as intended. Clearly, one way farmers could default on the loan is by diverting the input package to other crops. This way the farmer can sell the other crops while leaving CP with a paprika harvest too small to recover the costs of the borrowed input package.

Figure 1

Percentage of Borrowers that repay fully at maturity, by quintile

Note: High risk corresponds to the first quintile

We estimate a net benefit to the lender of close to US$ 2 per individual fingerprinted, and a benefit-cost ratio of 2.34. This ratio is based on benefits to the lender in terms of increase in repayment, and costs including equipment, loan officer time, and transaction cost per fingerprint checked but there are reasons to suspect that over time, the benefits of fingerprinting may be larger as the lender’s threat of enforcement becomes more credible and borrowers see benefits from having a good repayment history. These results are interesting because they suggest the importance of personal identification for credit market efficiency and shed light into how borrowers may respond to the introduction of a credit bureau.

Join the Conversation