Standard microeconomic theory establishes profit maximization as the ultimate goal of all enterprises. The entrepreneur’s motive for starting a business is not considered as a variable that could affect that goal. However, enterprises are not all the same. Across different countries, many entrepreneurs report non-pecuniary benefits as the primary reason for starting their business—and Mexico is not an exception. Those benefits include “flexibility” and “independence.” For other entrepreneurs, starting a business was a second option, only pursued after being laid off. These motives are especially common for microenterprises, which represent the large majority of businesses in Mexico.

In this study we shed light on how the motives for starting a business help explain differences in expectations and performance of firms. Different expectations mean different appetites for financing. A significant number of microenterprises’ owners in Mexico claim they do not need external financing. Moreover, most microentrepreneurs do not perceive the lack of financing as an obstacle for their businesses. Many of these businesses have little desire to grow or innovate, if any.

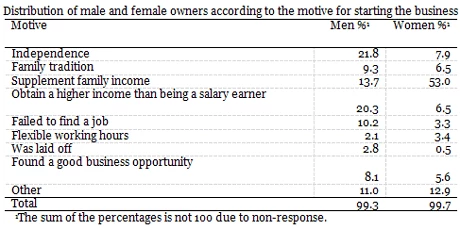

Mexico’s National Survey of Microenterprises (Encuesta Nacional de Micronegocios or ENAMIN) provides information on owners’ motives for starting a business, their expectations about business continuity, and the current performance of the firm. This survey has been conducted almost every two years since 1992 and has national representativeness. Its target population comprises microenterprises with 1 to 16 employees, including the owner. The table below shows the percentage of microenterprises according to the owner’s motive for starting the business as reported in ENAMIN 2008.

The most common motive for starting a business among women is to “supplement family income,” whereas “independence” is the most common motive for men. Further, the share of microenterprises’ owners reporting “failed to find a job,” “flexible working hours,” or “was laid off” is not low: those three options account for 15.1 and 7.2% of men and women, respectively.

We used data from six different rounds of the survey to estimate the degree of association between owners’ motives for starting a business and their plans to continue in it (as opposed to shutting down operations or changing occupation). We also estimated the degree of association with the actual performance of the firm in terms of its size, its demand for financing, and the owner’s perception of the lack of financing as a business obstacle. We controlled for owner’s characteristics (age, education and marital status), and included fixed-effects for the longevity of the business to capture existing variations between young and older businesses. In essence, we found that motives for starting a business are significantly correlated with firm performance, for both men and women. Our findings suggest motives are strongly associated with differences in expectations and demand for financing among businesses.

We also used the 2008 survey to study owners’ reservation wages. We found that in order to leave their business, most owners would require a monthly salary that exceeds their average profits. Risk aversion does not explain this finding–the inequality induced by risk aversion should go in the opposite direction. Our interpretation is that some owners would have to be compensated for the non-pecuniary benefits they obtain from their businesses. In fact, the percentage difference between the reservation salary and the average profits of the firm is also correlated to the owner’s motive for starting the business. The reservation wage is itself also informative: 50% of owners would leave their business for a monthly wage of less than 500 dollars, and 90% for a monthly wage of less than 1,200 dollars. These estimates strongly suggest that most microenterprises in Mexico have limited opportunities to grow.

The evidence analyzed in our study suggests the traditional profit-maximization model might not be appropriate for explaining the behavior and the performance of many microenterprises in Mexico. Many microbusinesses do not have plans to grow and they are not eager to obtain credit. Policy makers should consider this evidence when designing financing programs.

This study is part of the first volume of Estudios Económicos CNBV, a compendium of economic studies focused on the Mexican financial system prepared by the Economic Research Team of Mexico’s National Banking and Securities Commission (CNBV). A Spanish version of the study together with the rest of the studies in Estudios Económicos can be found at this link.

Join the Conversation