Surging account ownership among the poor. The highest rate of account ownership among women in developing countries. Widespread formal saving.

Those are some of the key financial inclusion trends in East Asia and the Pacific, as outlined in a new policy note drawing on the 2014 Global Findex database.

Since 2011, about 700 million adults worldwide have signed up for an account at a formal financial institution (like a bank) or a mobile money account. That means 62 percent of adults now have an account, up from 51 percent three years ago.

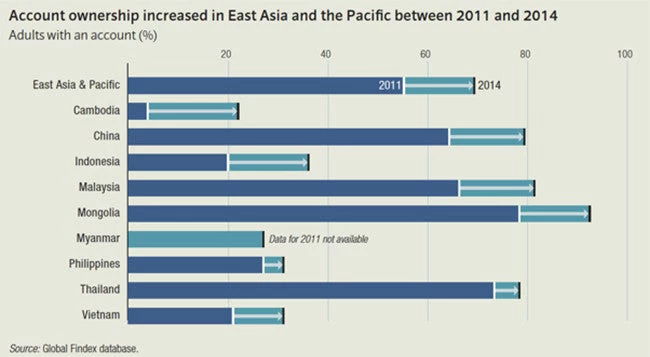

East Asia and the Pacific made an outsized contribution to this global progress. About 240 million adults in the region left the ranks of the unbanked; 69 percent now have an account, an increase from 55 percent in 2011 (figure 1). Poor people led the regional advance, as account ownership among adults living in the poorest 40 percent of households surged by 22 percentage points — to 61 percent. Much of the growth was concentrated in China — which saw account penetration deepen on the bottom of the income ladder by 26 percentage points — but China was hardly alone. In both Indonesia and Vietnam, account ownership doubled among adults living in the poorest 40 percent of households.

Figure 1

Unlike much of the developing world, women have benefitted from progress in East Asia and the Pacific. The account ownership gender gap in developing countries is stuck at 9 percentage points — exactly where it was when the original Global Findex was launched in 2011. East Asia and the Pacific defies the trend in more ways than one. Not only is its gender gap the smallest among developing regions — just 4 percentage points – but it has by far the highest rate of account ownership among women. Sixty-seven percent of women in East Asia and the Pacific own an account, compared to 50 percent of women in developing economies overall.

While account ownership is a necessary first step to financial inclusion, the benefits of really come from their active use — and this is another area where the region is succeeding. About 66 percent of adults in East Asia and the Pacific have what the Findex team defines a high use account — an account that is used for cash management, making payments in the past 12 months, or saving in the past 12 months — putting it in the same league as Europe and Central Asia, Latin America and the Caribbean, and Sub-Saharan Africa. Much of this is driven by formal savings, cited by 72 percent of adults in East Asia and the Pacific with a high-use account. In Thailand, 59 percent of adults save for old age – the highest percentage among developing economies.

Although less than 1 percent of adults in the region have a mobile money account, people are taking advantage of mobile technology to manage their finances. Regionally, 17 percent of account holders — including 19 percent of those in China — make payments from their bank account using a mobile phone, as compared to 13 percent in developing countries on average.

But despite the region’s massive progress, East Asia and the Pacific is still home to almost a quarter of the world’s 2 billion unbanked adults. The Global Findex reveals a number of ways governments and the private sector can help these people access financial services. About 30 percent of the unbanked receive wage or government transfers in cash; moving these payments into accounts could help up to 140 million adults become account owners. At the same time, about one-third of unbanked adults — about 160 million adults — receive payments for agricultural goods in cash. Shifting cash payments into account presents a big opportunity for expanding financial inclusion but it is not without challenges. Governments need to protect consumers from corporate abuse, and companies need to design products that are easy to use and actually meet peoples' needs.

Plenty of opportunities abound to increase account use as well. A staggering 705 million account-owning adults in East Asia and the Pacific still pay utilities bills or school fees in cash, while 155 million send or receive domestic remittances in cash. Using accounts to make these payments instead of cash could make life not only easier, but also help empower women economically. Research shows that account use gives women a stronger say over the household budget — often resulting in more spending on health care, education and other necessities. It also saves them money: women are often forced to travel and take time off work to pay school fees, resulting in lost wages.

For more information on the Global Findex: www.worldbank.org/globalfindex

Join the Conversation