Despite pressing needs for spending on social services and public investment, most developing countries struggle to raise sufficient tax revenues to meet their needs. Pakistan raises only 10% of GDP in tax revenue, whereas the United Kingdom raises more than twice as much, 25% (WDI 2012. In large part, this is due to the fact that tax evasion is widespread in developing countries. Estimates are scant, but we know that a significant share of firms are not even tax-registered (Bruhn et al 2013), and many firms that are tax-registered misreport their taxable income and transactions (Pomeranz 2013, Carillo et al 2014). What is less well known is that the tax instruments used in developing countries also differ significantly from those in developed countries (Gordon & Li 2009). For instance, many developing countries use production-inefficient taxes such as turnover taxes, which can distort firms’ input choices, and which standard prescriptions based on developed country contexts would discourage. What motivates these policies, and could they actually be an optimal response to the presence of evasion? In a paper forthcoming in the Journal of Political Economy, we shed light at this question, using theory and evidence from Pakistan.

Pakistan, like over thirty other developing countries, taxes firms either on profits or on turnover, depending on which tax liability is higher. Profits (=turnover-costs) are taxed at a rate of 35%, whereas turnover is taxed at a much lower rate of 0.5%. When filing their tax declaration, all firms calculate their liability on both profits and turnover, and firms whose profit rate (=profits/turnover) is below the ratio of the two tax rates (=0.05/0.35=1.43%) pay the tax on turnover. The stated aim of this minimum tax is to curtail evasion. Firms can evade the profit tax by either under-reporting sales or over-reporting costs, while evading the turnover tax requires under-reporting sales. If hiding output is more difficult than fabricating fake receipts for inputs, the minimum tax reduces the extent to which firms can evade taxes. In Pakistan, the policy seems to work. The turnover tax is paid by half of all corporations and constitutes about 60% of corporate tax revenue.

However, the wide-spread use of such minimum tax schemes and their success in raising revenue stands in stark contrast to the teachings of public finance theory. Indeed, one of the foundational results in public finance, the production efficiency theorem (Diamond & Mirrlees 1971), requires that optimal tax systems preserve production efficiency, even in second best environments. Turnover taxes clearly violate this optimal tax rule and are rarely used in developed economies. Turnover taxes distort production efficiency by cascading through the production chain, hence taxing the same item multiples times and incentivizing firms to integrate vertically (Keen 2013).

To shed light on this paradox between the theory and practice of taxation in developing countries, we model the optimal taxation of firms in the presence of evasion. By doing so, we relax the assumption of perfect enforcement in the Diamond & Mirrlees framework, which is clearly at odds with the reality in developing countries. In our model, governments face a trade-off between production efficiency and revenue efficiency motives in taxation. While a profit tax maintains production efficiency, it has low revenue potential in a high evasion context, because firms can evade the tax by inflating costs. A turnover tax, on the contrary, distorts production incentives but is more difficult to evade, as the tax base in broader. As a result, the turnover tax is a more powerful revenue raising tool. Countries with high levels of evasion thus have good reasons to tax turnover rather than profits.

Analyzing administrative tax return data on all taxpaying firms in Pakistan between 2006 and 2010 allows us to verify whether the model’s predictions are borne out in practice. The minimum tax creates a kink, a profit rate threshold at which firms move from the profit tax into the turnover tax regime. At this threshold, both the tax rate and the tax base change discontinuously, giving firms a strong incentive to locate at or around the kink. Consider for example a firm with a true profit rate of 3%. To evade taxes, the firm over-reports costs and its reported profit rate falls to about 1.4%. At this point, the firm will be required to pay taxes on turnover, so any further manipulation on the cost side has no impact on its tax liability. The firm could further reduce its tax liability by also under-reporting sales, but that may be more difficult than over-reporting costs. For example, while factories' output may be readily observable, the fuel used in production is much more difficult to observe. In this situation, the firm will simply report a profit rate that is close to the kink, where the tax liabilities on profit and turnover are equal, and the firm has reduced its tax liability as much as possible.

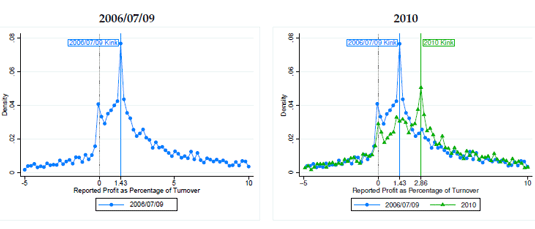

This is indeed what we observe when plotting the density distribution of firms’ reported profit rates around the kink. The figure below shows the profit rate distribution for firms in 2006/07/09 (blue), when the kink is at a profit rate of 1.43%, and in 2010 (green), when the turnover tax is increased to 1% and the kink moves to a profit rate of 2.86%. A disproportionately large number of firms report a profit rate close to the kink, and this excess mass moves across time with the location of the kink. Note that this sharp bunching around the kink must be driven by evasion rather than real output changes. Of course, being taxed on turnover rather than profits might lead some firms to reduce output, which would also generate bunching at the kink. But this effect would be tiny, because the turnover tax is levied at a very low rate. Only the firms’ tax evasion behavior, combined with the differential ease of misreporting profits and turnover, can explain the large and sharp bunching we observe.

Bunching of taxpayers around a threshold has been used in previous studies to estimate the elasticity of taxable income with respect to the tax rate (Chetty et al 2011, Saez 2010, Kleven & Waseem 2013). Following a similar methodological approach, but extending it to our setting where both the tax rate and the tax base jump at the threshold, we use bunching at the minimum tax kink to estimate the evasion rate response to turnover taxation. The intuition is that the excess firms around the kink are essentially those that have evaded the profit tax to some extent. We can estimate how many additional firms there are around the kink, and this number, together with our model and a range of assumptions about the real output elasticity, allows us to quantify the evasion rate change. We find that turnover taxation reduce evasion by up to 60-70% of corporate income compared to profit taxation. In a calibration exercise, we link our empirical estimates back to the theory, estimating that turnover taxation can increase revenue by up to 74% without reducing aggregate profits.

Figure I: Profit Rate Distribution—Taxpaying Corporations In Pakistan

These results remind us to be careful when comparing tax systems in developing countries to developed countries, or to conventional theories of optimal taxation. Given the particular characteristics of developing countries, especially the high degree of evasion, certain tax policies that seem suboptimal, such as production inefficient turnover taxes, can turn out to be an optimal response to the challenge of raising revenue in a developing country setting.

References

CARRILLO, PAUL, POMERANZ, DINA, & SINGHAL, MONICA. 2014. Tax Me if You Can: Evidence on Firm

Misreporting Behavior and Evasion Substitution. Working Paper, Harvard University.

CHETTY, RAJ, FRIEDMAN, JOHN, OLSEN, TORE, & PISTAFERRI, LUIGI. 2011. Adjustment Costs, Firm Responses, and Micro vs. Macro Labor Supply Elasticities: Evidence from Danish Tax Records. Quarterly Journal of Economics, 126, 749–804.

DE ANDRADE, GUSTAVO HENRIQUE, BRUHN, MIRIAM, & MCKENZIE, DAVID. 2013 (May). A Helping Hand or the Long Arm of the Law? Experimental Evidence on What Governments Can Do to Formalize Firms. IZA Discussion Papers 7402. Institute for the Study of Labor (IZA).

DIAMOND, PETER A, & MIRRLEES, JAMES A. 1971. Optimal Taxation and Public Production I: Production Efficiency. American Economic Review, 61(1), 8–27.

GORDON, ROGER, & LI, WEI. 2009. Tax structures in developing countries: Many puzzles and a possible explanation. Journal of Public Economics, 93(7-8), 855–866.

KEEN, MICHAEL. 2013. Targeting, Cascading and Indirect Tax Design. IMF Working Paper 13/57.

KLEVEN, HENRIK J., & WASEEM, MAZHAR. 2013. Using Notches to Uncover Optimization Frictions and Structural Elasticities: Theory and Evidence from Pakistan. Quarterly Journal of Economics, 128, 669–723.

POMERANZ, DINA. 2013. No Taxation without Information: Deterrence and Self-Enforcement in the Value Added Tax. Working Paper, Harvard Business School.

SAEZ, EMMANUEL. 2010. Do Taxpayers Bunch at Kink Points? American Economic Journal: Economic Policy, 2(3). WORLD BANK. 2012. World Development Indicators.

Join the Conversation