Small and medium enterprises (SMEs) often face financial constraints because they lack audited statements and other information about their operations, and as a result, financial institutions have difficulties assessing the risk of lending to them. Studies have shown that information sharing, credit bureaus, and credit scoring can increasing credit to SMEs, but not all countries have well-developed credit bureaus that gather the level of information needed to build a reliable credit-scoring model. For example, the average credit bureau in Latin America and the Caribbean complies with only half of best practices and covers only 40.5 percent of the adult population (Doing Business Report 2016).

While improving credit bureau information is a policy priority, other technologies may also help lenders to better screen loan applicants. One example is a psychometric credit information tool developed by the Entrepreneurial Finance Lab (EFL). Applicants fill out a 25-minute questionnaire administered by the lender and in less than 10 minutes EFL generates a credit score. The score is based on the applicant’s answers to questions capturing information that can predict loan repayment behavior, including the applicants’ attitudes, beliefs, integrity, and performance.

We collaborated with the fifth largest bank in Peru to study the effectiveness of the EFL tool in reducing the risk of lending to SMEs, as well as in expanding access to credit for these firms. The bank granted loans to applicants who were approved using either the EFL score or the traditional credit score. Because private credit bureaus cover 100 percent of the adult population in Peru, everybody has a traditional credit score. But for individuals who have not previously taken out a loan from a formal financial institution this score is based on demographic information rather than actual credit history; while for individuals who have previously taken out a loan from a formal financial institution this score is based on their credit history. This setup allowed us to test two possible uses of the EFL tool:

- As a secondary screening mechanism for entrepreneurs accepted under the traditional credit-scoring method, to lower the risk of the SME loan portfolio; and

- As a skimming mechanism for applicants rejected under the traditional credit-scoring method, to offer more loans without increasing the risk of the portfolio.

We find that:

- EFL’s psychometric credit application can help banks screen out high credit risk entrepreneurs who already have a credit history from a pool of applicants accepted based on the traditional credit score. As shown in figure 1, applicants who would have been offered a loan both based on their EFL score and their traditional credit score display better repayment behavior than those who would have been offered a loan based on their traditional credit score, but not based on their EFL score.

Figure 1: The EFL tool can identify those with better repayment behavior among applicants who were offered a loan based on their traditional credit score

Source: Author’s calculations based on data from the Superintendencia de Banca y Seguros (SBS) in Peru.

- When used as a tool to find loan applicants with low credit risk among a pool of entrepreneurs who have a credit history and have been rejected using the traditional credit scoring method, the EFL tool has limited power and could even lead to an increase in portfolio risk. In other words, with respect to portfolio risk, the EFL tool does well in complementing credit history information, but not in replacing it.

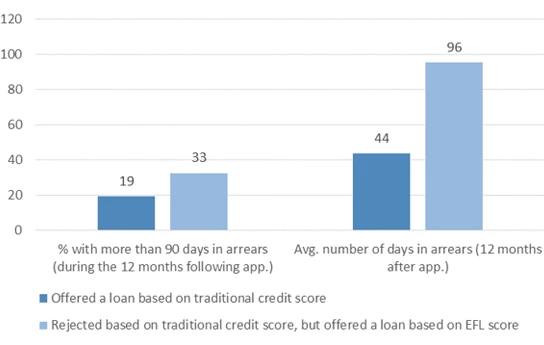

Figure 2: Applicants who were rejected based on their traditional credit score have bad repayment behavior, even if they were offered a loan based on their EFL score

Source: Author’s calculations based on data from the Superintendencia de Banca y Seguros (SBS) in Peru.

- The EFL tool can be used to make additional loans to entrepreneurs without a credit history without increasing the bank’s portfolio risk. In fact, we also find evidence that the EFL tool increase access to loans for entrepreneurs without a credit history.

Our results show the importance of information for assessing credit risk and expanding credit supply. They highlight the power of traditional credit scores to screen out applicants with a history of poor loan repayment. At the same time, the results illustrate that psychometric credit scoring is a viable tool, both to reduce risk on applicants with a credit history, and to reach applicants without a credit history in a way that does not lead to an increase in credit risk.

For further reading see: Arráiz, Irani, Miriam Bruhn, and Rodolfo Mario Stucchi. (2015) “Psychometrics as a tool to improve screening and access to credit” World Bank Policy Research Working Paper no. 7506

Join the Conversation