Editor's Note: The following post was submitted jointly by Roberto Rocha, Senior Adviser, MENA, Rania Khouri, Director, Union of Arab Banks, Subika Farazi, Consultant, MENA, and Douglas Pearce, Senior Private Sector Development Specialist, MENA.

Small and medium-size enterprises (SMEs) are increasingly a priority for policymakers in the Middle East and North Africa (MENA) region, who see SMEs as key to solving the challenge of improving competitiveness, raising incomes, and generating employment. Data from the World Bank’s Enterprise Surveys suggest that access to finance for SMEs is more constrained in MENA than in other emerging regions, with only one in 5 SMEs having a loan or line of credit. Yet until recently there has been no comprehensive survey of the supply of SME finance in MENA. SME policymakers may therefore lack comprehensive information to design reforms, while SME finance providers may not have access to valuable market information to inform design of SME financial services and delivery channels.

To fill this knowledge gap, the Bank recently carried out a survey in cooperation with the Union of Arab Banks of SME lending in the region. We were fortunate to receive a very high response rate – we have data from 139 banks, which account for about half of MENA banks and almost two thirds of the banking system loans in 16 countries. The survey covered the following themes: i) strategic approach to SME lending, ii) main products offered to SMEs, iii) risk management techniques employed, and iv) SME lending data. This is the first dataset of its kind for this region, and builds on similar efforts in the Latin America and Caribbean region.

In a recent paper I coauthored with Subika Farazi, Rania Khouri and Douglas Pearce, we use this rich dataset to examine the status of SME lending in MENA. Most notably, we find that:

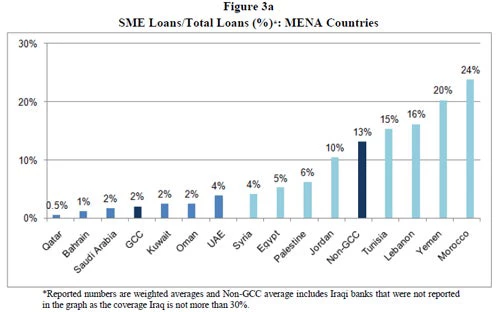

- Banks regard the SME segment as potentially profitable, and most banks are already engaged in SME lending to some degree. However SME lending accounts for only 8 percent of total lending in the MENA region. (The figure below gives a country-by-country breakdown of SME loans as a proportion of total loans.)

- More positively, bank targets for SME lending are significantly higher than current lending, indicating a significant potential supply side response if constraints can be eased.

- Drivers for banks to lend to SMEs include: the potential profitability of the SME market, the saturation of the large corporate market, and the desire to diversify risk.

- Principal constraints for SME lending include lack of SME transparency, poor credit information from credit registries and bureaus, and weak creditor rights.

- Larger banks have not played a more significant role in SME finance in MENA than smaller banks per se, reflecting the presence of large wholesale banks in the MENA region. However, banks with a larger branch network do more SME lending.

- State banks still play a notable role in financing SMEs in the MENA region, but they employ less sophisticated risk management systems than private banks.

- Credit guarantee schemes are a popular form of support to SME finance in the region, and are associated with higher levels of SME lending.

What does all this mean for policy? In the conclusion of the paper, we recommend that MENA governments should prioritize improvements in financial infrastructure, including greater coverage and depth of credit bureaus, improvements in the collateral regime, especially for movable assets, and stimulation of competition between banks and non-banks. Direct policy interventions through public banks, guarantee schemes, and other measures have played a role in compensating for MENA’s weak financial infrastructure but more sustainable structural solutions are needed.

While these solutions are implemented, MENA governments should also make an effort to improve the design and effectiveness of their policy interventions. This could include efforts to improve the design of guarantee schemes (e.g., better targeting and risk-related parameters), and efforts to improve the governance and risk management systems of state banks.

Join the Conversation