Access to banking services is viewed as a key determinant of economic well-being for households, especially in low-income countries. Savings and credit products make it easier for households to align income and expenditure patterns across time, to insure themselves against income and expenditure shocks, as well as to undertake investments in human or physical capital. Up to now, however, there is little cross-country evidence which documents how the use of financial services differs across households and, in particular, how cross-country variation in the structure of the financial sector affects the types of households which are banked. In a recent paper with Martin Brown, we use survey data from 28 transition economies and Turkey to:

- document the use of formal banking services (bank accounts, bank cards and mortgages) across these 29 countries in 2006 and 2010,

- relate this use to an array of household characteristics,

- gauge the relationship between changes in bank ownership and the financial infrastructure (deposit insurance and creditor protection) over time within a country and changes in the use of banking services, and

- assess how cross-country variation in bank ownership structures, deposit insurance and creditor protection affect the composition of the banked population.

For our analysis, we rely on household-level data from the EBRD-World Bank Life in Transition Survey (LITS) implemented in 2006 and in 2010, as a repeated cross-sectional survey. The two survey waves cover 29 countries in which the EBRD operates including 28 transition countries and Turkey. In each country, roughly 1,000 interviews were conducted with randomly selected households for each wave of the survey. The survey includes the following information on the household use of banking services: (i) whether any member of the household has a bank account, (ii) whether any member of the household has a bank (debit or credit) card, and (iii) whether a household that owns its dwelling has financed this dwelling mainly with a mortgage. In addition, the survey includes a rich set of demographic, educational, professional and social household-level information.

Our main findings can be summarized as follows:

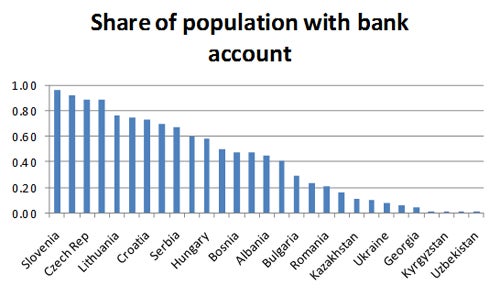

1. There is a large variation in the use of banking services across the transition economies. Specifically, we find that in 2010 more than 80 percent of households in the Czech Republic, Estonia, Slovakia and Slovenia had a bank account, while less than 5 percent of households in Azerbaijan, Georgia, Kyrgyzstan, Tajikistan and Uzbekistan did so. This compares to over 90 percent in France, Germany, Italy, Sweden and the U.K.

2. The use of banking services is more common among households located in urban areas, households with higher income, younger households, households headed by a male, as well as for households in which an adult member has university education and formal employment. By contrast, banking products are used less often by households which rely on transfer income and by Muslim households. Drilling down to the country-level, we find that income and education are the most robust predictors across almost all countries in our sample, while the other household characteristics are less consistent across different countries.

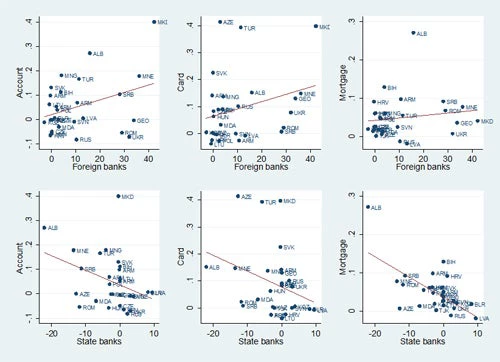

3. Using the within-country variation between 2006 and 2010, we find that the use of banking services increases in countries which privatized their banking sectors and where the presence of foreign banks increased (click on figure below to view a larger version). On the other hand, we find no consistent relationship between changes in deposit insurance or creditor protection and the share of households which use formal banking services.

4. We find evidence for substantial compositional effects of foreign bank ownership, deposit insurance and creditor rights. Foreign bank presence is positively associated with the use of banking products among high-income and formally employed households. Generous deposit insurance coverage increases the use of financial services among urban, rich and formally employed households. Creditor protection also seems to benefit households with formal employment and higher education. By contrast, we find that state ownership is not associated with more outreach to poorer households.

Our results confirm the positive impact that the privatization of state-owned banks has had on access to financial services in the transition economies, including privatization to foreign-owned banks. However, they also confirm previous findings of cherry-picking, with foreign banks targeting richer, more educated and urban population segments. Our results also shed doubt on the ability of structural policy to broaden the financial system to disadvantaged groups. Specifically, attempts to broaden the use of financial services through liberalization of the banking sector or more generous deposit insurance do not increase the likelihood that poorer, less educated and rural segments of the population use formal financial services. Similarly, a better contractual and information framework does not seem to foster financial inclusion. Our results do not imply that these policies do not help foster financial sector development, but rather that it is difficult to target this development to certain groups.

Join the Conversation