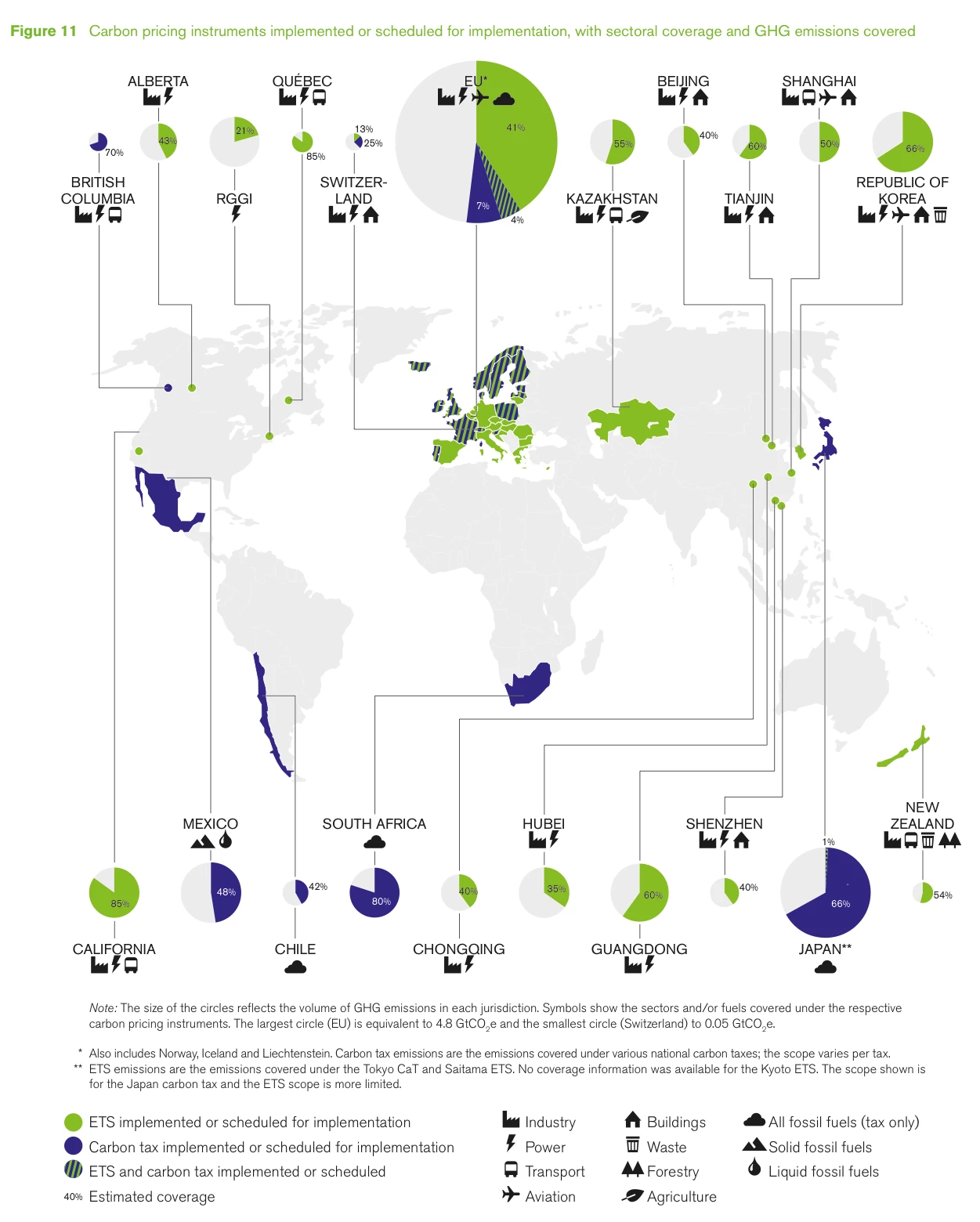

with sectoral coverage and GHG emissions covered.

Many of my compatriots in Poland, where over 90 percent of power generation comes from burning coal, are concerned that the EU climate policy is a risky outlier.

They worry that the EU Emissions Trading System may expose domestic industry to unfair competitition and cause companies to move production to countries where emission costs are lower, something called “leakage”.

The two reports recently released by the World Bank may change this perception.

The State and Trends of Carbon Pricing 2015 report shows that Europe is no longer alone in pricing greenhouse gas emissions. Several national and sub-national jurisdictions – from the US, China, Canada, Japan and the Republic of Korea to Chile and South Africa – have followed suit and often charge higher prices for a broader range of emissions than the European Union.

Covering about 12 percent of global CO2 emissions, carbon pricing instruments are yet to become the “new normal” in the world’s economic landscape, but clearly they are no longer in their infancy.

The second report, FASTER Principles for Successful Carbon Pricing report, released this week by the World Bank Group and the OECD summarizes what has worked well in the existing carbon pricing systems and what has been a challenge. The FASTER principles do not aim to identify the best practice or to tell governments how policies should be designed and implemented. They don’t advocate for any specific carbon price.

Instead of being prescriptive, the report simply pulls together the key lessons learned from the collective wisdom of carbon pricing practitioners and researchers from around the world.

The document lays out six key principles, which has made carbon pricing initiatives successful.

Firstly, successful carbon prices are Fair in three important aspects: they level the playing field between firms; they support social justice, especially by reducing income disparity; and they allow the fair and smooth transition of workers from emission intensive sectors, which are expected to shrink as the economy goes green, to the more efficient and innovative “cleaner” businesses. Economic fundamentals also suggest that the fairness of carbon prices lies in the fact that they shift the burden of the damage caused by harmful emissions from those who suffer from it to those who are responsible for it.

Secondly, carbon prices are Aligned with a suite of other policies and measures. Some of these policies need to complement a carbon price, where economic signal alone is not enough to achieve the intended impact. Other dis-harmonious policies, such as fossil fuel subsidies, need to be phased out to prevent contradicting and wasteful policy incentives. Overlapping energy, industrial or fiscal policies may have merits of their own, but their interference with carbon price incentives need to be carefully managed to achieve coherence across a range of policy areas.

Third, successful carbon prices are part of a Stable policy framework that gives the private sector a consistent, credible and strong investment signal, which strengthens over time. This sort of predictability encourages greater support by businesses, stimulates innovation, and allows firms and consumers to plan their actions in the long term.

Fourth, Transparency is critical to earn public trust and support. Early, regular and open dialogue with affected stakeholders is important, as is implementing trustworthy systems to monitor and verify emissions and mitigation efforts.

Fifth, successful initiatives deliver on the main economic promise of carbon pricing, namely improving Efficiency of the economy by correcting “the largest market failure the world has ever seen” (Nicolas Stern). Flexibility as to where, when and how to reduce emissions also reduces the overall cost of achieving climate stabilization targets, thus increasing the political support for them. Keeping administration simple and cost-effective, and making more productive use of carbon price revenues also contributes to efficiency.

Last, but not least, is Reliability in achieving a measurable and sustainable reduction in greenhouse gas emissions. This requires a comprehensive coverage of the instrument and strength of a carbon price signal that is adequate to cause intended behavioral and technology changes. The choice and design of carbon pricing policy and other measures is key – it can have an important impact on its effectiveness in delivering global and local benefits.

While the FASTER principles are brief and straight-forward. they are supported by a more technical, 40-page analysis targeted at a broad audience. This supporting document is designed as a living document of the Carbon Pricing Leadership Coalition. It will be updated and refined every year by the participants of the CPLC, as new experiences and research become available. It can also be used as a common conceptual framework to develop a methodology for monitoring performance of carbon pricing initiatives.

Working with my colleagues at the World Bank Group and the OECD on coordinating input, I learned a few important lessons myself, which I will share with my fellow Poles next time I go to my home country.

First, Europe is no longer an outlier in the business of pricing carbon emissions.

Second, we have not seen the much feared carbon leakage materialize on a significant scale to date.

Going forward, however, the risk of leakage is real as long as carbon prices differ significantly between jurisdictions. The good news is that this risk seems limited to only a few exposed sectors (not the whole economy) and can be successfully mitigated with smart policies. As more and more jurisdictions introduce similar carbon pricing signals, the risk of carbon leakage will disappear.

Join the Conversation