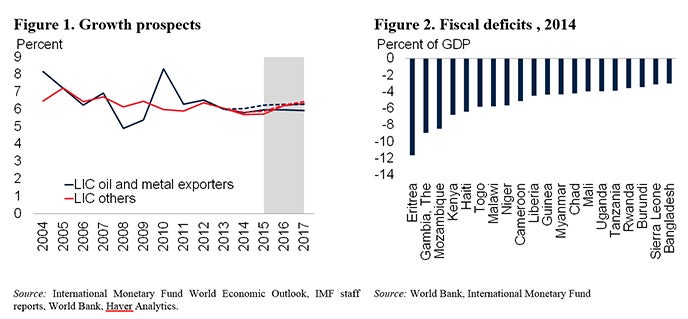

Large agricultural sectors, remittances, and public investment have cushioned the impact of sharply weaker terms of trade in commodity-exporting low-income countries (LICs). Growth in LICs was flat in 2014, but is expected to pick up in 2015 and remain robust during 2016–17. Declining commodity prices, however, are likely to increasingly put pressure on fiscal and current account balances of LICs that rely heavily on exports of energy and metals. Many commodity-exporting LICs have limited buffers to absorb this deterioration. Oil-importing LICs, on the other hand, are expected to benefit from shrinking vulnerabilities as current account balances improve on falling oil import costs.

For 2015–17, growth in LICs, on average, is expected to remain above 6 percent, reflecting continuing strong output growth in several large LICs, supported by sustained investment in public infrastructure (Côte d’Ivoire, Ethiopia) and mining (Democratic Republic of Congo). Consumer spending should be boosted by growth in remittances, even if this growth is down from 2014 (Bangladesh). Despite lower commodity prices, the forecast is for mining output to rise in a number of countries as past investments come on stream (e.g., gold and copper in Democratic Republic of Congo, coal in Mozambique) and other mining investments proceed, albeit at a slower pace (Mozambique, Tanzania). Several governments are prioritizing infrastructure projects, including in the energy sector, in some as part of recent regional agreements to upgrade regional energy grids (Kenya, Rwanda). Elsewhere, heavy government infrastructure investment is supported in part by Eurobond issuance (Côte d’Ivoire and Ethiopia). In several fragile countries (Madagascar, Malawi, Mali), growth should pick up as investment rises on the back of increased political stability. Rising political uncertainty will, however, dampen growth somewhat in Bangladesh in the near-term, although domestic demand should remain supported by resilient remittances. In Nepal, strong remittance inflows should help support domestic demand and post- post-earthquake reconstruction. Guinea, Liberia, and Sierra Leone are recovering as the effects of the Ebola crisis wane.

The outlook is subject to significant and increasing downside risks. A further decline in commodity prices would sharply lower revenue in oil-exporting countries, requiring them to undertake deeper fiscal adjustments, with sharper expenditure cuts. It may prompt some commodity extraction companies to delay or even cancel planned investments in 2015 (Guinea, Mozambique, Tanzania, Uganda). Given the importance of artisanal and small-scale mining in LICs, domestic private consumption may also prove weaker than expected in the baseline. Lower oil prices would also cause a more protracted recession than anticipated in Russia and dampen growth in Tajikistan through lower remittances and exports. Conflict could intensify again in fragile states (e.g., al-Shabab in Kenya, or insurgencies in Mali). A sudden adjustment of market expectations to the upcoming tightening of U.S. monetary policy could put pressures on capita account inflows and exchange rates, and on debt service costs of countries that have tapped international capital markets since the crisis (Côte d’Ivoire, Ethiopia, Kenya, Mozambique, Rwanda, Tanzania).

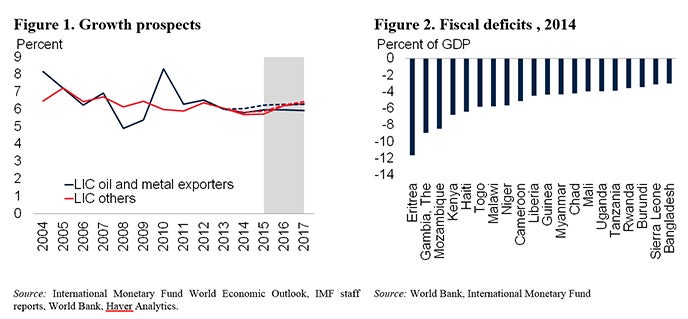

LICs continue to have limited buffers to absorb stresses should risks materialize. Current account deficits and government borrowing requirements are large in many LICs. Reserve coverage of imports in several countries is below three months of imports. Notwithstanding the spending restraint applied by commodity-exporting LICs until 2007, the sharp post-global crisis expansion in government spending has reduced fiscal space. As a result, several now have large twin deficits, with fiscal and current account deficits in excess of 5 percent of GDP.

For 2015–17, growth in LICs, on average, is expected to remain above 6 percent, reflecting continuing strong output growth in several large LICs, supported by sustained investment in public infrastructure (Côte d’Ivoire, Ethiopia) and mining (Democratic Republic of Congo). Consumer spending should be boosted by growth in remittances, even if this growth is down from 2014 (Bangladesh). Despite lower commodity prices, the forecast is for mining output to rise in a number of countries as past investments come on stream (e.g., gold and copper in Democratic Republic of Congo, coal in Mozambique) and other mining investments proceed, albeit at a slower pace (Mozambique, Tanzania). Several governments are prioritizing infrastructure projects, including in the energy sector, in some as part of recent regional agreements to upgrade regional energy grids (Kenya, Rwanda). Elsewhere, heavy government infrastructure investment is supported in part by Eurobond issuance (Côte d’Ivoire and Ethiopia). In several fragile countries (Madagascar, Malawi, Mali), growth should pick up as investment rises on the back of increased political stability. Rising political uncertainty will, however, dampen growth somewhat in Bangladesh in the near-term, although domestic demand should remain supported by resilient remittances. In Nepal, strong remittance inflows should help support domestic demand and post- post-earthquake reconstruction. Guinea, Liberia, and Sierra Leone are recovering as the effects of the Ebola crisis wane.

The outlook is subject to significant and increasing downside risks. A further decline in commodity prices would sharply lower revenue in oil-exporting countries, requiring them to undertake deeper fiscal adjustments, with sharper expenditure cuts. It may prompt some commodity extraction companies to delay or even cancel planned investments in 2015 (Guinea, Mozambique, Tanzania, Uganda). Given the importance of artisanal and small-scale mining in LICs, domestic private consumption may also prove weaker than expected in the baseline. Lower oil prices would also cause a more protracted recession than anticipated in Russia and dampen growth in Tajikistan through lower remittances and exports. Conflict could intensify again in fragile states (e.g., al-Shabab in Kenya, or insurgencies in Mali). A sudden adjustment of market expectations to the upcoming tightening of U.S. monetary policy could put pressures on capita account inflows and exchange rates, and on debt service costs of countries that have tapped international capital markets since the crisis (Côte d’Ivoire, Ethiopia, Kenya, Mozambique, Rwanda, Tanzania).

LICs continue to have limited buffers to absorb stresses should risks materialize. Current account deficits and government borrowing requirements are large in many LICs. Reserve coverage of imports in several countries is below three months of imports. Notwithstanding the spending restraint applied by commodity-exporting LICs until 2007, the sharp post-global crisis expansion in government spending has reduced fiscal space. As a result, several now have large twin deficits, with fiscal and current account deficits in excess of 5 percent of GDP.

Join the Conversation