The machinery in a paper mill plant in Santiago de Chile. | © shutterstock.com

The machinery in a paper mill plant in Santiago de Chile. | © shutterstock.com

Firms are key to addressing Chile’s sustainability challenges and realizing its ambition of carbon neutrality by 2050. Switching to more sustainable production is essential to reducing vulnerability to environmental shocks and developing new areas of comparative advantage. In a recent working paper, we illustrate minimal trade-offs between productivity and energy prices, and a positive relationship between productivity and investments with fossil fuel prices.

Cheaper energy is not always better.

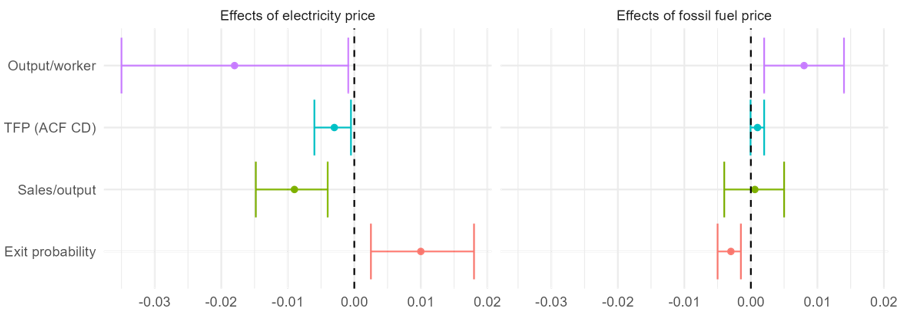

Our research shows that there is a crucial distinction between fossil fuel and electricity prices. Electric price increases correlate negatively with firm-level productivity; these effects are small, nonetheless (Figure 1). In turn, fossil fuel prices correlate positively with investment in machinery, wages, and higher Total Factor Productivity (TFP), and negatively with exit probability. Increases in fossil fuel prices can, therefore, enhance economic incentives for firms to adopt energy-efficient technologies. These results align with most studies that illustrate a positive relationship between fossil fuel prices and firm productivity (see, for example, studies on Indonesia, France, Mexico, and Oman.

Figure 1: The effect of energy prices on firm competitiveness

Note: Estimates based on baseline fixed-effects regression. Scatters and error bars: FE point estimates and 90 percent confidence intervals.

Firms respond to energy price changes in multiple ways.

In addition to investment in innovation and firm competitiveness, firms can also respond to energy price shocks through input substitution, cost absorption, or pass-on to consumers. The literature (e.g., Rentschler et al., 2017 and Coste et al., 2018) identifies these as the four main coping mechanisms firms use to navigate energy price increases. There is ample evidence that firms pass energy price increases along the production process and, ultimately, on to consumers. This may not be desirable from a policy perspective because it can have notable welfare implications. In the Chilean data, the input substitution and cost absorption effects can be observed; however, coping through the cost pass-on mechanism is less apparent.

Our results suggest that increases in electricity prices correspond to a significant reduction in consumed electricity. We also observe similar responses across all energy types in response to a surge in fossil fuel hikes, which are significant. Firms’ consumption of fossil fuels correlates positively with a price hike in electricity, but the degree of substitution between fossil fuels and electricity varies by fuel type. Cost absorption and pass-through also vary by energy type. While fossil fuel price hikes are associated with cost increases, electricity surges affect profit margins through a reduction in sales. The results for return on sales are consistent with the findings on sales costs and asset evolution, showing a consistent negative correlation with increases in energy prices. Chilean manufacturing firms' response to fossil price hikes does not translate into higher profitability (at least not in the short run), indicating that firms at least partly absorb such price hikes.

Response to energy price hikes varies by firm attributes.

- Firm size: Competitiveness and absorption indicators correlate more negatively with electricity price hikes for small firms, while fossil fuel price correlations do not vary as much by firm size. Small firms also adjust their energy consumption quantities more strongly to energy price increases.

- Global exposure: Domestically owned firms react more strongly to electricity price variations than foreign-owned companies.

- Sector attributes: Firm competitiveness in energy-intensive sectors has a larger negative correlation with electricity prices.

There could also be non-linearities in adjusting to higher energy prices.

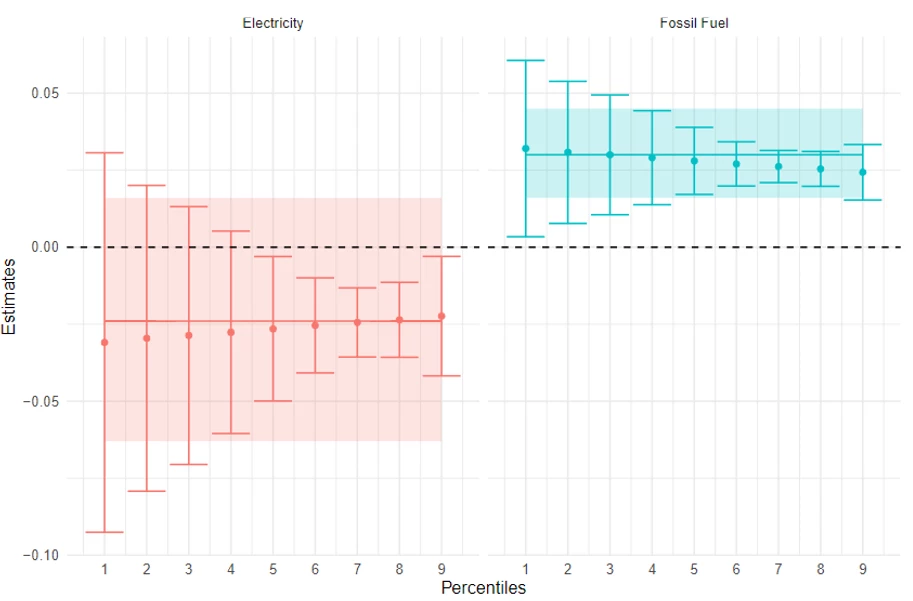

Our study also examines potential non-linearities in firm-level responses to energy price increases, as the strategies adopted at lower energy price levels may not necessarily work at higher prices. We find that the positive correlation between fossil fuel price increases and capital upgrading is more pronounced when fuel prices are low. Similar non-linear effects cannot be observed for electricity prices, although the adjustments are significant when electricity prices are higher (Figure 2). These patterns may suggest the potential differences in the cost of upgrading electricity-based technology relative to fuel-based machinery.

Figure 2: Non-linearities in adjustment of capital investments by energy prices

Note: The Y-axis plots the coefficients of a non-linear fixed-effects regression and baseline fixed-effects regression. Scatters and error bars: Percentile FE estimates and 90 percent confidence interval of non-linear FE regressions. Colored horizontal lines and shaded areas: Point estimates and 90 percent confidence interval of baseline FE regressions. Dashed horizontal line: Zero line.

Results from such micro-analysis can inform environmental policies.

Given the firm heterogeneity as well as non-linearity in outcomes, policy reforms affecting energy prices and accompanying measures are best targeted based on a solid micro-level analysis. Among the most vulnerable groups are small and domestic firms and those in specific sectors. The most vulnerable firms may not have the means to adjust to energy price fluctuations and may need some complementary support to undertake the necessary changes and investments. A better understanding of how existing inequalities interact with the risks posed by energy price policies, taking into account firm capabilities and management skills, will inform a more efficient policy design.

Join the Conversation