China and India are hard to ignore. Over the past 20 years they have risen as global economic powers, at a very fast pace. By 2012, China has become the second-largest world economy (based on nominal GDP) and India the tenth. Together, they account for about 36% of world population.

Their financial systems have also developed rapidly and have become much deeper according to several broad-based standard measures, although they still lag behind in many respects. For example, stock-market capitalisation increased from 4% and 22% of GDP in 1992 to 80% and 95% of GDP in 2010 in China and India respectively. By 2010, 2,063 and 4,987 firms were listed in China’s and India’s stock markets. Their financial systems have not only expanded, but also transitioned from a mostly bank-based model to one where capital markets have gained importance. Equity and bond markets in China (India) have expanded from an average of 11% and 57% of the financial system in 1990-1994 to an average of 53% and 65% in 2005-2010 in China and India.

But how much has this overall expansion in capital markets implied a more widespread use of those markets? Has it allowed different types of firms to obtain financing, invest, and grow? Do the cases of China and India show that the policies to promote capital-market development might be conducive to growth? If so, how inclusive is this growth? Is it associated with some convergence in firm size, with smaller firms benefitting the most? Or are China and India cases of growth without finance?

New stylised facts

To study these questions, we assemble a unique and comprehensive data set on domestic and international capital raising activity and performance of the publicly listed firms in China and India (World Bank Policy Research Working Paper 6401). In particular, we match transaction-level information on equity and bond issues with annual firm-level balance sheet information. Our matched data cover 2,458 firms in China and 4,305 in from India between 2003 and 2011.

This new dataset allows us to document important stylised facts:

- The expansion of financing to the private sector in China and India has been much more subdued than the aggregate numbers of financial depth suggest.

- Importantly, this expansion was not associated with widespread use of capital markets by firms.

- Not only have few firms made recurrent use of equity and bond markets, even fewer firms have captured the bulk of the capital market financing.

- Thus, capital markets have not been a significant source of financing across firms.

- Firms that use equity or bond markets are very different – and behave differently than – those that do not do so.

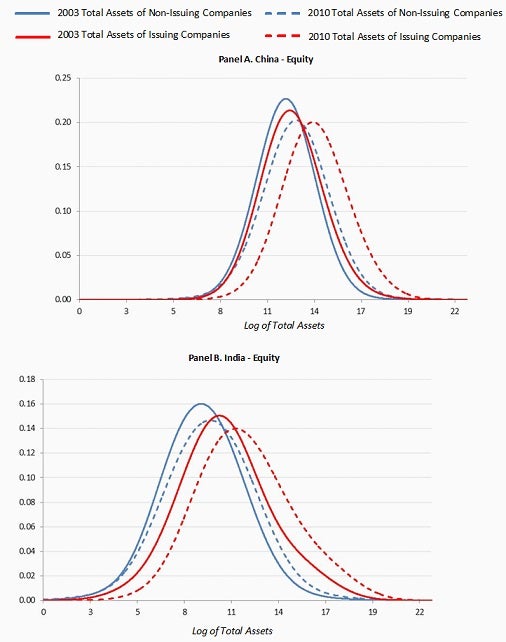

- Firms that raise capital through equity or bonds are typically larger than non-issuing firms initially and become even larger after raising capital.

- The evidence on firm size and growth has important implications for the firm size distribution of listed firms.

Figure 1. Firm size distribution

Note: The panels of this figure show the estimated Kemel distributions of the log of total assets (in2011 US dollars) for issuing and non-issuing firms in 2003 and 2010. User firms are those that raise capital through equity between 2004 and 2010, and non-users are the other firms in our sample. All firms with capital-raising activity in 2003 are excluded from the sample in this figure. Only firms with data on total assets in both 2003 and 2010 are included in this figure.

Contribution of the results

These results are relevant to many discussions in economics:

- First, a large number of studies argue that financial development is positively associated with overall economic growth.

- Second, China and India have generated significant interest because they do not appear to fit the predictions of the law, finance, and growth literature, according to which more developed legal and financial systems spur growth.

- Third, other work studies Gibrat’s law, which states that firm size and growth are independent and that the firm size distribution is stable over time and approximately log-normal.

Our findings suggest that even among the publicly listed firms, which consist of the largest firms, there is some heterogeneity: firms that use capital market financing are larger to begin with and grow faster than non-users. In fact, our results indicate that there is no convergence in firm size. Moreover, a misallocation of capital in China and India might have kept large, highly productive firms artificially small, which might explain why they are the ones that grow the most when financing becomes available.

Policy implications

The findings suggest that finance matters, but in more nuanced ways than previously thought. Even though the financial markets in China and India are not yet fully developed, the firms that are able to raise capital do seem to benefit from it, particularly in their overall expansion. In other words, at least part of the high growth in these countries seems to come from the firms that are able to raise new funds from the markets.

Moreover, the findings suggest that even the large, publicly listed firms (that arguably have access to formal markets) appear to be partly financially constrained. The results of differentiated performance between users and nonusers of capital market financing suggest that firms that issue securities are sensitive to the external capital raised. That firms perform differently and expand when they raise capital also suggests that they had investment opportunities ex ante that they could not realize. While we show that capital raising activity is related to changes in firm dynamics, we do not analyse to what extent the effects are driven by the supply side (the capital market side) or the demand side (the firm side). Doing so requires further research.

In recent decades, many emerging economies have undertaken large efforts to increase the scope and depth of their capital markets and to liberalise their financial sectors as a way to complete and increase the provision of financial services. But expanding capital markets might tend to directly benefit the largest firms – those able to reach some minimum threshold size for issuance. More widespread direct and indirect effects are more difficult to elucidate.

For the broader set of emerging economies, these findings suggest that even in fast-growing China and India with plenty of growth opportunities, receiving large inflows of foreign capital, and with thousands of firms listed in the stock market, only a few firms have directly absorbed the capital market activity. This could suggest that it might be difficult for a broad set of corporations from smaller and slower-growing countries to benefit from capital-market development.

A longer version of the above post appeared first in Voxeu.org.

Join the Conversation