This blog is the fourth in a series of ten blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook. Earlier blogs are here.

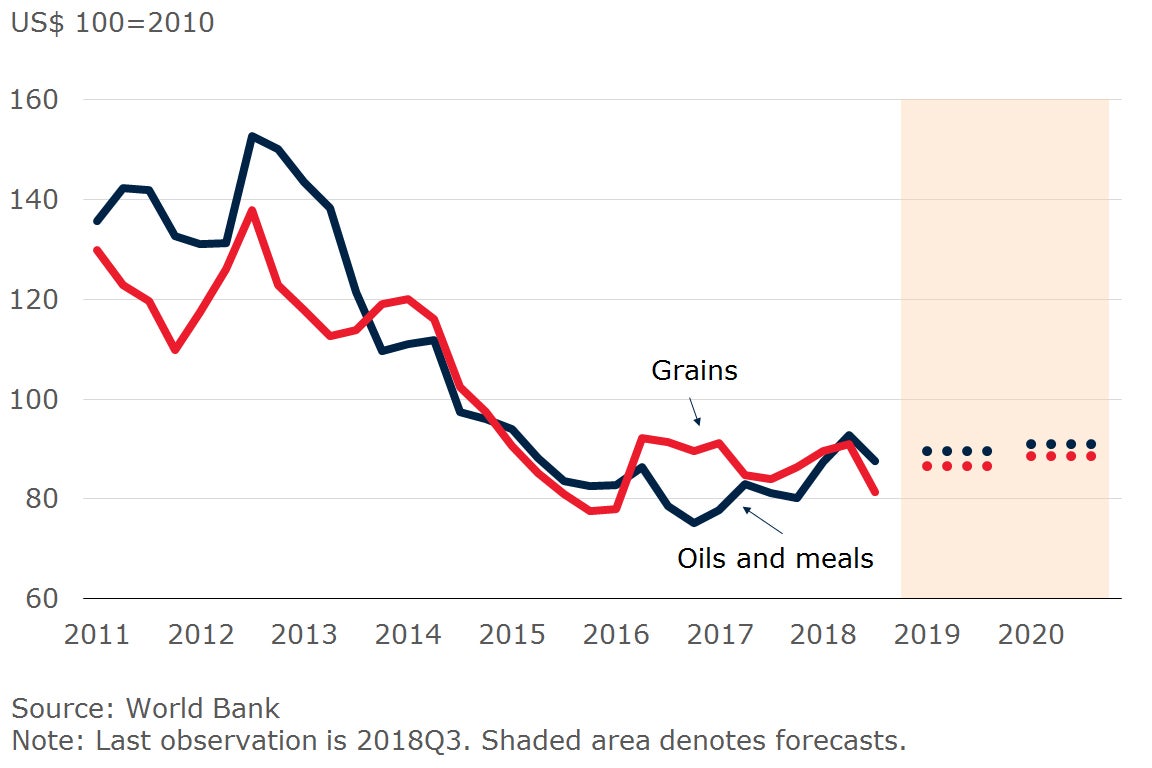

Grain prices are projected to edge up 1 percent in 2019 after an estimated 10 percent rise in 2018, and oils and meals prices are expected to increase more than 2 percent next year, reversing a 2 percent decline this year. However, these price forecasts are subjected to risks that include energy, trade, and foreign exchange movements.

After gaining some momentum in early 2018, most food commodity prices weakened significantly in the third quarter. The World Bank’s Grain Price Index declined nearly 6 percent in Q3 but was 8 percent higher than a year ago. The Oils and Meals Price Index fell almost 11 percent in Q3, and stands 3 percent lower than a year ago.

Food price indexes

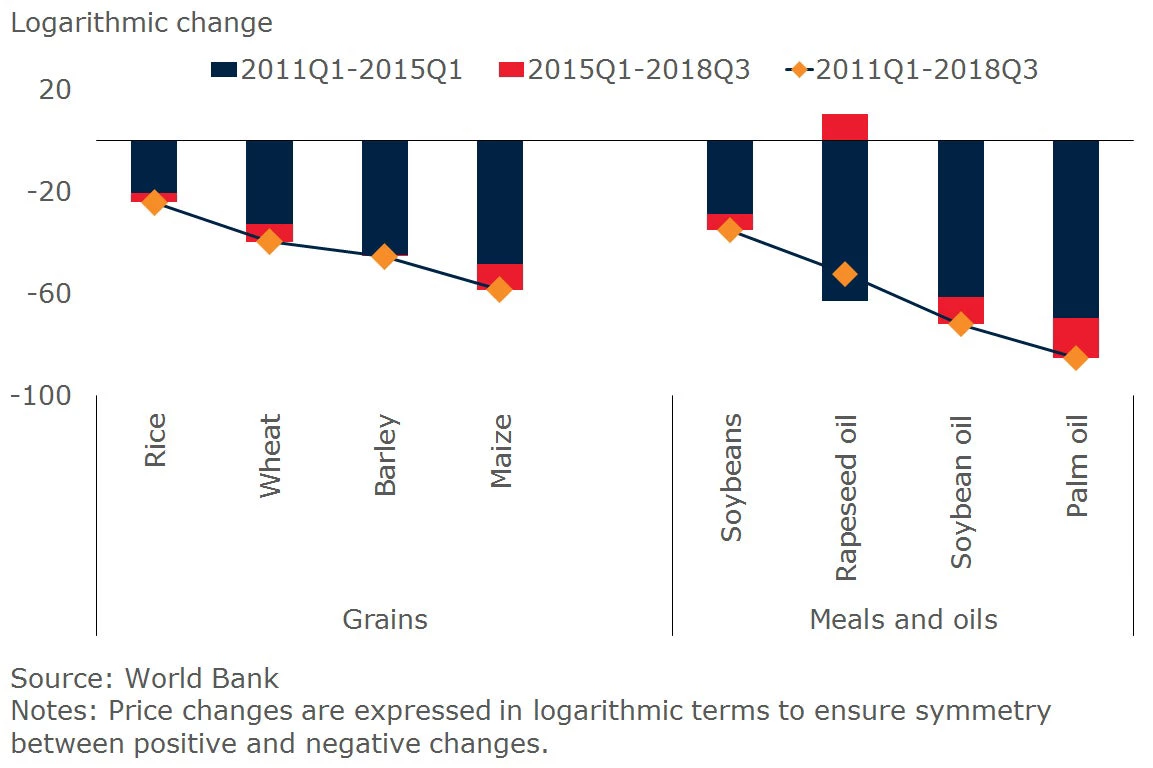

Despite recent price movements, food commodity prices have been relatively stable over the last 4 years after dropping sharply from peaks of 2011 Q1 and early 2015. Grain and edible oil prices are 40 percent down from their early 2011 highs.

Price changes of key food commodities

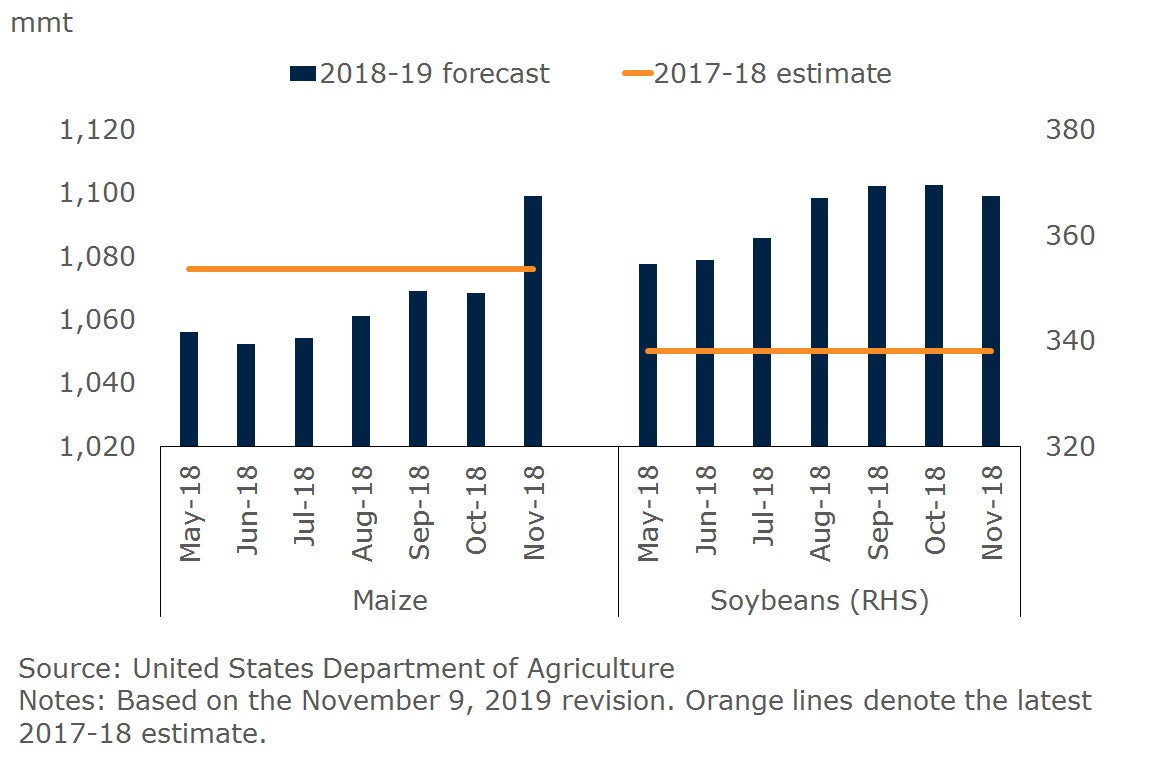

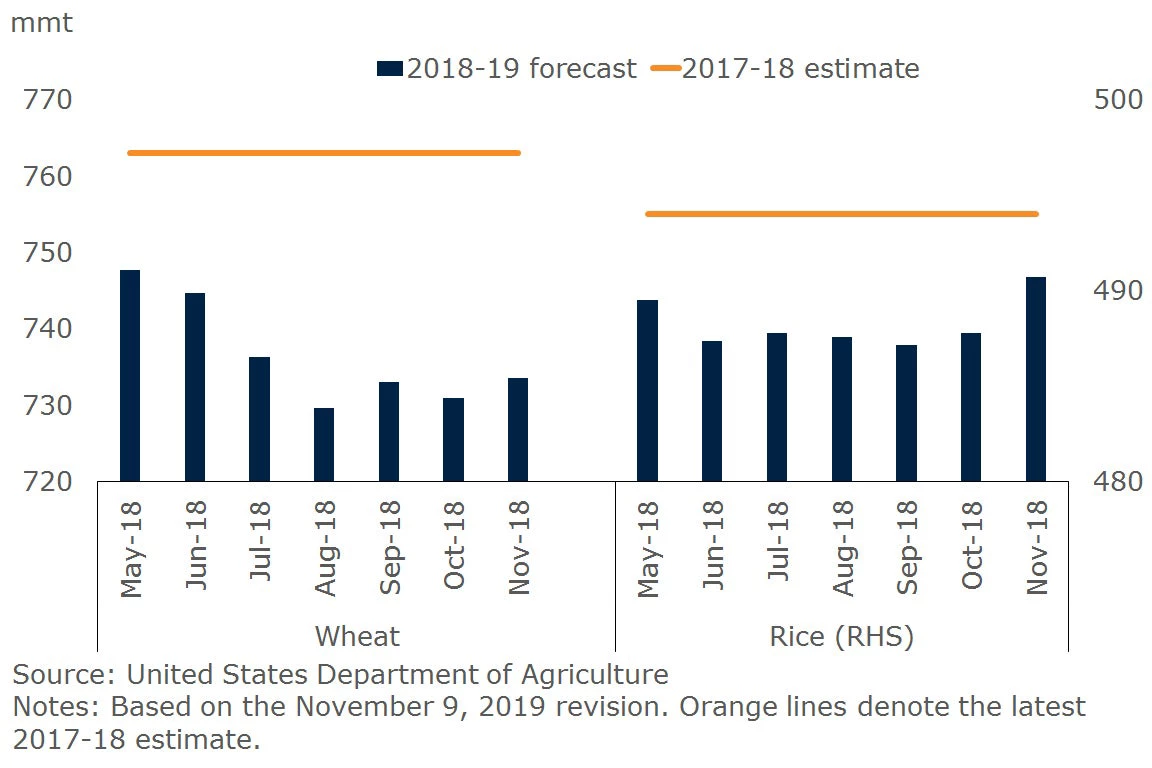

Growing conditions for most grains and oilseeds are favorable for the current season (September 2018 to August 2019). Production estimates for 2018-19 have been revised up for rice, maize, and soybeans. An exception is wheat, which suffered from crop losses due to heat waves in Eastern Europe and Central Asia. Global grain supplies for the current season are projected to reach a combined 3,104 million metric tons (mmt), marginally higher than last season’s 3,094 mmt, exceeding expectations.

Production of wheat and rice

Production of maize and soybeans

Risks to the outlook

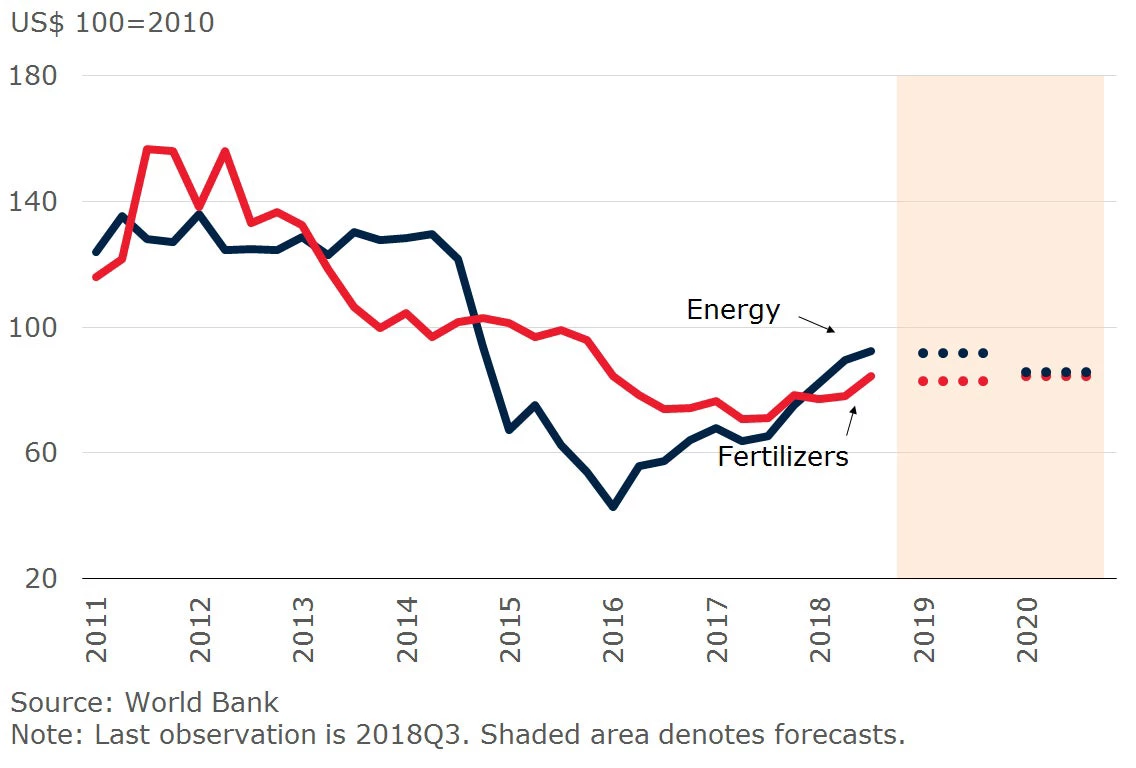

Risk # 1: Energy and fertilizer prices

Energy is a key input to most agricultural commodities and affects production costs directly (through fuel use) and indirectly (through fertilizer and other chemical use). Energy and fertilizer prices, which have strengthened considerably during the past two years, are expected to rise 1 and 2 percent respectively in 2019. Higher-than expected energy prices could exert upward pressure on grain and oilseed prices. A 10 percent increase in energy prices is associated with an almost 6 percent increase in fertilizer prices and a nearly 2 percent increase in grain and edible oil prices (see the Special Focus of the July 2016 Commodity Market Outlook).

Energy and fertilizers price indexes

Risk # 2: Trade and domestic support measures

Trade frictions are weighing on the outlook for food commodities. The recent imposition of tariffs by China on U.S. soybean imports led to a decline in soybean prices during June and July. The longer-term impact on commodity prices depends on the degree of trade diversion as well as changes to production and consumption patterns (for example, the substitution of soybean meal with maize for animal feed, or soybean oil with palm and rapeseed oils for human consumption). More importantly, an escalation of existing trade frictions among other countries or involving other commodities could further depress food commodity prices.

In addition to tariffs, other actions by major producing and exporting countries could affect food commodity prices. These include Argentina’s recent introduction of export taxes on selected agricultural products and the U.S. government’s $1.2 billion agricultural commodity purchases (part of a $12 billion emergency aid package).

Risk # 3: Macroeconomic conditions

Movements of the U.S. dollar against other currencies have already affected commodity prices and could have additional impact in the future. The dollar has appreciated nearly than 10 percent since April 2018. Further strength could depress commodity prices. A 10 percent appreciation of the U.S. dollar against major currencies leads to a 5 percent decline in the prices of internationally traded commodities (see the Special Focus of the July 2016 Commodity Market Outlook).

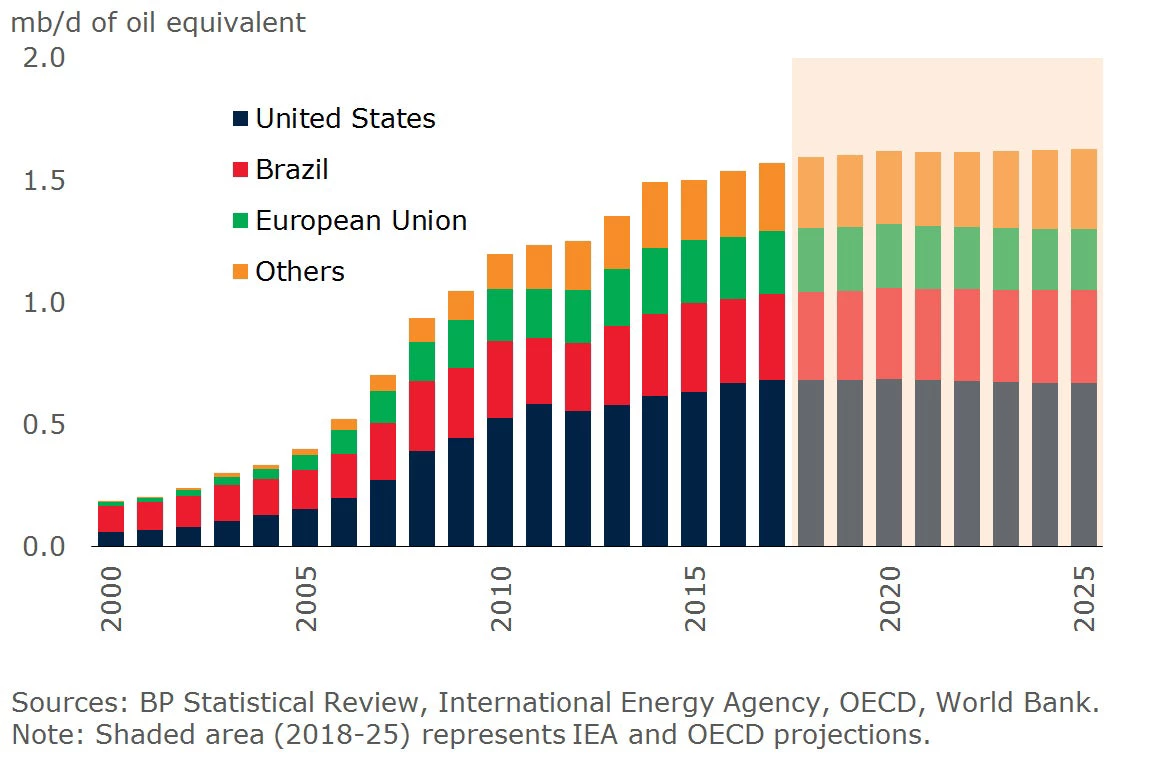

Risk # 4: Biofuels

The agricultural outlook assumes that biofuels will be a stable source of demand for some food commodities. Biofuels currently account for 1.6 percent of global liquid energy consumption. However, following a decade of double-digit growth rates for biofuel production, interest has waned since 2014. The International Energy Agency and the Organisation for Economic Co-operation and Development forecast marginal biofuels production growth in the medium term.

Even so, higher energy prices could reignite energy security concerns, while lower grain and oilseed prices could trigger policies in favor of increasing biofuel mandates.

Biofuel production

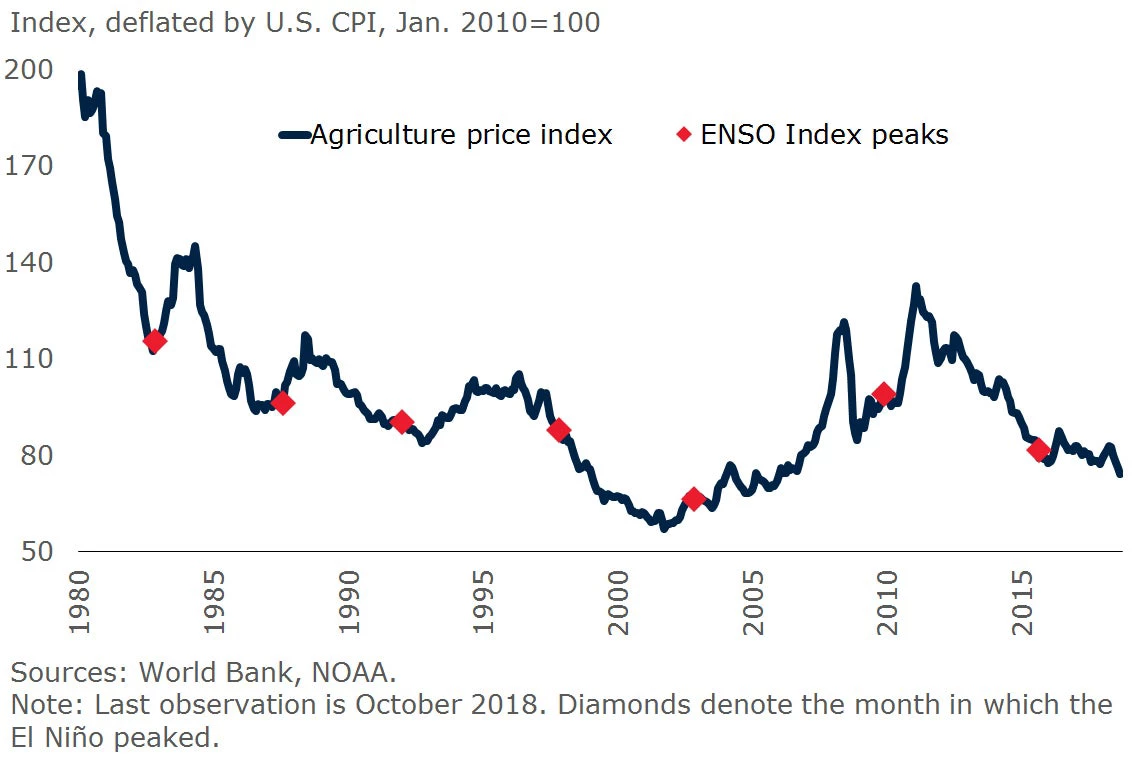

Risk # 5: El Niño

Conditions for El Niño, a weather pattern that raises the temperature of waters over a vast area of the Central and Eastern Pacific Ocean, are currently neutral. The U.S. National Oceanic and Atmospheric Administration in November assigned an 80 percent probability of a weak El Niño from December 2018 to February 2019. Should this El Niño materialize, heavier-than-expected rains could occur in Central Asia, South America, and East Africa, while drier than normal conditions could take place in Central America, the Caribbean, and Southern Africa. Bananas, coffee, palm oil, and natural rubber tend to be the commodities most affected by El Niño patterns (see the El Niño Focus Section of the October 2015 edition of the Commodity Markets Outlook).

Agriculture price index and ENSO Index peaks

Join the Conversation