In an earlier post, we highlighted a feature of the global pattern of investment in recent times: that since 2000, developing countries have gradually increased their share of global investment, moving from around 20 percent through much of the second half of the last century, to around 46 percent by 2010. The rapidity of this rise notwithstanding, the natural question is whether this trend will continue into the future.

Answering this question---on changing patterns of global investment---is one of the main concerns of the most recent edition of the Global Development Horizons report, entitled Capital for the Future. In order to frame the question, the report considers how different countries will distinguish themselves in the global economy and, consequently, how by doing so they will provide investment opportunities that would attract financing from the pool of global saving.

Being an attractive investment destination calls for more than simply high relative rates of return to capital. As alluded to in the previous post, attracting global capital will require a broader conception of what such returns mean; in particular, the notion of "returns to capital" needs to consider a broader conceptualization of what investors expect when they choose to finance capital accumulation. These returns could stem from, for example, differences in growth prospects across countries, as well as institutional and policy differences that drive investor sentiment.

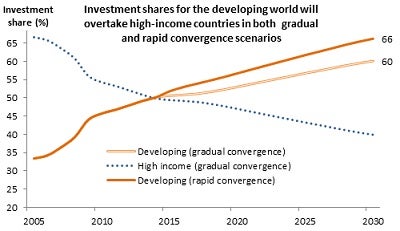

Taking these factors into account, the report foresees a future where global investment will, by 2030, be dominated by the developing world, which will account for between three-fifths to two-thirds of total investment (see figure below). This dominance will be anchored by China, which will account for around half of the developing world's share in 2030 (and around 30 percent of the global share), in spite of a decline in its investment rate (from rates close to 50 percent to a more modest, but nevertheless impressive, 37 percent). This massive flow of investment will be about three times that of the United States', and around twice as large as all of high-income Europe put together.

Source: World Bank staff calculations, from World Bank GDH database.

Note: Total investment is measured in 2010 U.S. dollars, and projections are drawn from the gradual convergence scenario of the report. Investment shares for high income countries in the rapid convergence scenario omitted for clarity.

But as is the case today, this will not merely be a China-centric story. The investment share of India – of 7.2 percent of the world total – will be comparable to that of non-G3 [*] high-income countries (8.7 percent). Taken together, investment accounted for by the next four largest developing countries – Brazil, Russia, Indonesia, and Mexico – will be a tenth of the global total, comparable to the United States and more than twice that of Japan.

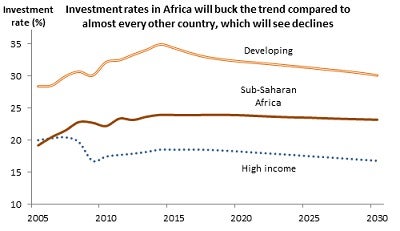

Just as interesting is the story of the economically smaller developing regions, in particular Sub-Saharan Africa. Unlike other regions, which will see declines in the investment rates to varying extents, Africa will buck the trend and maintain a more or less flat trend in its investment rate over the next two decades (see figure). A nontrivial part of this result will be due to Africa's remarkably favorable demographics, which will provide the region with a ready supply of working-age labor to be paired with capital, which in turn will be supportive of growth prospects (and that, in turn, further enhances investment opportunities).

Source: World Bank staff calculations, from World Bank GDH database.

Note: Investment rate is defined as gross investment divided by GDP (both denominated in current values of a basket of OECD exports, the numeraire). Projections reflect the gradual scenario in the report.

Of course, these changes to investment will not occur in a vacuum. More importantly, both the gradual and rapid convergence scenarios presuppose that institutional transformations will occur alongside economic growth.[†] Such institutional changes, of course, are the result of policy designed to ensure that these transformations come to pass. For instance, and as highlighted in the recent Global Financial Development Report, the state can play an important supporting role in encouraging further financial deepening in developing countries.

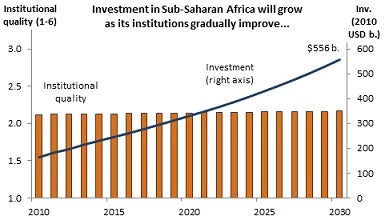

Just as important (and perhaps even more so), the overall quality of the institutional environment will need to improve in developing countries over time, in order to foster a positive investment climate. In many ways, developing countries have already made tremendous strides in this regard (as discussed in a previous post). In the future, Sub-Saharan Africa's relative outperformance in terms of investment will be due, in no small part, to the gradual ratcheting up of, among other things, its institutional quality. Investment in 2030 will reach $556 billion in the case where its institutions evolve in a manner consistent with history, but will increase by more than $100 billion more if institutions in Africa converge at a more rapid pace toward US levels (see figure).

Source: World Bank staff calculations, from World Bank GDH database.

Notes: Investment is gross investment measured in 2010 U.S. dollars. Institutional quality is measured as the simple average of the index for rule of law and corruption indices. Projections reflect, in turn, the gradual and rapid convergence scenario in the report. For clarity (because of the existing difference in the institutional environment of South Africa vis-a-vis the rest of Sub-Saharan Africa, the region is defined here to exclude South Africa.

*The G3 is defined as the United States, high-income Europe, and Japan.

†More specifically, the gradual convergence scenario assumes that the path of key structural and institutional variables will follow that of their historically-established relationship with per capita income, while the rapid convergence scenario assumes that developing countries will close a quarter of the initial gap that exists between them and the United States by 2030.

Join the Conversation