Salesman in a jewelry shop

Salesman in a jewelry shop

This blog is the last in a series of nine blogs on commodity market developments, elaborating on themes discussed in the latest edition of the World Bank’s Commodity Markets Outlook.

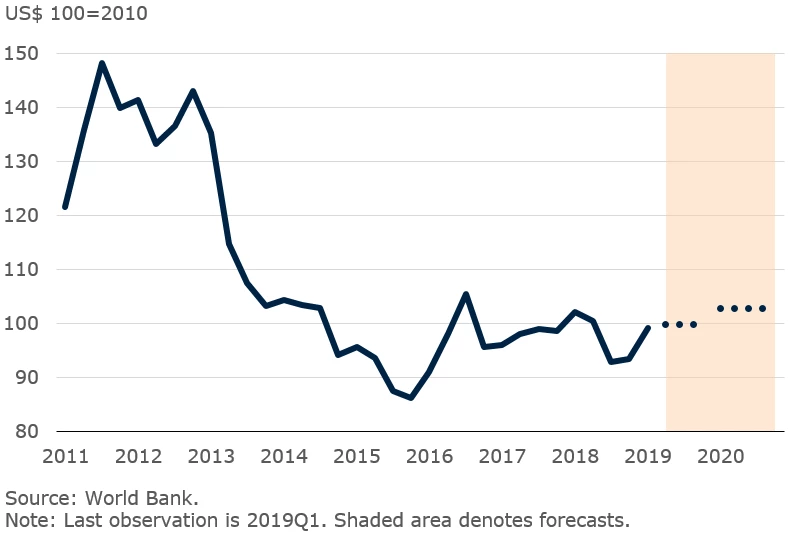

Following some weakness earlier in the year, precious metals prices picked up recently on rising expectations of an interest rate cut by the U.S. Federal Reserve and an escalation in trade tensions between the United States and China. The World Bank’s Precious Metals Price Index is projected to be 2.6 percent higher in 2019, led by gold, according to the latest Commodity Markets Outlook.

World Bank’s Precious Metals Price Index

Gold

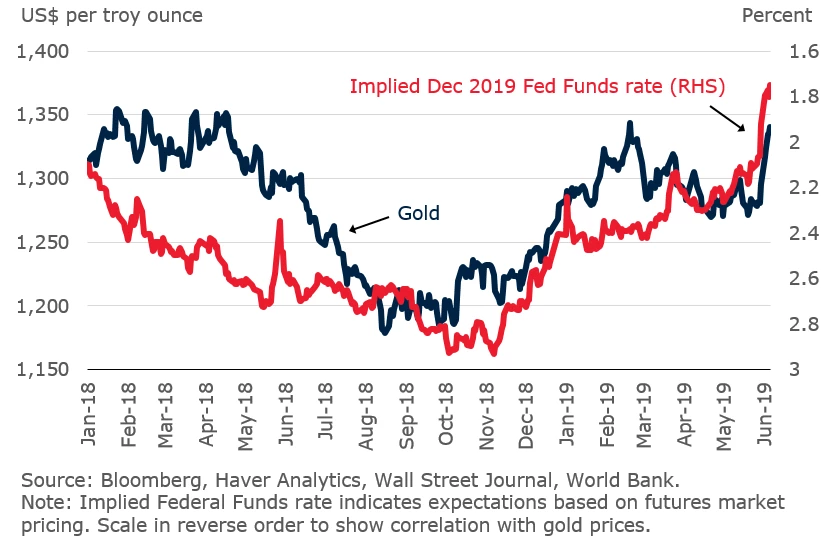

After reaching a recent trough in August 2018, gold prices climbed to $1,340 per troy ounce in early June 2019—the second highest level in more than a year. Prices have been supported by higher expectations of an interest rate cut by the U.S. Federal Reserve, a breakdown in trade negotiations between the United States and China, and strong demand from emerging market central banks. Gold prices are forecast to increase by 3.2 percent in 2019.

• Accommodative monetary policy. Expectations that the U.S. Federal Reserve may further ease monetary policy—from the current “pause” in interest rate hikes to a lowering of interest rates later this year—has increased due to recent weak U.S. economic data. The probability of a reduction in the federal funds rate by the end of the year has spiked to 98 percent in early June from 50 percent a month earlier.

Federal funds rate expectations and gold prices

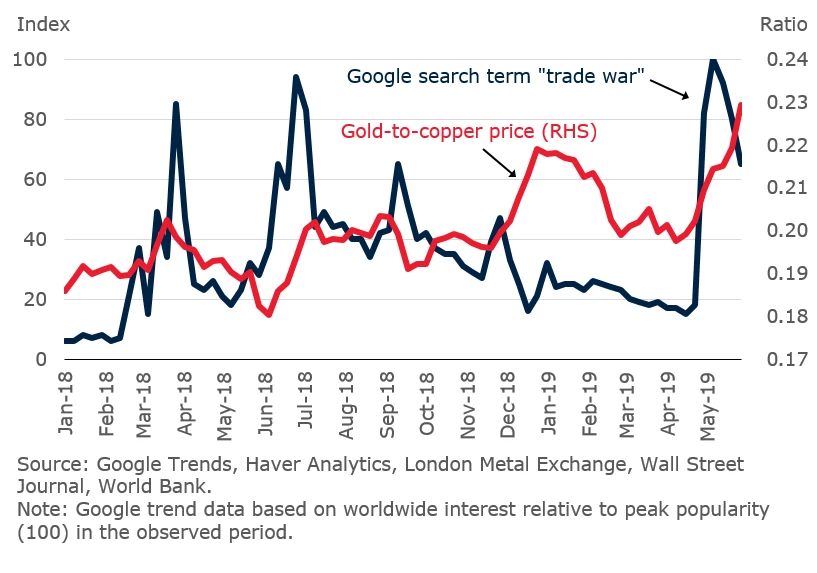

• Trade tensions. Following U.S. tariff hikes on $200 billion of Chinese goods in May 2019, gold prices—an indicator of the demand for safe haven assets—have surged whereas copper prices—a barometer of the global economy—have retreated. The gold-to-copper price ratio has risen to the highest level since the fourth quarter of 2016. Global concerns about a trade war—measured by search term frequency in Google—have pulled back from their mid-May highs, but remain elevated.

Trade tensions and gold/copper price ratio

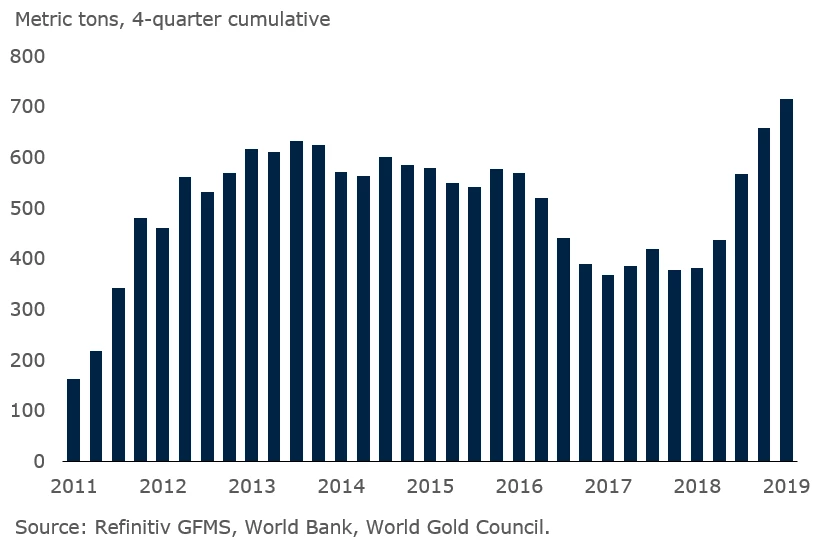

• Strong central bank demand. In the first quarter of 2019, gold demand from central banks— especially China, India, Turkey, and Russia—increased by 68 percent year-on-year. The four-quarter cumulative gold buying by central banks is the highest on record.

Central bank gold demand

Silver

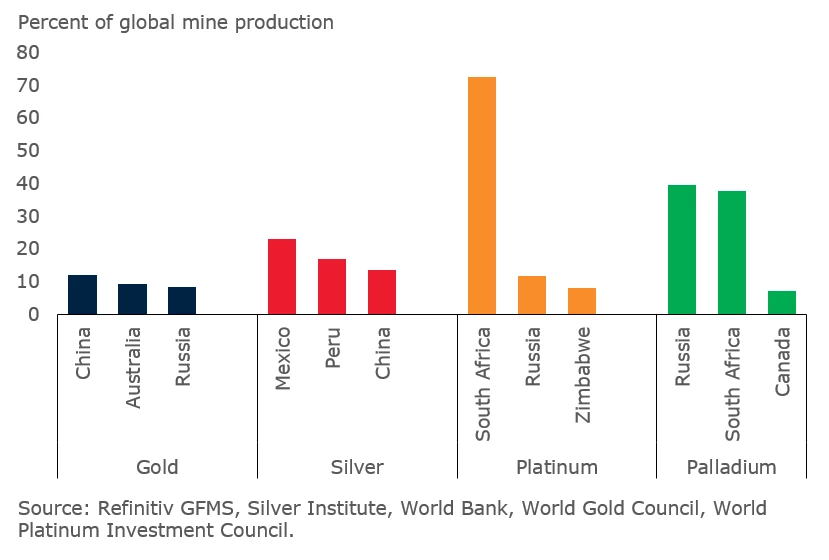

Despite some reprieve since trade tensions intensified in May 2019, silver prices have not seen the gains made by gold prices and the gold-to-silver price ratio remains elevated. Demand is constrained by the lack of new industrial applications and less central bank and investor buying interest relative to gold. Supply is expected to expand from mine production in the Americas; more silver supply is further expected from lead and zinc operations in Australia (silver is often a by-product of lead/zinc mining). Exchange inventories have also stabilized near record-high levels. Silver prices are forecast to remain broadly unchanged in 2019.

Silver prices and exchange inventories

Platinum

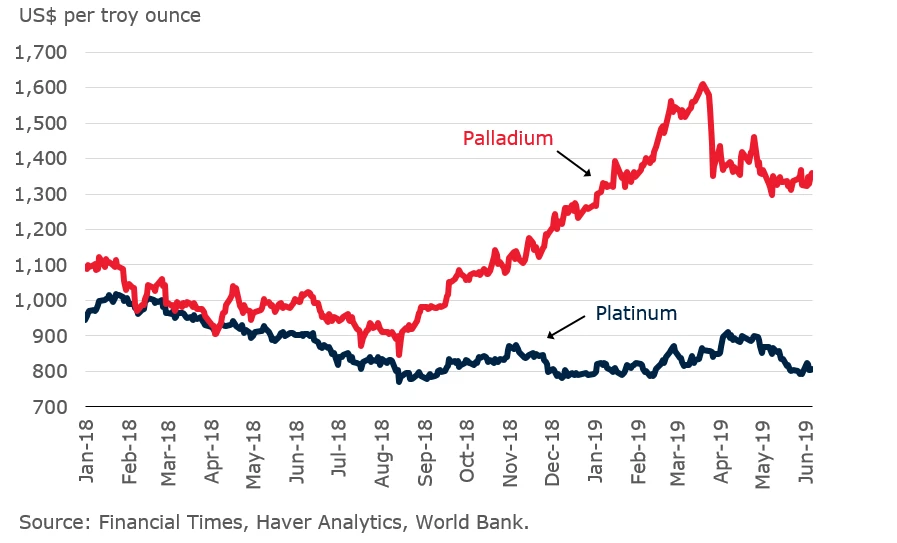

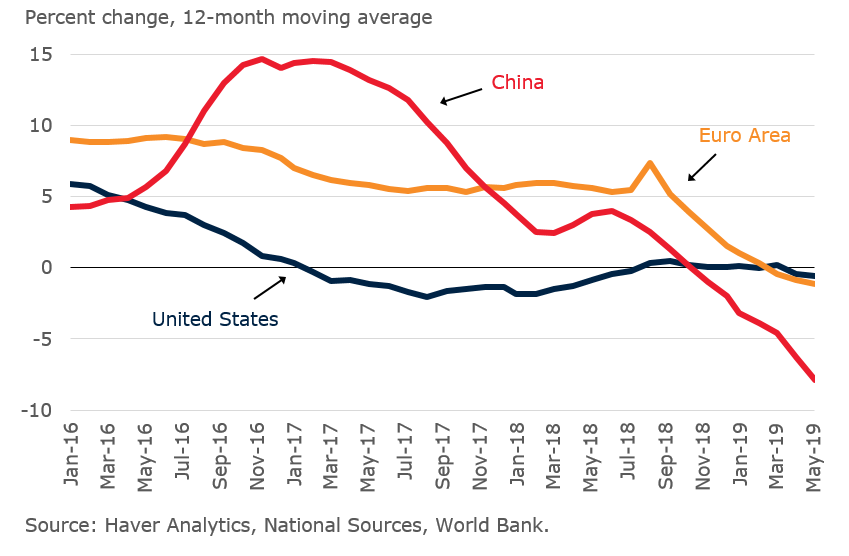

After posting significant gains in April 2019, platinum prices have since retreated to near 2018 lows. The easing of mine supply concerns in South Africa and weak auto sales in China and Europe have weighed on prices.

Platinum and palladium prices

Although the divergence in platinum and palladium prices has somewhat compressed, it remains large. Prospects for substitution in auto catalysts are limited due to tighter emissions regulations and technological constraints (platinum is used in catalytic converters on diesel engine vehicles, and palladium in gasoline-powered ones). Platinum prices are forecast to decline by 4.5 percent in 2019.

Motor vehicles sales growth

Top precious metals miners in 2018

Join the Conversation