The literature on growth convergence and divergence is vast and deep. Some have argued that divergence is persistent. Lant Pritchett in his paper, “Divergence, Big Time” has argued that backwardness appeared to carry severe disadvantages that generated long-term divergence between growth in per capita incomes of developing countries compared to rich countries. Others have found evidence in favor of convergence. Arvind Subramanian, in his paper, “The hyperglobalization of Trade and its Future”, has argued in favor of convergence, since the number of developing countries experiencing catch-up has more than trebled (from 21 to 75 countries) and the rate of average catch-up has doubled from 1.5 percent per year to over 3 percent. However, what has been overlooked in this debate is the role that agriculture, manufacturing and services have played in growth convergence/divergence. Which of these sectors have played a bigger role in growth convergence?

Indeed, global growth convergence has continued unabated during the last two decades. Just like the East Asian Tigers, the Lions of Africa are growing faster than the developed economies. However, the growth escalators in Africa are turning out to be different than in East Asia. The East Asian Tigers benefitted from the manufacturing sector. The latecomers to development are benefitting from others sectors including the service sector.

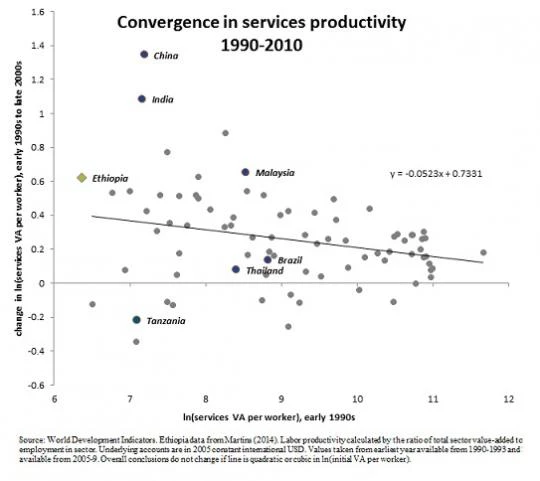

Figure 1 plots growth in service labor productivity for 100 countries--both developed and developing--on the vertical axis, and initial service labor productivity on the horizontal axis. The fitted line is a downward sloping line implying that low income countries in Africa that started with a lower level of labor productivity in services, and were further away from the global labor productivity frontier, have experienced a much faster catch up and growth in service labor productivity. Take Ethiopia for example, a latecomer to development in Africa. It is above the trend line. So are China and India. They remain above the trend line even when estimates are changed from linear to non-linear regressions. This is good news for low income countries. They have more room to catch-up, and they are doing it faster, quicker, better, and smarter.

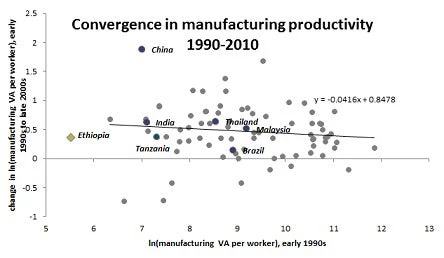

Figure 2 plots growth in manufacturing labor productivity on the vertical axis and initial labor productivity on the horizontal axis. The fitted line is also downward sloping implying that latecomers to development that started with a lower level of labor productivity in manufacturing have also experienced a faster growth in productivity. Unfortunately, many latecomers to development in Africa are well below the trend line, implying a much slower progress in the manufacturing sector compared to the East Asian Tigers which are above the line.

What is striking when one compares figures 1 and 2 is that the growth convergence story in services is comparable to, if not stronger than in manufacturing, i.e., the convergence line is steeper for service than for manufacturing. This would suggest that growth escalator and catch up in services is much stronger than in manufacturing. So the latecomers to development stand to benefit much more from services, the largest sector in the global economy. However, the latecomers to development in Africa should not ignore other sectors.

Figure 1: Global Growth Convergence in Service is much faster

Figure 2: Global Convergence in Manufacturing is a bit slower

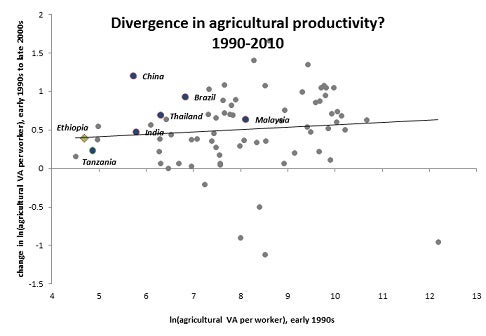

However, the global growth convergence narrative in agriculture is distressing. There is no growth convergence in agriculture. The fitted line linking productivity growth in agriculture with initial productivity level is flat or even upward sloping. This means that labor productivity growth in agriculture has remained low in Africa and in other low income countries, and is not catching up with more developed economies, unlike the services and manufacturing sectors. This is a big concern.

Africa has about 60% of the world’s uncultivated cropland. The sector has the potential to become a major part of the global agricultural value chain through continued expansion of commercial farming onto uncultivated land, shifting some production from grain crops to higher-value crops such as horticulture and biofuels, and by improving the productivity and yields of smallholder finance. However, yields per hectare have been stagnating in much of Africa (Stiglitz, 2013). Only a small proportion of arable land is irrigated in Africa compared to 29% in East Asia. Fertilizer use in Africa amounts to just 13 kilograms per hectare, compared to 90 kilograms in South Asia and 190 kilograms in East Asia.

Figure 3: No Global Growth Convergence in Agriculture

It is not the case that all developing countries suffer from low productivity in agriculture. Brazil is a country where productivity growth in agriculture in the last 20 years has been very high, and the evidence suggests that a big part of this was the reallocation of land away from traditional crops toward new cash crops (primarily soybeans). The Green Revolution in India almost 40 years ago was characterized by a “structural transformation” of land away from traditional rain-fed agriculture toward irrigation and fertilizer-intensive high-yield seeds, although land allocation efficiency remains a concern in the region.

So what can late comers to development do? This is a vast agenda. Land-title reform aimed at opening more farmland without deforestation is a high priority. Farmers should expand the use of fertilizer and mechanized equipment. They need to shift to commercial and profitable crops. Food distribution and marketing channels should also be reformed, so that farmers can keep more of the proceeds from the sale of their crops.

The growth landscape in Africa is still evolving. This landscape will be shaped by many policy levers. The conventional policy prescription to reduce bureaucratic red tape, and facilitate foreign investment applies to the Lions in Africa just like they applied to the East Asian Tigers.

But the latecomers to development need much more. The Lions of Africa should also draw upon other levers including demographic dividend, smarter urbanization, more investments in education and infrastructure, and inclusive and more modern institutions. Indeed they are already doing it. A broader set of initiatives will help to reduce coordination failures, government failures and market failures. Ideally, the focus ought to be not on policy best practices but on policy best matches with institutional capabilities. Of course, no policy is failure proof.

This blog post is based on a paper,"Can Service Be a Growth Escalator in Low Income Countries?," by Ejaz Ghani and Stephen D. O’Connell. Please read the paper to see the references.

Join the Conversation