Microfinance institutions aim to serve customers ill-served by traditional commercial banks and thus the associated business model is challenging by definition. And yet the industry has achieved impressive scale reaching 211 million customers globally in 2013. Paradoxically, recent evidence suggests that the benefits of microcredit to borrowers may be modest. For example, six prominent randomized controlled trials found small impacts of access to microcredit on the incomes and consumption levels of marginal borrowers, though the studies found some “potentially important” (though modest) impacts on “occupational choice, business scale, consumption choice, female decision power, and improved risk management.” (Banerjee et al., 2015, p. 14).

Even if one takes those modest benefits at face value, it would be wrong to consider the microfinance business model a failure without paying greater attention to the costs incurred to achieve those benefits. Modest benefits to borrowers could nonetheless feed into sizable benefit-cost ratios if the costs are also proportionally small. Indeed, this was a fundamental premise of microfinance.

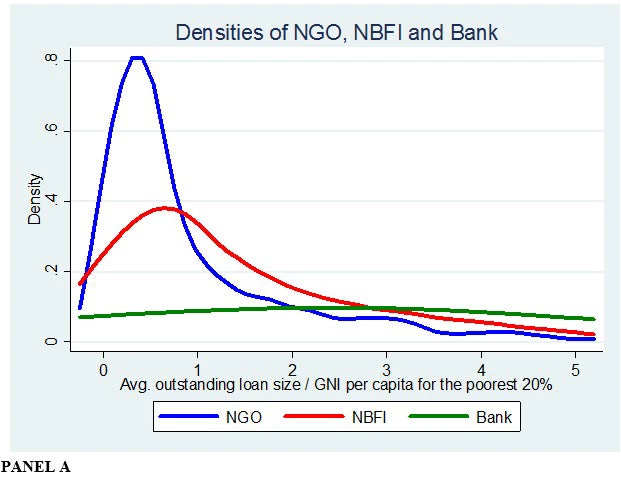

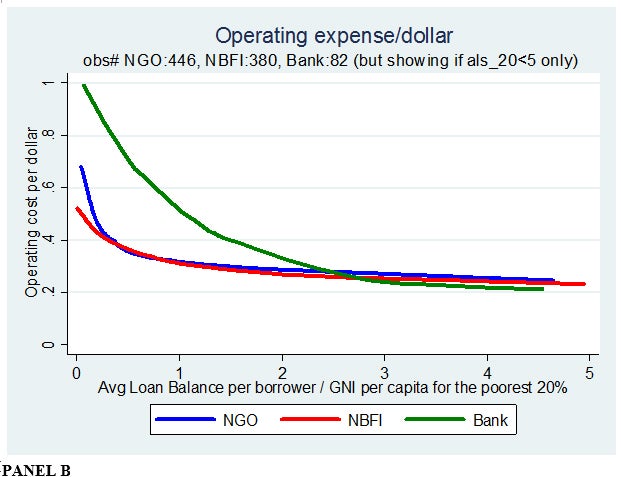

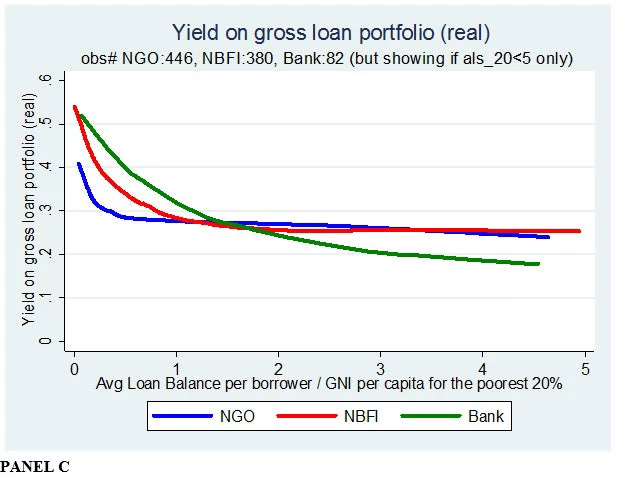

To better understand how microfinance institutions target their customers and cover the costs associated with reaching them, we use proprietary data from 930 microfinance institutions that jointly served 80 million customers in 2009. We show that there is no single microfinance business model, but rather a number of models pursued by different types of institutions. Those chartered as non-governmental organizations (NGOs) tend to make smaller loans (panel A), which are substantially more costly per dollar lent (panel B), and thus require higher interest rates (panel C), than microfinance providers chartered as banks or non-bank financial institutions (NBFIs). Not only do they make smaller loans (the proxy for lending to poorer borrowers in much of the literature and in our analysis), NGO microfinance institutions also lend substantially higher shares of their portfolios to women.

But are those higher interest rates enough to cover the costs of reaching harder-to-serve clients? In an accounting sense (i.e., whether revenues covers costs), the answer appears to be yes for the majority of institutions in our sample. However, once we take account of the opportunity costs of the capital received by those institutions, a much smaller share of them is profitable in an economic sense. When we use the local prime interest rate as the opportunity cost of capital, only about one-third of the institutions are economically profitable.

Original, underlying data provided by Microfinance Information eXchange, Inc. (MIX).

Panels B and C show relationships from bi-variate lowess regressions between average loan size (normalized by the per capita income at the 20th percentile in a country), operating costs per dollar lent, and real yields on gross loan portfolios (our proxy for interest rates charged on loans). Data points for individual microfinance institutions are suppressed to reduce clutter.

______________________

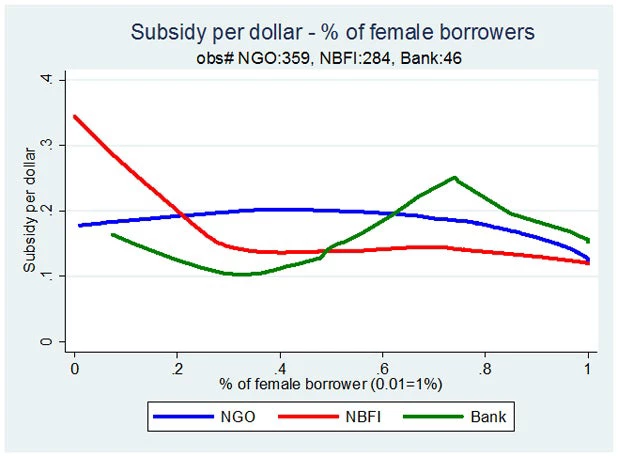

By calculating the difference between the market rate of capital and what the microfinance institutions actually paid, we develop measures of the subsidies they receive on their funding. Because much of their external finance is received in the form of donated equity capital or concessional loans at below-market interest rates, these subsidies can be large. And because the costs of making small loans is higher per dollar lent than making larger ones, it’s not a surprise that NGO microfinance institutions receive more subsidy (per dollar lent) than banks or NBFIs that provide microcredit. But the spread in subsidy levels across institutional types is tighter than one might expect: NGO microfinance institutions receive 18.4 cents of subsidy per dollar lent, but for-profit NBFIs receive 12.2, and for-profit commercial banks receive 14.5.

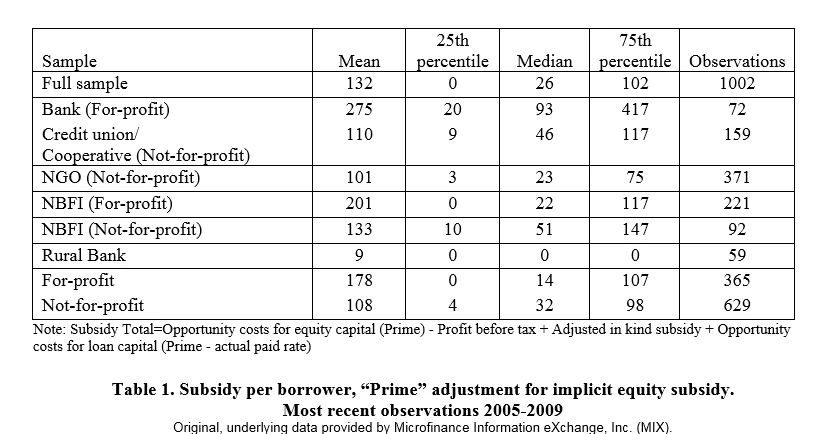

Because the range in subsidy per dollar lent across types is narrow, while their average loan sizes vary widely (with more commercially oriented, for-profit institutions making substantially larger loans), subsidies per borrower tend to be relatively small for NGO microfinance institutions. Table 1 shows that the mean subsidy per borrower for commercial microfinance banks is $275, while for NGOs the mean is $101. For-profit microfinance institutions as a group receive more subsidy per borrower on average, relative to not-for-profits ($178 versus $108), though the picture switches with the medians ($14 versus $32). The data show that there are some heavily subsidized for-profit institutions, but most for-profits are only modestly subsidized. Still, most for-profits are subsidized.

Figure 2 shows how the data on subsidy per unit lent lines up with the gender-orientation of institutions. The relationship for NGOs is flat. For NBFIs, however, the largest subsidy per unit goes to institutions that tend to favor men. The curve for banks draws on a small sample (n=46) but shows a generally pro-female orientation of subsidy. However, when we control for additional features of the institutions (age, size, region, cost structure, loan pricing) using regression models, none of the MFI types show a robust positive link between lending to women and subsidy per borrower. In addition, the paper provides evidence that dependence on subsidies declines but does not disappear as institutions become older, and in fact many older institutions continue to rely upon substantial subsidies.

Original, underlying data provided by Microfinance Information eXchange, Inc. (MIX).

By tilting away from those who may be able to benefit most from subsidies (poorer customers and women), microfinance subsidies support institutions that may not be the most worthy of them, at least from the vantage of traditional social analysis. And the finding that per-borrower subsidies are relatively small for parts of the NGO sector more focused on women and those making smaller loans, reinforces the call for cost-benefit analyses to place pessimistic conclusions drawn from recent impact studies in a fuller context. Finally, because our calculations indicate that subsidy remains an important element of the current microfinance business model, they also underline the importance of pursuing new ways to change the cost structure faced by most microfinance institutions such as digital payments and mobile money.

Join the Conversation