Growth in the Middle East and North Africa region is estimated to have slowed sharply in 2017 and is forecast to recover to 3 percent in 2018. Regional activity is anticipated to strengthen gradually over the medium term in response to policy reforms and easing fiscal adjustments. A number of downside risks continue to cloud the outlook for the region, including geopolitical tensions and conflict, weakness in oil prices, and obstacles to reform progress. These are only partly offset by the possibility of stronger-than-expected Euro Area activity.

Regional growth tumbled last year, led by oil exporters

Growth in the Middle East and North Africa is estimated to have slowed sharply to 1.8 percent in 2017 from 5 percent the year before, driven by decline in growth among oil exporters. Growth declined among Gulf Cooperation Council and non-GCC oil exporters, with oil production cuts and continued geopolitical tensions contributing to the fall-off. Source: Bank for International Settlements

Broad-based growth improvements likely

Growth is projected to improve in 2018 across both oil importers and exporters, supported by policy reforms and easing fiscal adjustments, as well as improvements in tourism among oil importers.

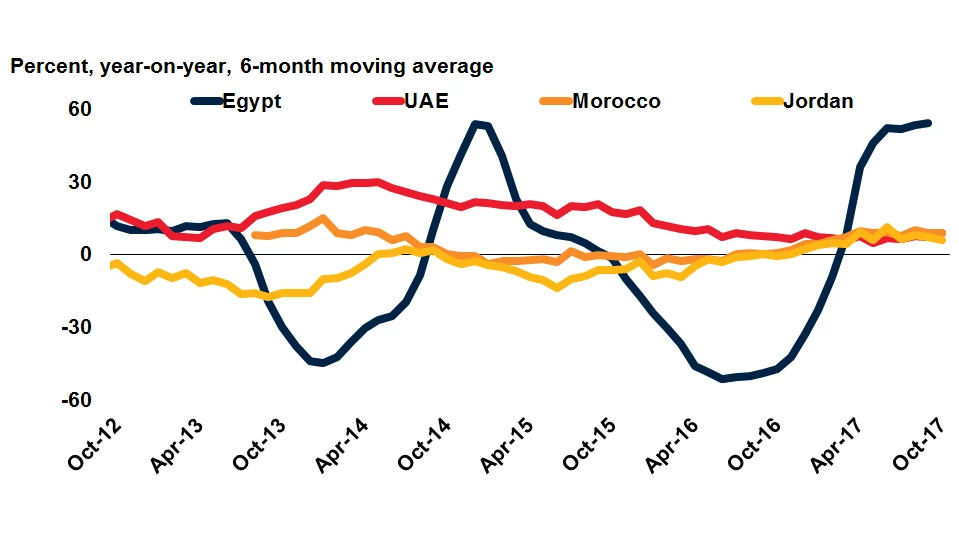

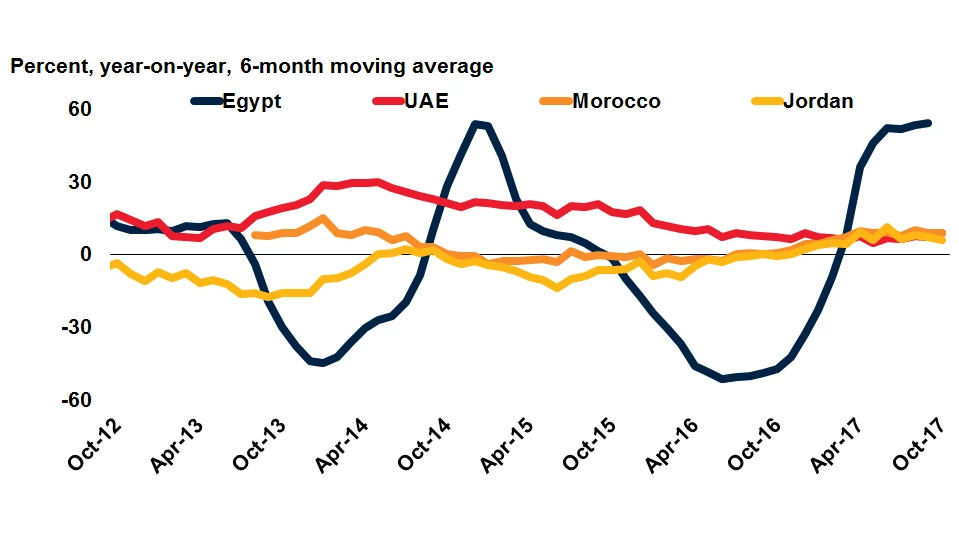

Tourism growth

Source: Haver Analytics

Despite growth acceleration, challenges remain

Nevertheless, the region faces a number of challenges, including low female labor force participation.

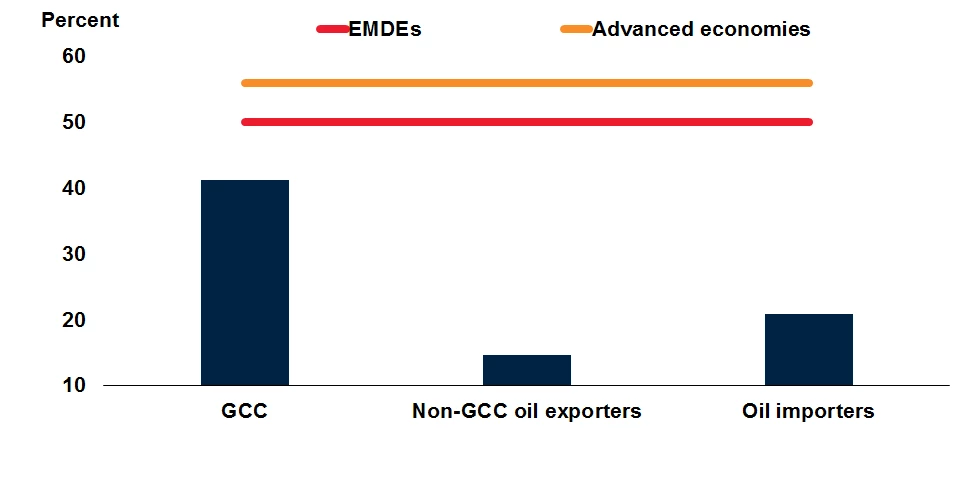

Female Labor Force Participation

Source: World Bank

European growth could spill over to region

Despite improving growth in coming years, the MENA region still faces a number of long-standing risks, such as geopolitical conflicts and weaker-than-expected oil prices. At the same time, stronger than-expected activity in the Euro Area would present an upside risk for many economies, especially oil importers.

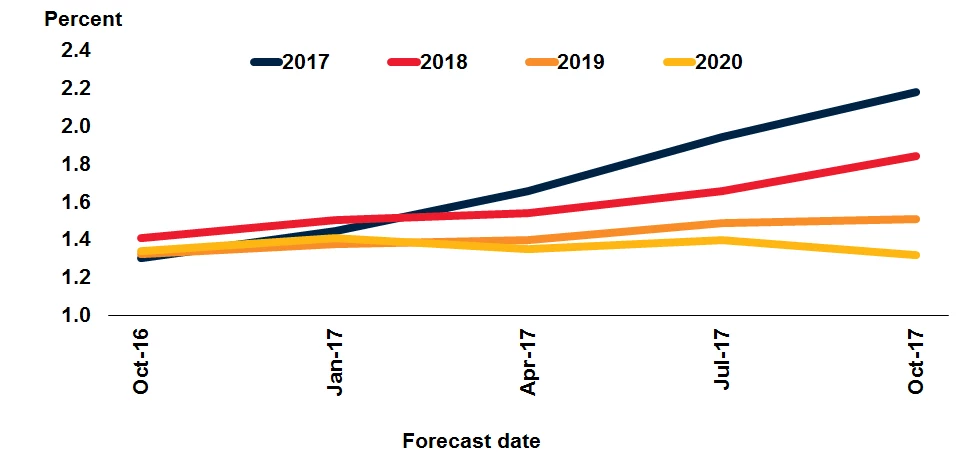

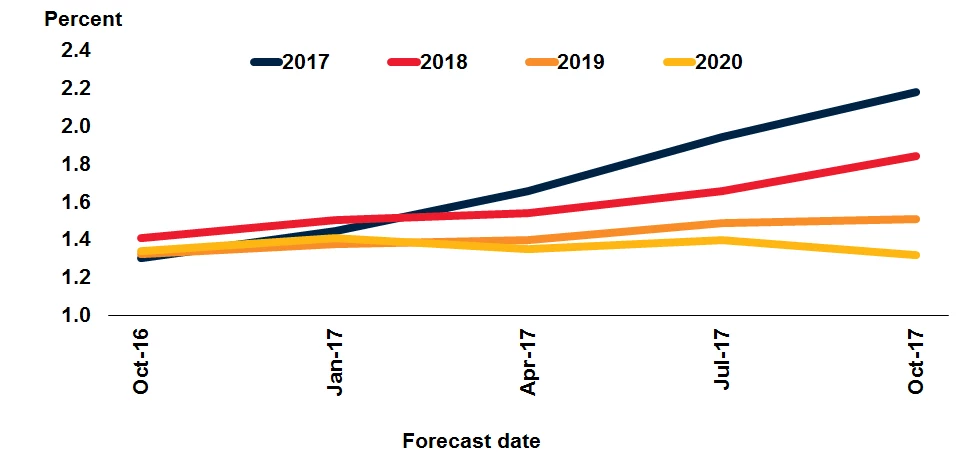

Consensus growth forecasts: Euro Area

Source: Consensus Economics

Regional growth tumbled last year, led by oil exporters

Growth in the Middle East and North Africa is estimated to have slowed sharply to 1.8 percent in 2017 from 5 percent the year before, driven by decline in growth among oil exporters. Growth declined among Gulf Cooperation Council and non-GCC oil exporters, with oil production cuts and continued geopolitical tensions contributing to the fall-off.

Growth

Upswing in debt issuance

Fiscal adjustments across the region have contributed to large sovereign bond issuances, leading to a rapid rise in the volume of international debt securities.

International Debt Securities

Source: Bank for International Settlements

Notes: Sum of international debt securities outstanding for 14 MENA countries. Last observation

is 2017Q2.

Broad-based growth improvements likely

Growth is projected to improve in 2018 across both oil importers and exporters, supported by policy reforms and easing fiscal adjustments, as well as improvements in tourism among oil importers.

Tourism growth

Source: Haver Analytics

Notes: Growth of tourist arrivals for Egypt, Jordan, and Morocco. Data for the United Arab Emirates denote hotel guest arrivals in Abu Dhabi.

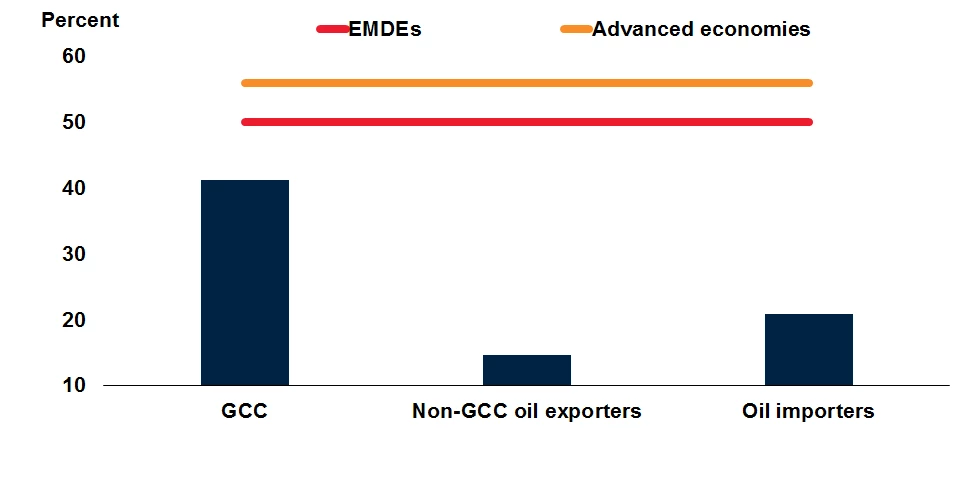

Despite growth acceleration, challenges remain

Nevertheless, the region faces a number of challenges, including low female labor force participation.

Female Labor Force Participation

Source: World Bank

Notes: Workforce as a percent of female population ages 15+. Unweighted average of 5 GCC economies, 2 Non-GCC oil exporters, and 5 oil importers. Based on latest available data since 2010 for each country.

European growth could spill over to region

Despite improving growth in coming years, the MENA region still faces a number of long-standing risks, such as geopolitical conflicts and weaker-than-expected oil prices. At the same time, stronger than-expected activity in the Euro Area would present an upside risk for many economies, especially oil importers.

Consensus growth forecasts: Euro Area

Join the Conversation