The following post is a part of a series that discusses 'managing risk for development,' the theme of the World Bank’s upcoming World Development Report 2014.

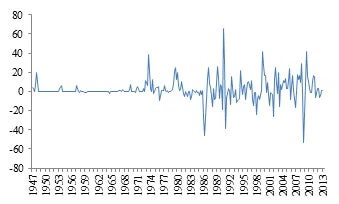

Crude oil is arguably one of the single most important driving forces of the global economy, and changes in the price of oil have significant effects on economic growth and welfare around the world. Indeed, the level of oil dependency of industrialized economies became particularly clear in the 1970s and 1980s, when a series of political incidents in the Middle East disrupted the security of supply and had severe effects on the global price of oil. Since then, oil price shocks due to such exogenous events have continuously increased in size and frequency (cf. Figure 1). While oil demand tends to be slow moving, mainly driven by economic growth and to some extent climate policies, the prospects of future oil supply are highly uncertain – not least considering persistent political instability in exporting countries and the uncertainty regarding the discovery of new reserves. As a result of such uncertainties, oil prices could undergo further (increasingly) drastic fluctuations in the future.

Figure 1. Percentage changes of the quarterly price of crude oil (Source: Dow Jones & Co., Thomson Reuters)

Oil price shocks (i.e. sudden changes) can be transmitted into the macro-economy via various channels. In the private sector, a positive oil price shock will increase production costs and hence restrict output – with price increases at least partially passed on to consumers. Moreover, as prices for gasoline and electricity increase, households face higher costs of living, with the poor being particularly vulnerable. These impacts can have further significant knock-on effects and repercussions throughout the economy, affecting macro-indicators such as employment, trade balance, inflation and public accounts, as well as stock market prices and exchange rates. Thereby, the nature and extent of such knock-on effects depend on the structural characteristics of an economy; for instance, the more a country engages in oil trade, the more it is exposed to price shocks on global commodity markets. Countries relying on a high fossil fuel share in their energy mix, or on energy intensive industrial production, are also more vulnerable. Furthermore, oil price shocks on the international market might be amplified in specific countries, depending on the respective Dollar exchange rate and prevailing inflationary pressures.

While a given oil price increase may be perceived positively by oil exporting countries and negatively by importers, an increase in oil price volatility (i.e. consecutive positive and negative oil price shocks) increases perceived price uncertainty for all countries – regardless of their trade balance. Such oil price volatility reduces planning horizons, causes firms to postpone investments, and may require expensive reallocation of resources. Formulating robust national budgets becomes more difficult, as importing countries face uncertainty regarding import costs and fuel subsidies levels, and exporters face volatile revenues. This may be a particularly profound problem in budget constrained developing countries, which rely on oil exports as a main source of public revenue. In order to protect firms and households against price volatility on international markets, particularly in developing countries, governments often allocate large parts of their budgets to subsidizing fuel. These subsidy systems not only expose governments to significant budgetary risks, but result in significant environmental costs, benefit mainly the wealthier, create disincentives for energy efficiency, and crowd out resources from education, health and other investments in development.

However, volatility and uncertainty are not interchangeable terms as uncertainty exists even in the absence of volatility. Even when prices remain relatively stable over an extended period of time, a sudden exogenous event independently of previous events could disrupt the balance at any point in time and cause significant upward or downward price changes (e.g. a large earthquake in an exporting country may disrupt supply, thus increasing prices). However, when prices are stable, economic agents (incl. households, firms and governments) tend to overlook this ubiquitous, permanent underlying uncertainty, when making economic decisions. On the contrary, in an environment of already volatile prices agents are more likely to take future price uncertainty into account when making investment decisions. Overall, oil price volatility typically results in an increased sense of economic uncertainty, whereas the absence of volatility instills a false sense of stability.

Owing to the complex interaction of direct effects, knock-on effects, and repercussions induced by oil price volatility, its consequences extend from government level to firms and households. Therefore, it is critical for policy makers to adopt an integrated risk management approach. Subject to country-specific circumstances, an integrated approach also implies accounting for related risks, such as the price volatility of other key commodities.

In order to reduce a country’s structural exposure and vulnerability to price volatility, policy makers have various long-run policy instruments at their disposal. Typically these are measures aimed at transforming and reforming economic structures in order to reduce the level of dependency on international commodity markets. This includes measures such as decreasing the fossil fuel share in the national energy portfolio, increasing energy efficiency, and developing structural and technological alternatives to make production processes less fossil fuel intensive. Since such structural policy measures have long-term time horizons, they need to be complemented with short-term risk management instruments, such as physical reserves, strategic purchasing contracts and financial instruments, which are all common practice among many large private companies for hedging their supply risks. To facilitate the implementation of an integrated risk management framework, it is critical to make institutional arrangements with adequate technical capacity, political independence, and ability to coordinate across ministries and sectors. In developing countries, such actions could make a significant contribution for reducing the exposure of economic activity and protecting the livelihoods of the poor.

Join the Conversation