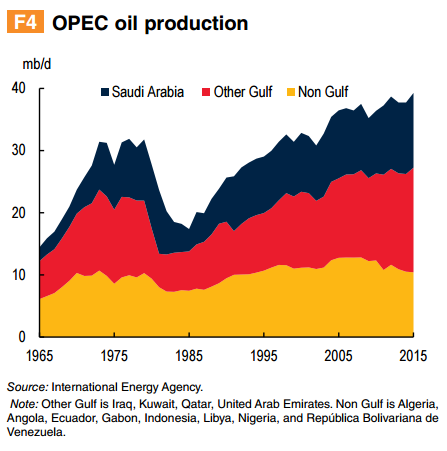

The Organization of the Petroleum Exporting Countries (OPEC) unsettled oil markets in September when it announced it would resume placing limits on oil production among its members, effectively reversing two years of unrestrained production.

But how much control can OPEC really exert over prices? History suggests that formal agreements to influence the price of a particular commodity eventually fall apart. OPEC’s own history also shows that the short term benefits of managing supplies become long term liabilities. In addition, the oil producing landscape has changed dramatically in recent years with the advent of nonconventional producers, notably the U.S. shale oil industry. These factors will test the oil exporting organization’s power to influence markets.

OPEC’s 14 members, which account for one-third of global oil production, agreed in September to limit output to between 32.5 million and 33 million barrels per day. That ceiling would lower current production by between 500,000 and 1 million barrels per day. The terms have yet to be finalized and are due to be unveiled in November. OPEC members must agree on individual member quotas and timing. Some members – Iran, Libya, and Nigeria -- would be exempt from the production limit because of earlier losses, and the membership would have to agree how to accommodate any increased production from those three countries. OPEC must also reckon with non-OPEC producers, such as Russia, and has scheduled talks with them.

OPEC, founded in 1960, had a huge impact on oil markets in 1973 when it imposed an export embargo and quadrupled prices. Over the next three decades, OPEC influenced prices through member quotas, adjusting them as needed to adapt to price fluctuations, changes in demand, and outside supply.

OPEC is not the first organization to try to manage the market for a particular commodity to control prices. Arrangements aimed at stabilizing prices at levels deemed fair to both producers and consumers were established after World War II governing coffee, olive oil, sugar, tin and wheat. Agreements controlling natural rubber and cocoa were established in the 1970s after a price boom.

But over time, price and trade restrictions had the effect of encouraging the emergence of a substitute, such as aluminum for tin, or the entry of new producers not bound by the terms of the agreement, as was the case when Vietnam began producing coffee. All of these organizations have collapsed except OPEC.

More recently, production restraint among OPEC members helped keep oil prices high even as prices for other industrial commodities began slipping in 2011. Reduced supply from several countries, including Iran, was also a factor.

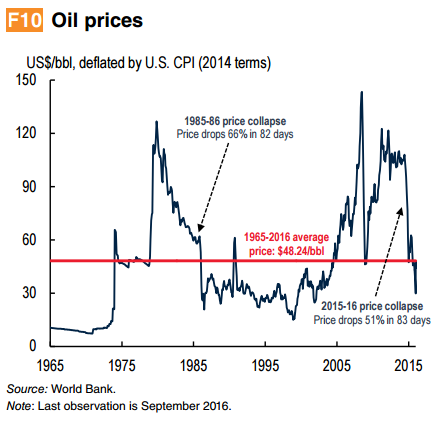

Not surprisingly, these high prices brought new oil supplies into the market, including U.S. shale oil, Canadian oil sands, and product from non-OPEC producers. Supplies from Russia, Brazil and China, were also added to the mix. OPEC decided in 2014 that rather than cutting production, it would let prices drop in order to try to maintain market share. Oil prices plunged, falling as low as $30 per barrel in January 2016.

However, low prices did not drive non-conventional producers from the market. U.S. shale technology – which has expanded U.S. production to the point where the United States accounts for 5 percent of global oil production – has been resilient to price swings. Not only do shale wells follow a much shorter production cycle than conventional oil, but production costs have fallen significantly as the industry has evolved. Further, shale producers can hedge against price dips by selling production on futures markets to receive a predictable revenue stream, further enhancing their resilience.

Oil prices are now not far from their 50-year average of just over $48 per barrel. Even if OPEC members and other producers can agree on a way to limit production and raise prices in the near term, investment in oil production and non-OPEC supply are likely to rise – undercutting OPEC’s ability to lift oil prices over time.

For a more detailed discussion, please see the Special Focus.

The World Bank Development Economics unit issues a quarterly Commodity Markets Outlook: http://www.worldbank.org/en/research/commodity-markets

Join the Conversation