Trade growth has slowed sharply since the 2007-2009 financial crisis. An analysis of U.S. trade data shows that trade between unaffiliated firms (arm’s-length trade) – as opposed to trade between firms linked by control or ownership (intra-firm trade) – accounted for the lion’s share of this slowdown. Arm’s-length trade depends more heavily on sectors of the economy, such as textiles and apparel, that have languished since the crisis. Arm’s-length trade also relies substantially on emerging market and developing economies, where growth has slowed since the crisis.

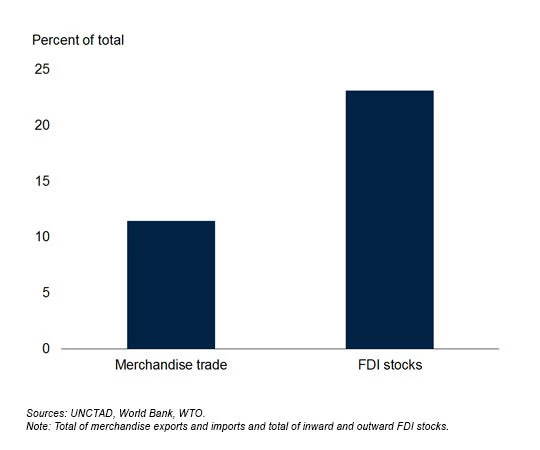

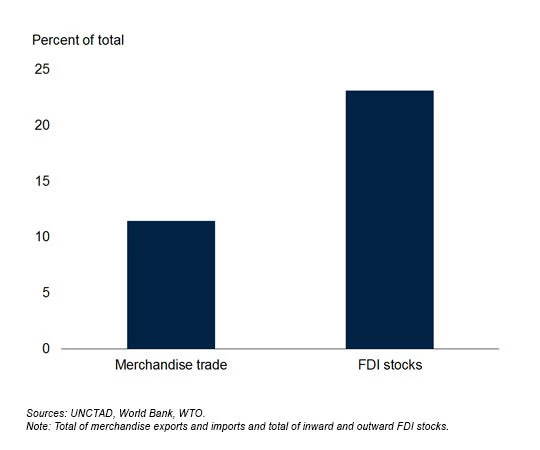

U.S. Share of Global Trade and FDI

The United States plays an important role in global trade: it accounts for about 11 percent of global goods trade and 23 percent of global foreign direct investment stocks. U.S. firms account for about 30 percent of the employment and sales of the world’s 100 largest non-financial multinational companies.

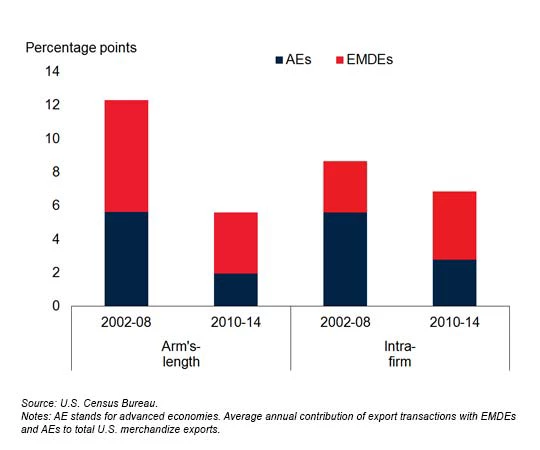

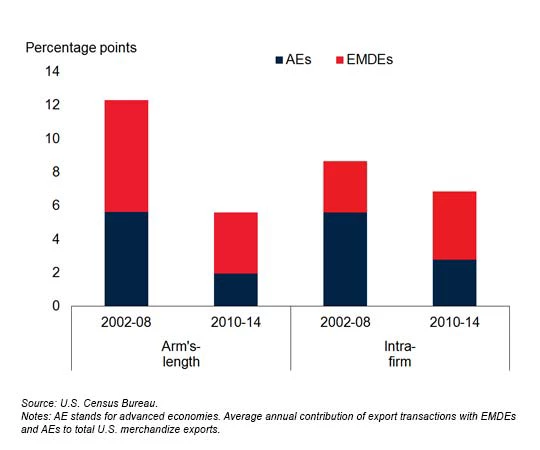

Contribution to Average Annual Export Growth

Arm’s-length trade growth among U.S. firms has slowed steeply relative to intra-firm trade in the years following the financial crisis. During the 2010-2014 recovery, trade among non-affiliated firms grew at about half the pre-crisis rate; intra-firm trade growth also slowed, but considerably less.

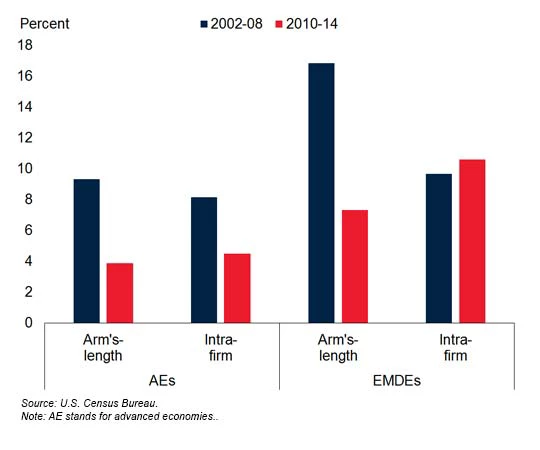

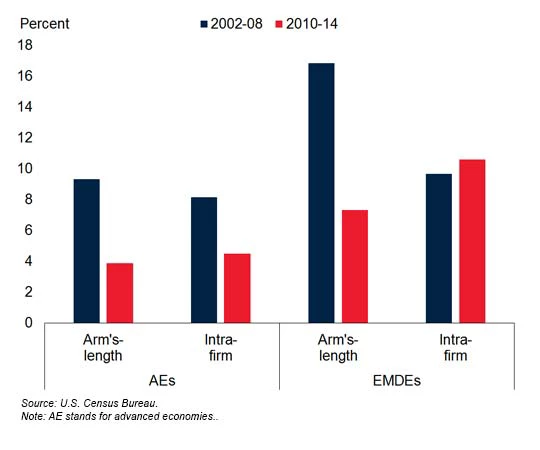

Export Growth

A greater share of U.S. arm’s-length exports is shipped to emerging market and developing economies than to advanced economies. Just as the rapid pre-crisis growth of emerging market and developing economies boosted export growth among unaffiliated firms, the sharp post-crisis growth slowdown in these economies decelerated it.

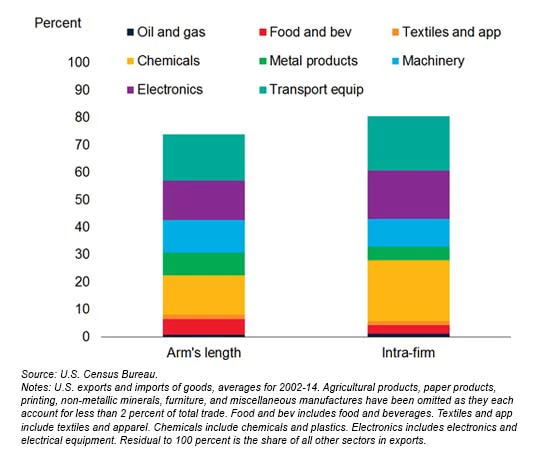

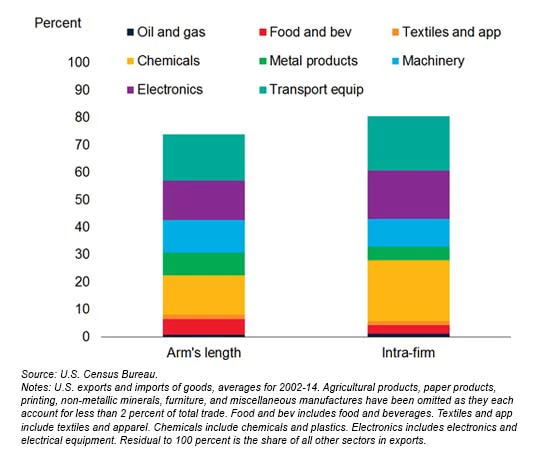

Share of Sector in Intra-firm and Arm's-length Trade

Arm’s-length transactions tend to be more concentrated in textiles and apparel and food and beverages, sectors that have languished post-crisis, while intra-firm trade is more concentrated in sectors such as transportation equipment, electronics, and chemicals, which have rebounded strongly from the global financial crisis.

U.S. Share of Global Trade and FDI

The United States plays an important role in global trade: it accounts for about 11 percent of global goods trade and 23 percent of global foreign direct investment stocks. U.S. firms account for about 30 percent of the employment and sales of the world’s 100 largest non-financial multinational companies.

Contribution to Average Annual Export Growth

Arm’s-length trade growth among U.S. firms has slowed steeply relative to intra-firm trade in the years following the financial crisis. During the 2010-2014 recovery, trade among non-affiliated firms grew at about half the pre-crisis rate; intra-firm trade growth also slowed, but considerably less.

Export Growth

A greater share of U.S. arm’s-length exports is shipped to emerging market and developing economies than to advanced economies. Just as the rapid pre-crisis growth of emerging market and developing economies boosted export growth among unaffiliated firms, the sharp post-crisis growth slowdown in these economies decelerated it.

Share of Sector in Intra-firm and Arm's-length Trade

Arm’s-length transactions tend to be more concentrated in textiles and apparel and food and beverages, sectors that have languished post-crisis, while intra-firm trade is more concentrated in sectors such as transportation equipment, electronics, and chemicals, which have rebounded strongly from the global financial crisis.

Join the Conversation