One must think of government data like a matchstick; it must be taken out of its box and lit. The first step to generating public trust in a government institution is to show it has nothing to hide. The disclosure of data, or

Open Data, is a public-private partnership for solving social issues transparently.

However, more than establishing moral authority, Open Data also gives public institutions deeper insight and understanding into their own operations. Moving a step further, voluntarily disclosing not just data in comma separated values or excel spreadsheets, but insights -- even weaknesses -- to the public, can accelerate change across institutions and society. I say this with a caveat: disclosure should be made with a nuanced message, such as the acknowledgment of data and its limitations, the humility to accept limitations as an agency with scarce time and resources, and the courage to come up with clear steps for implementation. In the Philippines, Finance Secretary Cesar Purisima echoes this, noting that “We must be the first to admit our weaknesses.” Open Insights is the next logical step to Open Data.

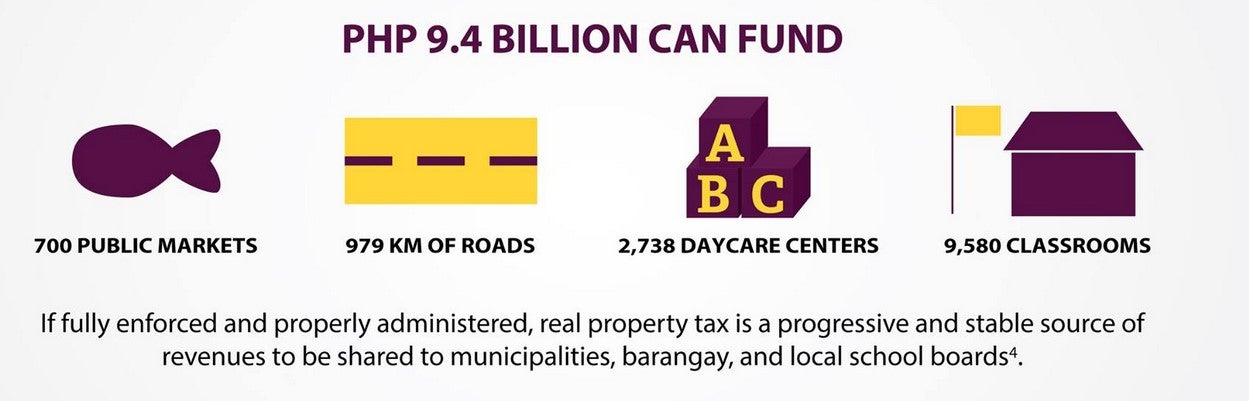

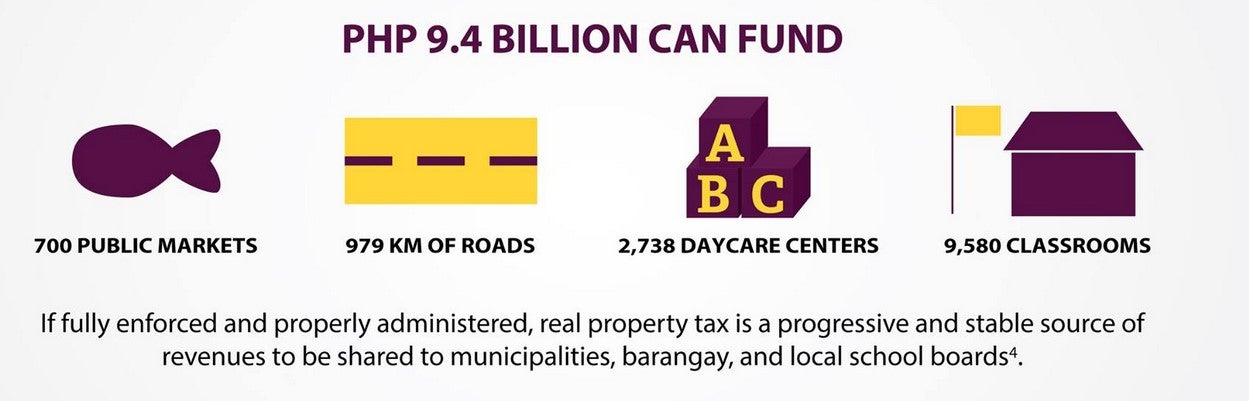

Since 2013, the Philippines’ Department of Finance (DOF) has published more than 100 weekly full-page ads * in national newspapers and social media containing data nuggets such as: “Doctors pay less taxes than a public school teacher,” “The weighted average declared price of imported spam was only 5 pesos ($0.10) at the customs border,” “Only 3 in every 10 local treasurers complied with local treasury reporting standards with some local governments failing three times in a row at our scorecard, " The "Tax Watch" campaign by the DOF Fiscal Intelligence Unit in partnership with revenue-generating bureaus has produced insights that drove public discourse on tax, customs, and local finance over the past two years. Saying all this in national papers came with risks, including public outrage, but such is the friction required in lighting matches.

So far, it has been able to show the way and deliver results:

In a time of platforms, apps and smartphones, data like matchsticks must be taken out of their boxes and lit. Policymakers should embrace this trend and take calculated risks towards it.

* The revenue generating bureaus are the Bureau of Internal Revenue (BIR), the Bureau of Customs (BOC), and the Bureau of Local Government Finance (BLGF). The Analytics Team of the DOF Fiscal Intelligence Unit (DOF FIU), established in early 2013, compiles the data and distills the insights. An in-house graphic designer at the DOF Office of the Secretary converts these insights into full page ads and sends them to press every Wednesday.

** The anti-tax evasion, anti-smuggling and anti-corruption programs are respectively called, Run After Tax Evaders (RATE), Run After the Smugglers (RATS), and Revenue Integrity Protection Service (RIPS).

(Kenneth Abante is the Deputy Chief of Staff to the Philippines's Secretary of Finance Cesar V. Purisima. )

However, more than establishing moral authority, Open Data also gives public institutions deeper insight and understanding into their own operations. Moving a step further, voluntarily disclosing not just data in comma separated values or excel spreadsheets, but insights -- even weaknesses -- to the public, can accelerate change across institutions and society. I say this with a caveat: disclosure should be made with a nuanced message, such as the acknowledgment of data and its limitations, the humility to accept limitations as an agency with scarce time and resources, and the courage to come up with clear steps for implementation. In the Philippines, Finance Secretary Cesar Purisima echoes this, noting that “We must be the first to admit our weaknesses.” Open Insights is the next logical step to Open Data.

Since 2013, the Philippines’ Department of Finance (DOF) has published more than 100 weekly full-page ads * in national newspapers and social media containing data nuggets such as: “Doctors pay less taxes than a public school teacher,” “The weighted average declared price of imported spam was only 5 pesos ($0.10) at the customs border,” “Only 3 in every 10 local treasurers complied with local treasury reporting standards with some local governments failing three times in a row at our scorecard, " The "Tax Watch" campaign by the DOF Fiscal Intelligence Unit in partnership with revenue-generating bureaus has produced insights that drove public discourse on tax, customs, and local finance over the past two years. Saying all this in national papers came with risks, including public outrage, but such is the friction required in lighting matches.

So far, it has been able to show the way and deliver results:

- Tax collections from professionals increased by 14%, which could potentially fund the equivalent annual salaries of 21,000 nurses for the Department of Health;

- We have filed tax cases against canned meat importers;

- Local treasurer reporting compliance increased from 30% in 2014 to 90% in 2015, with the public disclosure of fiscal sustainability scorecards of 1,477 municipalities, 144 cities, and 80 provinces.

- Customs, by releasing open data on the import entry level, has become one of the most transparent agencies in government.

- A team of young civil servants who formed the Bagumbayani Initiative and partnered with Kalibrr, a jobs-matching platform, made 3,600 vacancies of more than 6 government agencies available online, resulting in around 29,000 applications.

In a time of platforms, apps and smartphones, data like matchsticks must be taken out of their boxes and lit. Policymakers should embrace this trend and take calculated risks towards it.

* The revenue generating bureaus are the Bureau of Internal Revenue (BIR), the Bureau of Customs (BOC), and the Bureau of Local Government Finance (BLGF). The Analytics Team of the DOF Fiscal Intelligence Unit (DOF FIU), established in early 2013, compiles the data and distills the insights. An in-house graphic designer at the DOF Office of the Secretary converts these insights into full page ads and sends them to press every Wednesday.

** The anti-tax evasion, anti-smuggling and anti-corruption programs are respectively called, Run After Tax Evaders (RATE), Run After the Smugglers (RATS), and Revenue Integrity Protection Service (RIPS).

(Kenneth Abante is the Deputy Chief of Staff to the Philippines's Secretary of Finance Cesar V. Purisima. )

Join the Conversation