The latest macroeconomic data released by China’s National Bureau of Statistics (NBS) on April 18 suggest that China’s economic growth has moderated in the first quarter of 2014. GDP growth has decelerated from 7.7 percent (year-over-year) in the last quarter of 2013 to 7.4 percent (year-over-year) in the first quarter of 2014.

On a sequential basis, the quarter-on-quarter seasonally adjusted growth slowed from 1.7 percent in Q4 last year to 1.4 percent in Q1 2014.

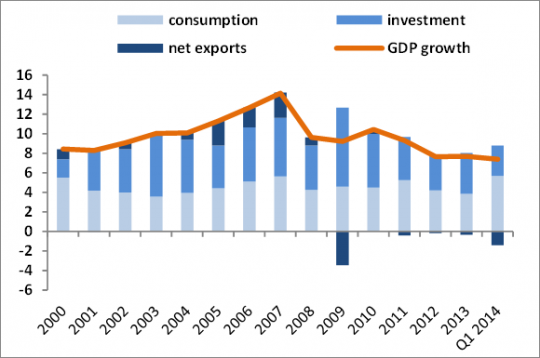

The deceleration in the first quarter of this year is in line with World Bank expectations (see our latest East Asia Economic Update) (Figure1).

Figure 1: Official growth data on the demand side reflect subdued export growth and a moderation in investment growth. Consumption led growth in the first quarter of 2014, contributing 5.7 percentage points to growth, followed by investment, contributing 3.1 percentage points. Net exports dragged down growth by 1.4 percentage points.

Many economists speculate that the weakening trend in growth may put more pressure on the government to implement more and stronger growth supportive fiscal and monetary policies, following the stimulus measures unveiled recently that include accelerated expenditures on railway construction and social housing, as well as tax breaks for small businesses.

One prevalent concern is that macroeconomic policies may remain growth-oriented and that China would fail to push through the reforms required by a more sustainable development path, which deviates from its traditional growth model characterized by government-led investments fueled by rapid credit expansions (for instance, see this Wall Street Journal article entitled “China’s slowdown likely to spur stimulus, not reforms” )

This concern may well be valid. However, it may be interesting for us to find out what specific reform measures have been proposed, and which parts of the reform package unveiled by the Third Plenum in November 2013 are more likely to support growth.

What are the reforms announced at the Third Plenum last November?

The ambitious reform package covers 16 areas and 60 individual items. The main idea is to reduce government interventions in the market economy and state-introduced distortions in China’s markets. An important step to deepen economic reforms will be redefining the relationship between the government and the market. The proposed reforms focus on China’s land, capital, and labor markets. (detailed in our East Asia Economic Update)

China’s product market has become increasingly competitive after the 1978 opening up. However, continued economic progress is threatened by significant distortions in China’s factor markets. In response, the Plenum approved reforms in land, capital, and labor markets, including integrating the urban and rural land markets, removing barriers in the capital market through financial sector reforms, and addressing distortions in the labor market through changes in the household registration (Hukou) system.

All these reforms require significant changes in China’s fiscal system so that expenditure responsibilities are matched by fiscal powers and the interests of central and local governments are balanced.

The authorities are also trying to address other areas such as education and health services, social security, the one-child policy, institutional governance, and further opening up of the economy. In particular, the authorities have pledged to promote reforms to enhance the social safety net and reduce income disparity. The plan is to give priority to low-income groups and expand the size of the middle class. Specific measures include increasing labor compensation and property-related income for rural households. Income redistribution through taxation, transfer payments, and the redistribution of state-owned enterprises (SOE) profits will also be considered.

So is there absolutely a tradeoff between growth and reforms? The short answer is “not necessarily”. If implemented, the reforms will have a profound impact on China’s land, labor, and capital markets, and enhance the long-term sustainability of its economic growth. Some reforms are also likely to support growth in the short term. For instance, removing entry barriers and reducing regulatory and administrative burdens will enhance incentives for private investment.

Likewise, consolidating the business tax with the value-added tax will lower the tax burden and promote investment, in particular in transportation and financial services. Making more land available for commercial activities will also improve the prospects for service sector growth. However, the reform process is likely to be gradual, with more specific follow-up implementation plans expected as the year goes on.

The prospect of growth falling below the government target will likely trigger accommodative fiscal and monetary policies. The government should have sufficient maneuver room for those policies, but our concern is that more accommodative policies may perpetuate China’s traditional growth model which relies on government-led investment fueled by credit expansion.

Fortunately, the government seems to be aware that focusing policies on meeting growth targets might prevent China from transitioning onto a sustainable development path. For instance, while trying to restore market confidence amidst the economic slowdown, Premier Li Keqiang pledged not to respond to “short-term fluctuations in growth” with heavy-handed stimulus.

Let’s hope this promise will be kept, so that the current slowdown would not delay the reforms China urgently needs in meeting its development challenges.

Join the Conversation