The South Asian Free Trade Area (SAFTA) agreement has been in effect since 2006—with little success.

This is in sharp contrast to the ASEAN free trade area (AFTA), which started in 1992 with six six countries and later added more members, completing the ASEAN ten by 1999.

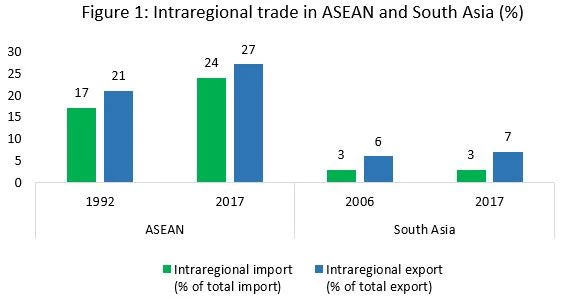

Between 1992 and 2017, intraregional imports as a share of global imports in ASEAN increased from 17 to 24 percent, and exports from 21 to 27 percent.

In South Asia, these shares were largely stagnant since SAFTA came into effect, at 3 percent for intraregional imports and 6-7 percent for intraregional exports.

In fact, intraregional trade in South Asia has been the lowest among world regions for quite some time, hovering around 5 percent of its overall trade with the world .

So why is intraregional trade not growing in South Asia, despite over a decade of SAFTA, several bilateral Free Trade Agreements, and a unilateral duty-free tariff regime from India to all the region’s least developed countries (Afghanistan, Bangladesh, Nepal, Maldives, and Bhutan)?

The World Bank’s recent report “A Glass Half Full: The Promise of Regional Trade in South Asia” gets to the bottom of this.

And here are the reasons behind SAFTA’s ineffectiveness.

First, SAFTA is undermined by the so-called “sensitive list”- a long list of products that are exempted from the tariff liberalization program.

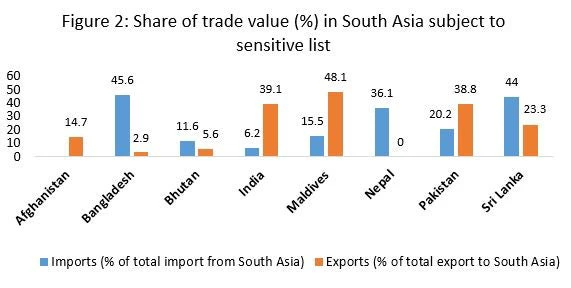

Each country has many products in this sensitive list, ranging from 6 - 45 percent of its imports from other South Asian countries. Bangladesh, Sri Lanka, and Nepal have the highest share of sensitive imports from South Asia.

Similarly, 5 – 48 percent of exports to South Asia face do not receive tariff preferences from recipient countries , with Maldives, India and Pakistan having the highest share of exports subject to such treatment.

Overall, about 36 percent of trade in South Asia falls outside the preferential regime. In contrast, on average, ASEAN countries have zero import duty on 96 percent of products, stimulating more intraregional trade.

Second, the region has been very adept at creating a proliferation of “para tariffs”, which are duties that are applied only on imports and not on domestic production : in effect, tariffs by another name.

Within South Asia, such para tariffs have become ubiquitous in Bangladesh (supplementary duty, regulatory duty), Sri Lanka (port and airports development levy, cess), and Pakistan (regulatory duty, additional duty).

These para tariffs increase overall protection, non-transparency, and dispersion of tariffs, and the overall anti-export bias of trade regimes where they prevail. This para tariff phenomenon is not observed in most countries in the world, including the ASEAN states.

Given their lack of transparency, imposing countries have so far usually been able to keep para tariffs outside the ambit of free trade negotiations.

In South Asia, for several countries, SAFTA is the most important free trade agreement that they are part of. Since para tariff reductions are not part of SAFTA negotiations, this undermines the free trade agreement.

If SAFTA is to become more effective, the two issues above need to be addressed.

Downsizing the sensitive lists of countries in a time-bound manner will be necessary. This can be calibrated carefully, taking into account revenue and short-term job impacts, and items of exceptional concern can be kept off tariff liberalization (subject to an upper limit, say 5 percent of tariff lines). But for the process to be credible, the schedule of tariff liberalization by each country needs to be clearly articulated and adhered to, unlike the case in the current SAFTA process.

Second, the issue of para tariffs needs to be squarely addressed. A starting point could be to reduce and accelerate the elimination of para tariffs on items not on sensitive lists and include para tariffs in SAFTA negotiations.

Our report shows that intraregional merchandise trade in South Asia can triple, from its current volume of US$ 23 billion to US$67 billion .

Given the deep linkages between trade and investment, a more effective free trade regime can also have spillover effects in attracting FDI from within the region as well as from outside .

By not exploiting this trade and investment potential – which affects human welfare through lower prices and higher variety of goods, better quality inputs for producers and exporters, and expanded markets and job creation -- South Asian countries are missing opportunities at their doorstep.

Join the Conversation