Bid Analysis

Bid Analysis

Last month, we marked International Anti-Corruption Day with a nod to the ways in which data tools are helping the World Bank and its partners detect and prevent fraud and corruption. I thought some elements of that discussion were worth sharing here.

The core mandate of the Integrity Vice Presidency (INT) is to investigate fraud and corruption in contracts financed by the World Bank. Where allegations of misconduct are substantiated through our Sanctions System process, companies may be banned from participating in future Bank-funded projects. This system is in place to protect scarce development resources from graft and duplicity; put simply, money that is supposed to help build schools and hospitals should not end up in the pockets of corrupt individuals.

Corruption is a major challenge to the World Bank’s twin goals of eradicating extreme poverty and promoting shared prosperity, in part, because it often hits the poor hardest. And we are quite busy. In fiscal year 2019, we received 2,460 complaints, opened 355 preliminary inquiries, and selected 49 of those for full investigations. (If you are interested in learning more, please check out our Annual Report.)

But our interest in data is not only to keep track of our work, as important as that may be. We have recently embarked on a data modernization effort to better understand the fraud and corruption risks our institution faces and to better anticipate problems as they come up. We are changing the way we collect, manage, analyze, and share information within our group and with our partners and clients inside and outside the World Bank Group. This is critical because exploring emerging technologies allows us to continuously improve the way we deliver our services, from investigations and forensic analysis to the identification and management of integrity risks.

Data analytics is quickly becoming essential to effectively fight fraud and corruption. Software can now identify patterns in the evidence we collect during an investigation. Algorithms can highlight possible bid rigging schemes in our projects. Artificial intelligence can help us focus on the highest risks, so that we make better decisions on where to target limited resources.

For INT, this data work has many uses. It might feed into an investigation, which could lead to debarment, precluding a firm or individual from participating in future World Bank-funded contracts. It also might help inform our preventive work, both in our development operations around the world and in our efforts with the private sector to promote clean business.

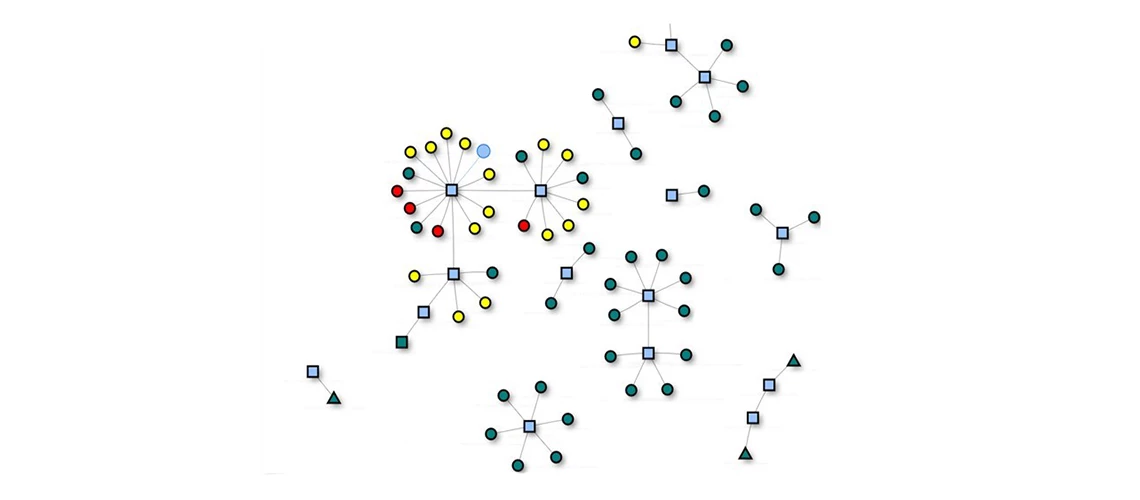

Specifically, we have built an online application to detect patterns among companies bidding on Bank-financed projects. This tool looks at information across projects, sectors, or in specified geographical areas. It brings together key information investigators use for analysis – such as data and documentation on project, procurement, risk, complaints and investigations – to quickly determine if investigators should take a closer look. The system is also used to retrieve a company’s bidding and contracting history with the World Bank with the push of a button.

The World Bank is at its foundation a development organization. Our “bottom line” is advancing and sharing wealth. And corruption impedes these goals, largely because it harms the poor the most.

Our data work is helping us more effectively protect the scarce development resources that our donors have entrusted to the World Bank to advance our mission and ensure that those resources are used for their intended purposes. Modernizing our approach to data is helping us improve the way we provide those protections to the institution and to our donors.

Join the Conversation