The idea that economic growth needs good governance and good governance needs economic growth takes us to a perennial chicken-and-egg debate: Which comes first in development—good governance OR economic growth? For decades, positions have been sharply divided between those who advocate “fix governance first” and others who say “stimulate growth first.”

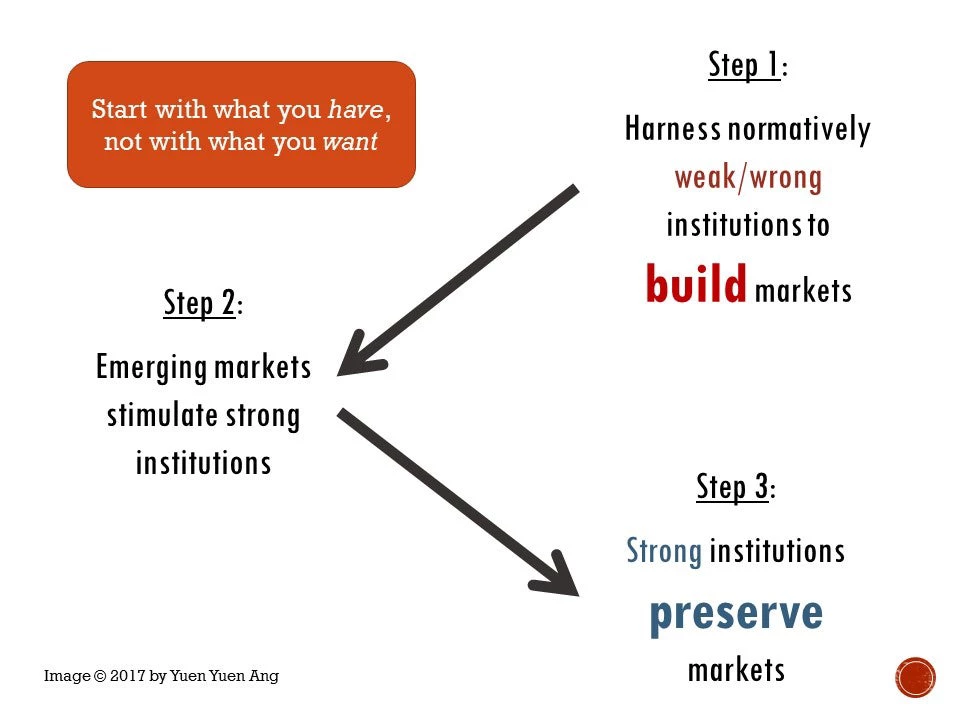

My research finds a surprising answer to this debate. The first step of development is to harness normatively “weak” institutions to kick-start markets. This argument seems paradoxical, even impossible. But once laid out, the logic is obvious.

Contesting the dichotomy of good/bad governance

While experts may not agree on the definition of “good” governance, we know what it is not when we see it. For example:

- Bureaucracies dominated by patronage ties and non-experts

- Dispersed, uncoordinated policy implementation

- Prebendalism (public agents self-finance by taking a share of public revenue)

- Communes (rather than individuals) as economic units

- Non-transparent, risky schemes of public financing

- Piracy

An illustration from China

Taking history seriously, my book How China Escaped the Poverty Trap, traces the steps of economic-institutional changes in China from 1978 to 2014. This exercise reveals that development occurs in a sequence of three interactive steps, summarized below.

To illustrate, did China’s coastal cities escape poverty by first establishing private property rights, eradicating corruption, and hiring technocrats? No, they did not. Instead, local governments dispatched all civil servants to recruit investors using their personal relationships, like an en masse sales team. Officials received a personal cut of investments made, allowing them to legitimately reward themselves, while formal salaries were kept low.

By conventional norms, it is a case of bad governance. Yet the strategies selected fitted the goals of rapid, coarse growth. It made use of the best resources at the time: communist officials with family and friends. And it was “inclusive” in that the entire civil service (some 20,000 people per city) were mobilized to participate and shared the profits.

Subsequently, as markets took off, the goals of development evolved: from desiring large volumes of investment to high-quality investment only. Evolved preferences and new wealth then propelled local governments to recruit professionals and formally protect property.

In short, my argument can be summed up in a pithy maxim: start with what you have, not with what you want. Instead of blindly importing global best practices, China sparked change by re-purposing what it had in the beginning, including communist and personalist features. This is innovation and adaptive development, unorthodox-style.

Beyond China

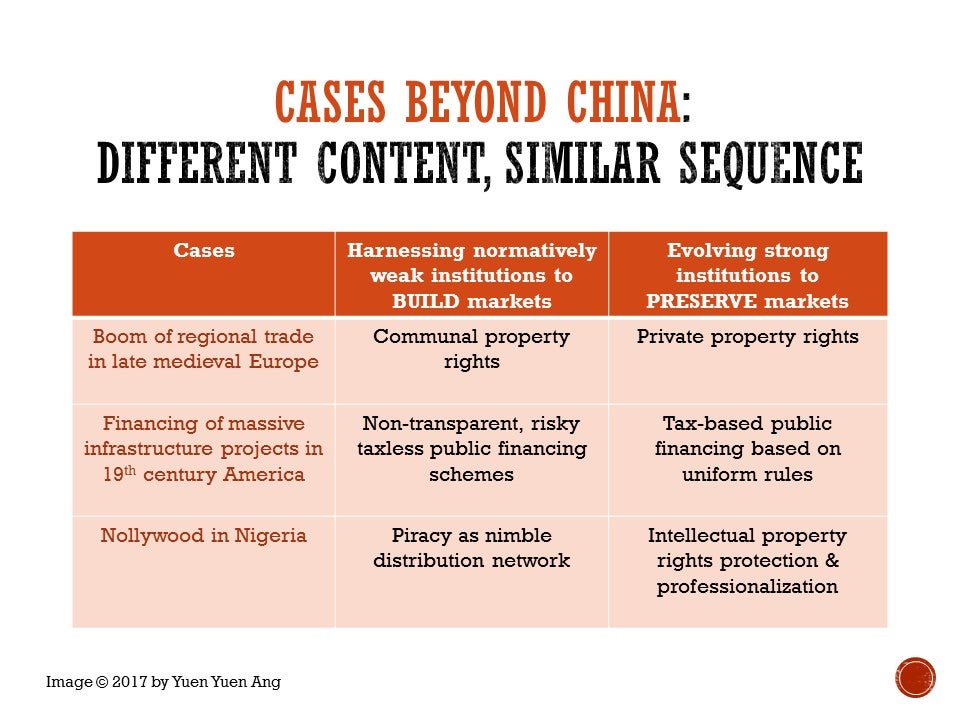

Is China’s process of development unique and therefore not replicable? The particular details found in China are of course unique to the country, as it is the case for all countries. What is generalizable, however, is the three-step sequence of development I’ve identified.

The final chapter of my book turns from China to three cases that appear to have nothing in common: late medieval Europe, 19 th century America, and contemporary Nigeria. In fact, they share a surprising feature: the first step of development is building markets using normatively “weak” institutions. Conventionally strong institutions or good governance emerged later in the development process, serving to preserve—rather than b uild—markets.

What are the implications for development practitioners? I highlight three key ideas below.

- Normatively weak institutions can be functionally strong. This message resonates with the World Development Report 2017’s groundbreaking emphasis on institutional functions over forms. By challenging the binary view of institutions—good/bad, strong/weak—policymakers can begin to leverage what the poor have in abundance and expand their toolbox.

- Building markets ≠ preserving markets. Of course advanced market economies need good governance. Yet the institutions that propel new markets are not the same as those that later on evolve to preserve established markets. Hence, in promoting markets, we must first ask: What stage of development are we dealing with?

- Weak institutions and corruption do not cause growth by themselves. What matters, rather, is how people adapt existing institutions to solve particular problems at hand.

Editor's Note: The findings, interpretations and conclusions expressed herein are those of the authors and do not necessarily reflect the view of the World Bank Group, its Board of Directors or the governments they represent.

Join the Conversation