Poor households in rural areas are exposed to substantial weather shocks that can generate great fluctuations in income and consumption if insurance markets are not complete (Dercon and Christiaensen 2011, etc.). However, evidence from several countries shows that even when formal insurance products were provided, the participation rate is usually sub-optimally low, even with heavy government subsidies (Cole et al. 2011). This disappointing development of formal insurance markets has been referred to as a “puzzle” in need of an explanation. Although existing works have tested the possible explanations of trust, credit constraints, ambiguity aversion, and experience of disasters (Cole et al. 2011; Bryan 2010; Cai and Song 2011), insurance demand is still low even after some of the above treatments were implemented. One approach to increasing take-up might be to exploit social network effects, which can be an important factor in decisions on whether or not to adopt new financial products: people may learn about benefits of a product from their friends, imitate their decisions, or respond to their experience.

My Experiment

In my job market paper, I study the role of social networks in influencing households’ insurance demand in both short term and over longer periods. I use data from a two-year randomized experiment that I implemented in rural China, which includes 185 villages and about 5300 households. The product I am studying is a new weather insurance policy for rice farmers offered by the People’s Insurance Company of China (PICC). The novel experimental design allows me not only to identify the causal effect of social interactions, but also to test various channels through which social networks operate. Additionally, using household level price randomization, I am able to estimate the price equivalence of the social network effect.

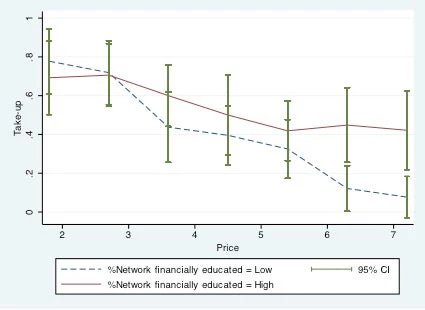

I begin by investigating the value of social networks for insurance take-up using the experiment implemented in year one. Specifically, if only a subset of farmers were offered financial education about the product, would this have a spillover effect on untreated farmers? To establish causality, I randomly assigned households in each village to early versus late round sessions, and simple versus intensive (including financial education) sessions. For each household, the social network variable is defined as the fraction of a group of friends (named in a preliminary survey) who were invited to an early round intensive session. As shown in Figure 1, I find a large and positive spillover effect of financial education: for second-round participants, having one additional friend who obtained first round financial education increases take-up by half as much as the effect of attending financial education directly. I use a household level price randomization to show that this effect is equivalent to decreasing the average insurance premium by 12%.

Figure 1: Effect of Having Friends Attending Financial Education on Insurance Demand

Note: The variable %Network financially educated is defined as "high" if it is above the sample median and is defined as "low" if it is below the sample median.

After observing a large and significant effect of social networks, it is natural to ask what information conveyed by social networks drives this large effect? Do social networks matter in insurance adoption because they can diffuse knowledge among farmers about the product benefits? Or is it because farmers learn about each other’s purchase decisions and make their own decisions based on that? While distinguishing different mechanisms through which social networks operate is crucial from both theoretical and policy perspectives, only a few studies to date have shed light on this point. I find that there is something special about social networks in rural communities: they do not convey information about what other people do, even though others would like to obtain such information, but they do effectively convey information about what other people know. As a result, the main mechanism that drives the social network effect is social learning about insurance benefits, as opposed to a scale effect, imitation, or informal risk sharing. This result is reached in the following way:

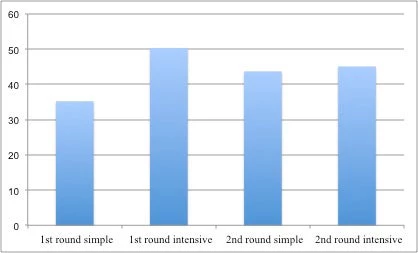

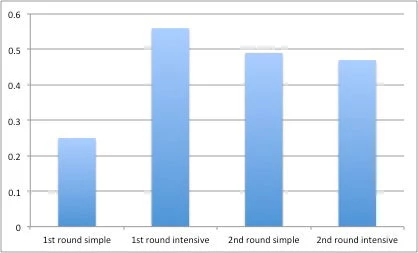

§ To identify the insurance knowledge mechanism, I compare the effect of financial education on insurance take-up and knowledge between the two rounds. As shown in figure 2, I find that in the second round, the effect of financial education is smaller, and that farmers understand insurance benefits better when they have a greater number of friends who received financial education. This means that there was knowledge diffusion from first-round to second-round participants.

§ To identify the purchase decision mechanism, I exploit the exogenous variation in both the overall and individual take-up decisions generated by randomized default options to estimate whether or not subjects are affected by their peers’ decisions. No significant effect is found, but, surprisingly, when I told farmers about other villagers’ decisions, it actually mattered a lot to them.

Figure 2.1: Average Take-up Rate in Different Sessions

Figure 2.2 Insurance Knowledge in Different Sessions

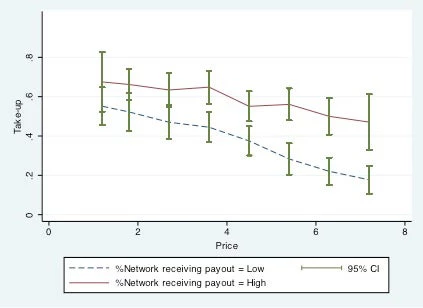

For products such as insurance, sustained take-up over time, even if subsidies are gradually removed, is required to generate the hoped-for impact on households and to maintain financial sustainability of the program. As a result, identifying sustainable ways of maintaining high take-up rates over time is essential. I followed up one year later with a subsample of households from the first year experiment to study the effect of social networks overtime. The randomization in year two included a household level insurance price. I find that households are not influenced by their friends’ purchase behavior during the previous year. However, observing an above median share of friends receiving payouts increases second year take-up at all price levels (by 21.7 percentage points on average) and makes people less sensitive to price change (offsets the price effect by more than 50%). The effect is equivalent to reducing the average insurance premium by 35%, and is as effective as about 54% of the impact of receiving an actual payout. This means that social networks affect insurance take-up over time through social learning about friends’ experience with payouts.

Figure 3: Effect of Observing Friends Receiving Payouts on Second Year Insurance Demand

Notes: The variable %Network receiving payout is defined as "high" if it is above the sample median and is defined as "low" if it is below the sample median.

Policy Implications

The findings in this paper speak to the commonly used policy of providing a one-time subsidy to a subset of potential buyers with the expectation that this will affect the take-up of the others. My result suggests that such a policy alone cannot lead to indefinitely sustainable voluntary purchases over time. However, combining it with social norms marketing, which disseminates information about the actions of a population’s peers, may improve take-up significantly. Moreover, providing financial education to a subset of households and relying on social networks to extend the effect, as well as disseminating payout information effectively, would be good ways of improving the sustained insurance demand.

Jing Cai is a job market candidate from the University of California at Berkeley.

Join the Conversation