The latest AEA papers and proceedings has a number of interesting papers:

- In the Richard T. Ely lecture, John Campbell discusses the challenge of consumer financial regulation – he distinguishes 5 dimensions of financial ignorance many households exhibit: 1) ignorance of even the most basic financial concepts (financial illiteracy); 2) ignorance of contract terms (such as not knowing about the fees build into credit cards or when mortgage interest rates can change); 3) ignorance of financial history – relying too much on own experiences and the recent past; 4) ignorance of self- a lot of financially illiterate people are over-confident about their abilities; and 5) ignorance of incentives, strategy and equilibrium – failure to take account of incentives faced by other parties to transactions. Given these problems, and the limits of financial education and disclosure requirements to fix them, he discusses what financial regulation is needed: “consumer financial regulation must confront the trade-off between the benefits of intervention to behavioral agents, and the costs to rational agents….the task for economists is to confront this trade-off explicitly”

- The productivity dispersion across hospitals in treating heart attacks is quantitatively similar to or slightly smaller than productivity dispersion within narrowly- defined manufacturing industries like ready-made concrete

- The city of Boston held a prediction tournament to crowd-source algorithms that used Yelp review texts to predict restaurant health and sanitation violations – results suggest the the City of Boston could increase inspection productivity 30–50 percent by allocating inspections as suggested by the top-performing algorithm from the tournament

- The Bloom, Van Reenen management surveys cost $400-500 per firm surveyed, and have an average response rate of 40%. Doing a “mandatory” mail/email survey of firms in the US cost $35 per survey and had 80% response – but they suggest costs would be higher in poorer countries due to unreliable mail. Different answers from the same plant only had a correlation of 0.5, suggesting half the management score is measurement error.

- School quality is more consequential for boys than girls (in Florida)

- The psychological lives of the poor

- The acceptance rate at the AER ranged from 6 to 8 percent in recent years – but in 2015 the average time from submission to acceptance was 101 weeks!; 33/84 empirical papers received exemptions to the data-sharing policy. AEJ applied had an acceptance rate of 6 percent for papers submitted in 2014 (plus 1 percent more in R&R status), and only 1 paper had a decision time exceeding 3 months, average time from submission to acceptance was 41 weeks (of which only 15 were weeks in review).

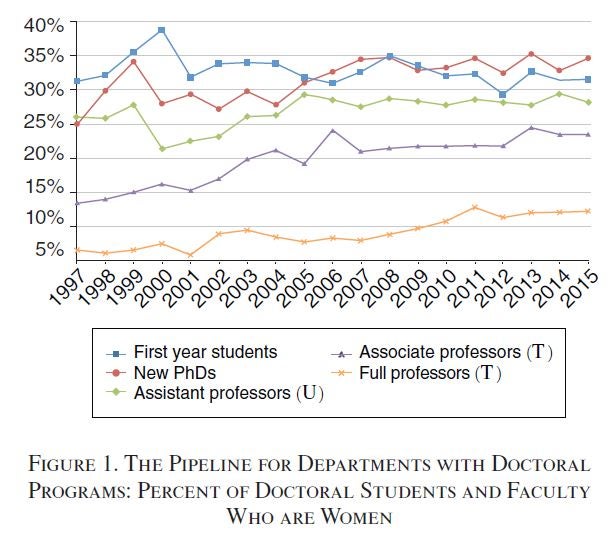

- I was surprised to read that the share of students entering PhD programs who are female appears to not have increased in the last decade – women are 31.6% of all econ PhD students, and 23.9% of first years in top-10 departments (see graph), while the female share of faculty has been rising.

Join the Conversation