Understanding Macroeconomic Volatility: Part 2

The fact is that a government can soften a recession by increasing spending (the counter-cyclical approach) to raise demand and output. If government reduces spending (the pro-cyclical approach), the likely result is a deeper recession.

Why? It’s more than just the short-term effect of lower government purchases. Talvi and Végh found in a 2005 study that lower expenditures on infrastructure, public health and education can result in less human capital development and lower productivity, increasing an overall downturn.

However, government policy on this question can be quite different in the developed and developing worlds. Talvi and Végh find that government spending is pro-cyclical in most developing countries but counter-cyclical in most G-7 countries.

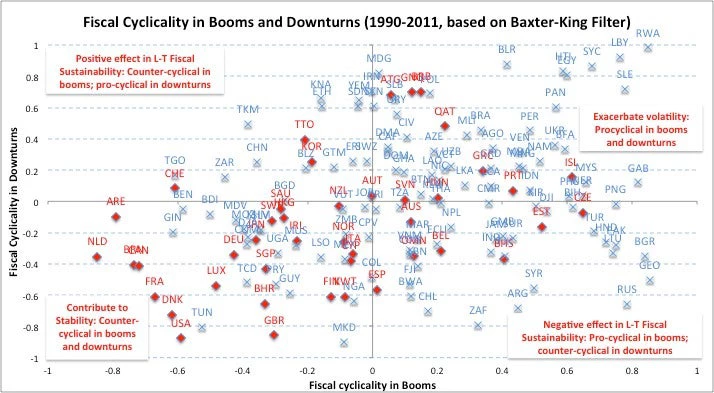

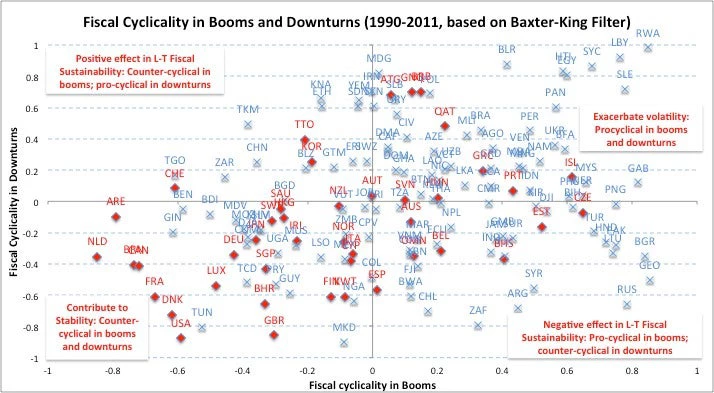

You can see that in the chart below: OECD countries (in red) are concentrated in the lower left quadrant, which represents fiscal policy that’s counter-cyclical both in boom and recession times. Many of the world’s poorest countries, meanwhile, are in the upper right quadrant, meaning their fiscal policy is pro-cyclical in both times. It’s a complicated trend to measure, however, with some countries being counter- or pro-cyclical in one situation but not the other. Nonetheless, it’s clear that counter-cyclical fiscal policy is far more common in the developed world.

To Spend or Not to Spend—Using Fiscal Policy to Influence the Business Cycle

Source: Authors’ calculations based on IMF, WEO, October 2014.

But that may be changing. Other studies suggest that the counter-cyclical approach in gaining ground in developing countries. Carneiro and Garrido (2015) looked at 104 developing countries and found that about half either continued or switched to counter-cyclical fiscal policies in the 1990-2010 period.

The question remains of why developing countries so often engage in pro-cyclical spending. We see three possible explanations:

The fact is that a government can soften a recession by increasing spending (the counter-cyclical approach) to raise demand and output. If government reduces spending (the pro-cyclical approach), the likely result is a deeper recession.

Why? It’s more than just the short-term effect of lower government purchases. Talvi and Végh found in a 2005 study that lower expenditures on infrastructure, public health and education can result in less human capital development and lower productivity, increasing an overall downturn.

However, government policy on this question can be quite different in the developed and developing worlds. Talvi and Végh find that government spending is pro-cyclical in most developing countries but counter-cyclical in most G-7 countries.

You can see that in the chart below: OECD countries (in red) are concentrated in the lower left quadrant, which represents fiscal policy that’s counter-cyclical both in boom and recession times. Many of the world’s poorest countries, meanwhile, are in the upper right quadrant, meaning their fiscal policy is pro-cyclical in both times. It’s a complicated trend to measure, however, with some countries being counter- or pro-cyclical in one situation but not the other. Nonetheless, it’s clear that counter-cyclical fiscal policy is far more common in the developed world.

To Spend or Not to Spend—Using Fiscal Policy to Influence the Business Cycle

Source: Authors’ calculations based on IMF, WEO, October 2014.

But that may be changing. Other studies suggest that the counter-cyclical approach in gaining ground in developing countries. Carneiro and Garrido (2015) looked at 104 developing countries and found that about half either continued or switched to counter-cyclical fiscal policies in the 1990-2010 period.

The question remains of why developing countries so often engage in pro-cyclical spending. We see three possible explanations:

- The countries have no choice: in bad times, it’s hard for them to borrow in international credit markets.

- Domestic concerns rule: People often think of counter-cyclical spending as only meaning cranking up government outlays in hard times. But it also means reining them in in good times. That can be hard, because in those periods governments face political pressure and temptations to keep spending high and run fiscal deficits.

- Delays: actual execution of well thought-out fiscal policies can come too late to make a difference.

Join the Conversation