In observance of the International Migrants Day, Dec 18

2015 is shaping up to be the year of Financing for Development. Besides official aid and private capital flows – the former expected to run flat, and the latter to remain volatile/cyclical, a few under-exploited financing options are directly connected to international migration.

As much as $100 billion, actually more, could be raised annually via:

- Mobilizing diaspora savings - $40 billion

- Reducing remittance costs - $30 billion

- Reducing recruitment costs - $20 billion

- Mobilizing diaspora giving - $10 billion

Remittances can further be leveraged for development financing via:

- Future-flow securitization of remittances

- Enhancing sovereign ratings

- Linking remittances to financial savings and insurance

Mobilizing diaspora savings ($40 billion): Annual saving of diasporas from developing countries was likely higher than $500 billion in 2012. These savings are often held in bank deposits that currently yield zero interest. If the country of origin of the migrant were to issue a 5-year diaspora bond yielding 4 percent, billions of dollars could be mobilized for financing development projects and programs. Further details on diaspora bonds can be found in this article and this paper.

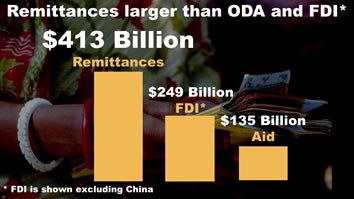

Reducing remittance costs ($30 billion): In 2013 migrants sent home $413 billion to developing countries, as remittances. At that level, remittances were three times the size of official development assistance. Excluding China, remittances were even larger than foreign direct investment. Reducing remittance costs from the current average of 8 percent to, say, 1 percent would translate into saving of $30 billion annually for the migrants and their relatives.

Is it really that difficult to reduce remittance costs to 1 percent? The Remittance Prices Worldwide database shows that in the second quarter of 2014, the average cost of sending $200 was under 1 percent for 56 providers and below 3 percent for 374 providers. Many leading remittance service providers have now reduced the fee for account-to-account transfers to zero (yes!) in high-volume corridors like India. I got word this morning that this Christmas, one money transfer operator (MTO) is waiving the fees for remittances from Europe. Some MTOs are toying with the idea of remittance fees being paid by merchants (where the remittances might be spent) rather than the migrants. And a start-up is giving the choice to the remitter to pay a fee of his/her choice. Since my TED talk two months ago, I have heard from several start-ups with very low cost for remittances.

The most important barrier to lowering remittance fees arises from the anti-money laundering and countering the financing of terror (AML-CFT) regulations. Recognizing that remittances under $1,000 are not money-laundering will open up the remittance market to better technologies and drive down remittance costs.

Fearing these stringent AML-CFT regulations, commercial banks are closing the bank accounts of MTOs, thus cutting off an economic lifeline to many countries such as Somalia. Perversely, these regulations are also driving flows underground, making it harder to monitor them.

The need for disrupting the remittance market through possibly the creation of a non-profit remittance platform remains urgent.

Reducing recruitment costs for low-skilled migrants ($20 billion): As Manolo and Phil highlighted in their blog, many low-skilled migrant workers pay exorbitant and illegal fees – often a multiple of their expected earnings – to illegal recruitment agents. For example, Bangladeshi construction workers in some GCC countries reportedly pay $4,000 in recruitment fees to labor agents for job paying less than $2,000 annually. In other words, for the initial 24-36 months, the earnings flow to recruitment agents, not to the family members, even as the workers themselves become vulnerable to workplace abuse. For every 1 million low-skilled migrants paying such fees, eliminating illegal recruitment fees could translate into $4 billion of savings. If 5 million migrants benefit from this reduction, they would save $20 billion annually.

Mobilizing diaspora giving ($10 billion): There are no global estimates of charitable giving by diaspora members. If diaspora giving is even 2 percent of remittances, it would approach $10 billion annually. The key challenges of mobilizing these funds are two-fold: (a) to be able to reach the diaspora givers, and (b) to use their contributions properly. Diaspora givers can be approached when they come to send money (see this article). The second challenge remains.

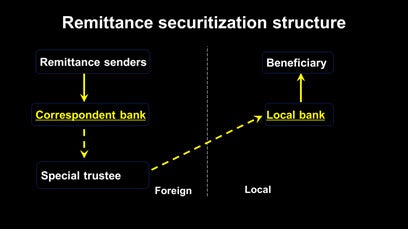

In addition, the use of future remittances as collateral – future-flow securitization of remittances (see chapter 2 of this volume) – can lower borrowing costs and lengthen bond maturity. It may sound esoteric, but it is similar, in my view, to harnessing electricity from flowing water: you insert a special purpose vehicle offshore to issue the bond and shield it from sovereign interference. The dollar volume that could be raised via future-flow securitization can be very large (see chapter 6 of the same volume).

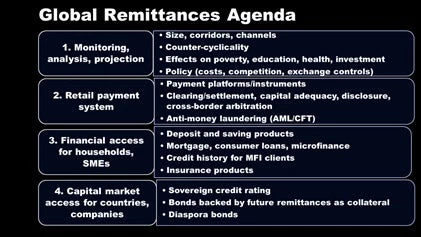

Finally, because remittances are large and stable, they can greatly enhance the recipient country’s sovereign credit rating, thus lowering borrowing costs and lengthening debt maturity. For a similar reason, remittance receipts can be used to judge poor people’s creditworthiness. And they can be used to promote micro-saving and micro-insurance, all to enhance financial inclusion for the poor. See items 3 and 4 of the Global Remittances Agenda.

Join the Conversation