In observance of the International Migrants Day, Dec 18

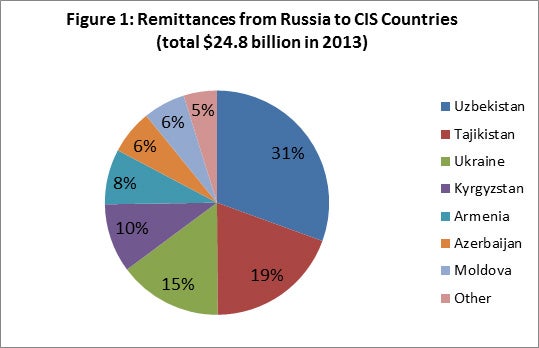

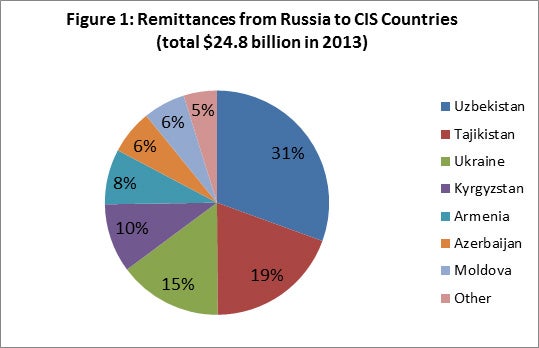

Russia is a major source of remittances with a flow of $37 billion in 2013. Of this, the CIS countries received $24.8 billion. In many countries, remittances provide a lifeline to the economy (for example, remittances are 42 percent of GDP in Tajikistan). The fall in ruble against the dollar and in the price of oil poses major risks of a slowdown in remittances to the CIS countries.

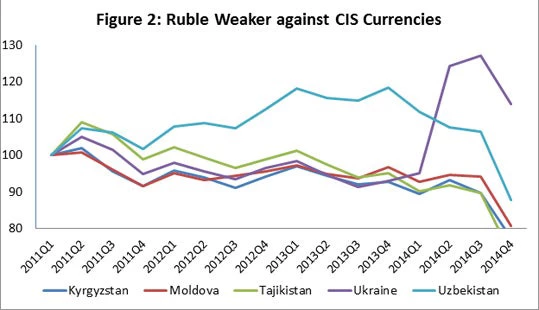

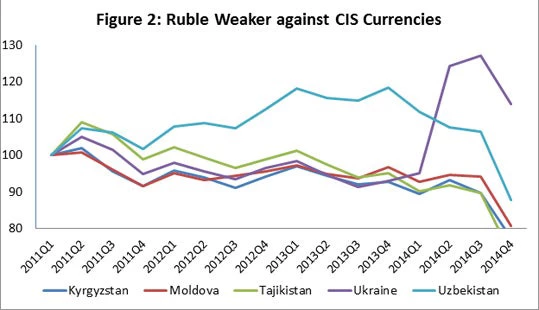

The ruble has depreciated by more than 44 percent against the US dollar since the beginning of 2014 (of which 23 percent only in the last quarter). A less known fact is that the ruble has also been depreciating – by more than 8.5 percent - against most CIS currencies from 2011Q1 to 2014Q3. (This is calculated excluding the 21% depreciation of the Ukrainian hryvnia and the 64% depreciation of Belarusian ruble against Russian ruble - see Figure 2).

Note: Exchange rates of largest CIS remittance recipients against ruble (2011Q1 = 100)

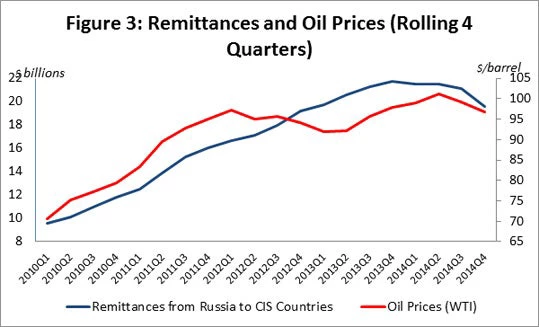

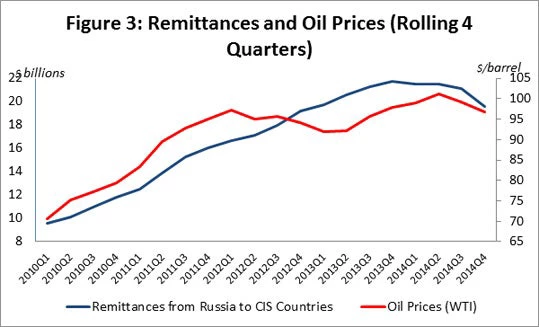

Remittances to the CIS are expected to decline due to Russia’s economic slowdown, the sanctions against Russia due to the crisis in Ukraine, and importantly because of lower oil prices (Figure 3).

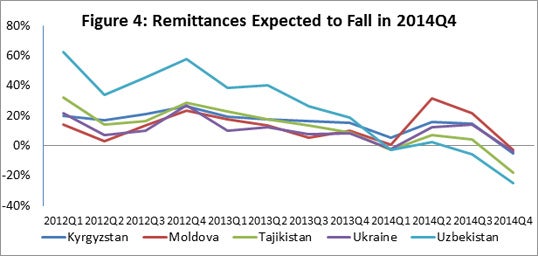

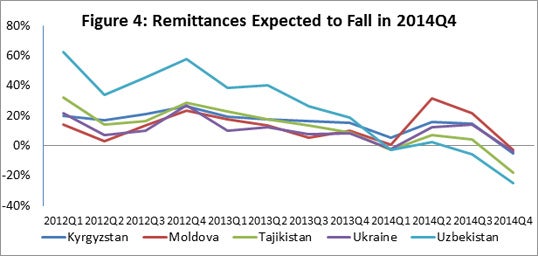

People in CIS are not solely hit because of lower growth rates in remittances from Russia (projected to be up by only 1.8 percent from 2013Q4 to 2014Q4 in ruble terms), but particularly because they receive much less for a ruble in their local currency. For instance, Uzbeks who received 4.9 trillion Soms in remittances in 2013Q4, are now expected to receive only 3.0 trillion Soms in 4Q2014 (World Bank estimates). Similarly, remittances are expected to decline in Moldova by 2.9 percent in Ukraine by 4.2 percent, in Kyrgyzstan by 4.9 percent, and in Tajikistan by even 17.8 percent (see Figure 4 below).

Note: Year-on-Year Growth of quarterly remittances in the largest CIS recipient countries measured in local currency units.

In 2014Q3, remittances dropped more significantly measured in US dollar terms than in local currencies, and they are expected to drop even greater in the fourth quarter (26 percent lower compared with that in the same quarter in 2013). Remittances are vital for some CIS economies. In Tajikistan, for example, remittances are more than three times of total exports of goods and services. They are huge relative to the reserves, as in Kyrgyzstan (102 percent) or Tajikistan (542 percent). Hence, drastic decline of remittances not only hits families who heavily rely on them for survival, but also they can cause macroeconomic and balance of payment problems in the recipient economies.

Russia is a major source of remittances with a flow of $37 billion in 2013. Of this, the CIS countries received $24.8 billion. In many countries, remittances provide a lifeline to the economy (for example, remittances are 42 percent of GDP in Tajikistan). The fall in ruble against the dollar and in the price of oil poses major risks of a slowdown in remittances to the CIS countries.

The ruble has depreciated by more than 44 percent against the US dollar since the beginning of 2014 (of which 23 percent only in the last quarter). A less known fact is that the ruble has also been depreciating – by more than 8.5 percent - against most CIS currencies from 2011Q1 to 2014Q3. (This is calculated excluding the 21% depreciation of the Ukrainian hryvnia and the 64% depreciation of Belarusian ruble against Russian ruble - see Figure 2).

Note: Exchange rates of largest CIS remittance recipients against ruble (2011Q1 = 100)

Remittances to the CIS are expected to decline due to Russia’s economic slowdown, the sanctions against Russia due to the crisis in Ukraine, and importantly because of lower oil prices (Figure 3).

People in CIS are not solely hit because of lower growth rates in remittances from Russia (projected to be up by only 1.8 percent from 2013Q4 to 2014Q4 in ruble terms), but particularly because they receive much less for a ruble in their local currency. For instance, Uzbeks who received 4.9 trillion Soms in remittances in 2013Q4, are now expected to receive only 3.0 trillion Soms in 4Q2014 (World Bank estimates). Similarly, remittances are expected to decline in Moldova by 2.9 percent in Ukraine by 4.2 percent, in Kyrgyzstan by 4.9 percent, and in Tajikistan by even 17.8 percent (see Figure 4 below).

Note: Year-on-Year Growth of quarterly remittances in the largest CIS recipient countries measured in local currency units.

In 2014Q3, remittances dropped more significantly measured in US dollar terms than in local currencies, and they are expected to drop even greater in the fourth quarter (26 percent lower compared with that in the same quarter in 2013). Remittances are vital for some CIS economies. In Tajikistan, for example, remittances are more than three times of total exports of goods and services. They are huge relative to the reserves, as in Kyrgyzstan (102 percent) or Tajikistan (542 percent). Hence, drastic decline of remittances not only hits families who heavily rely on them for survival, but also they can cause macroeconomic and balance of payment problems in the recipient economies.

Join the Conversation