As stakeholders from around the world gather at Habitat III in Quito, Ecuador, to agree on a New Urban Agenda, one of the important questions that remains unanswered is why we continue to see housing projects that target the rich but ignore the inadequately sheltered poor.

This question has dogged me for years as I try to understand affordable housing crises gripping cities from Washington, D.C., to Nairobi. At one point, I believed the issue stemmed from a lack of financial liquidity lubricating developers’ and homebuyers’ actions. But alleviating that issue often contributes to increasing prices and building projects in the wrong places.

In my search for an answer, I asked developers and government officials in many countries why they think there is still such a mismatch. Their answers often contradict.

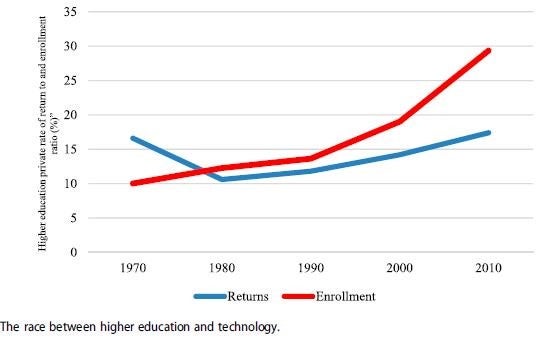

Developers say high infrastructure costs make it impossible to build lower-cost units. Meanwhile, government officials bemoan developer’s huge profits and avoidance of long-term risk. Nonetheless, academic and development literature continues to conclude the public sector needs to leverage private sector investment to close the housing gap in countries across the world.

In a one-day workshop in Nairobi in September, I began to see that providing affordable housing is not just about clearing technical hurdles but is also a communications and process issue more broadly related to forming public-private partnerships (PPPs) in urban development.

Real estate PPPs are too often posed as one-time negotiations with an assumption of clarity and trust between actors. However, using the right process, they can become a means to shape urban development rather than just a narrow opportunity to increase the provision of affordable housing. The public sector can require affordable housing as one of the goals of the partnership. To get there, PPPs require a series of dialogues, adjustments and learning opportunities that reduce risk for both governments and developers.

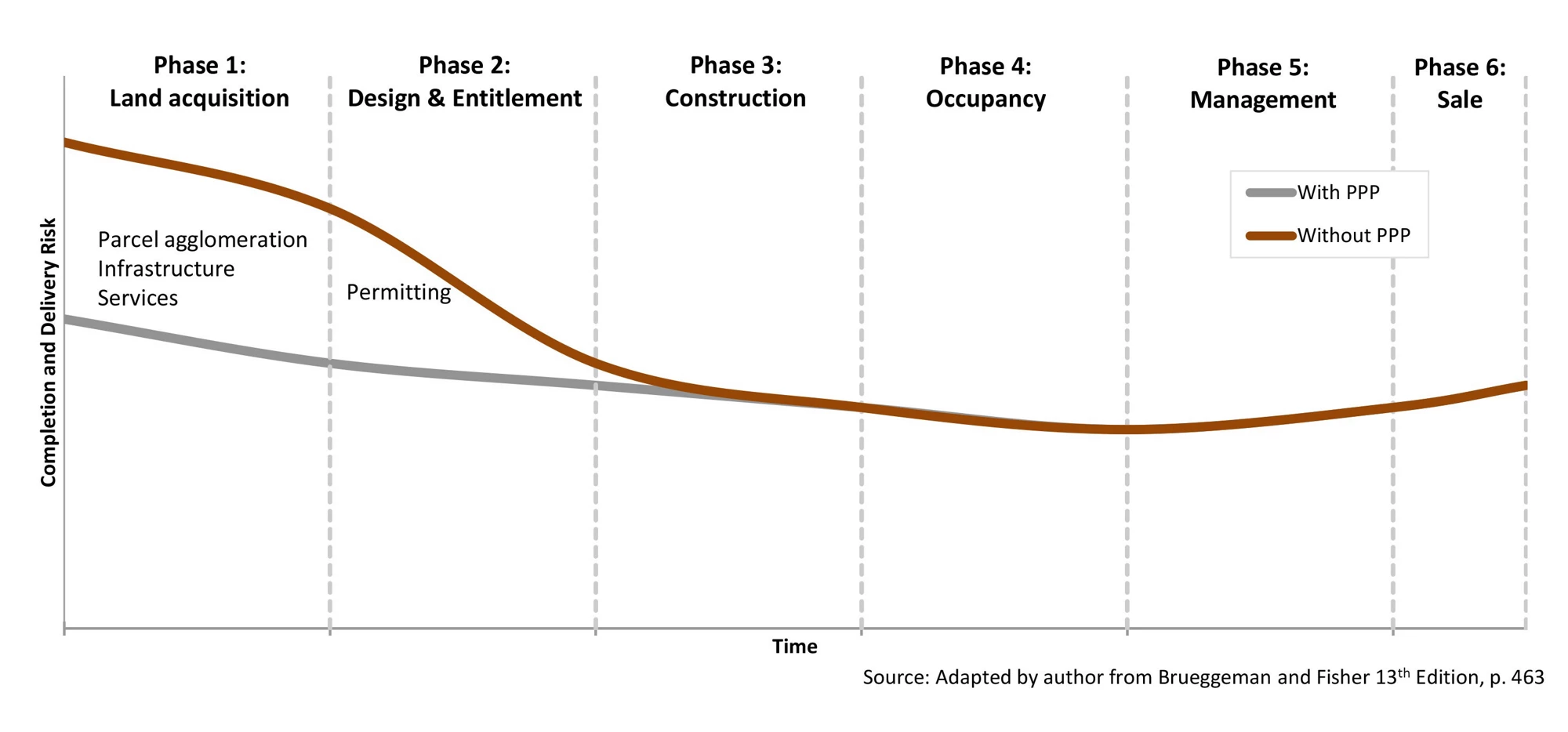

This process can be broken down into six interrelated phases that present a unique opportunity to engage public and private stakeholders to build trust through communication and risk reduction.

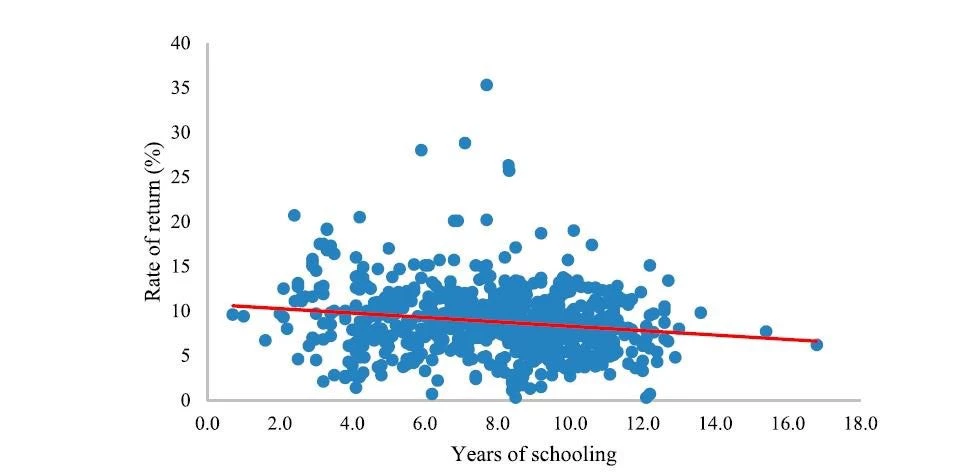

In each phase there are a variety of options and roles that each actor can pursue with two broad types of risk facing the project: completion risk and financial risk. Completion risk is the chance that a project fails to deliver the physical assets under development. Financial risk is the exposure to monetary liability. Through the seven phases of development, completion risk declines as financial risk increases.

Effective partnerships significantly reduce both types of risk. Yet, the process only works if all parties trust each other and believe the other will deliver.

Completion risk causes developers to push up the price of final products and avoid low-income projects. The public sector can reduce variability by providing underutilized land, infrastructure, services, parcel agglomeration and permitting. In return, private developers bring development expertise, construction knowledge and project management skills. In combination development hurdles are reduced to ensure the provision of affordable housing or other public goods. It also builds trust, a shared vocabulary, and opens lines of communication.

Partnerships can also significantly reduce financial risk by sharing liability between both actors. Public financing options include site proffers (such as access roads or parking structures), bonds and tax abatement. Developers often have better access to capital markets for construction debt and permanent financing. Mitigating financial risk reduces the exit price and allows the provision of down market housing while also allowing project goals to be better aligned.

Click to see larger image

In Kenya, I heard stakeholders express their desire and willingness to create affordable housing and find pathways to reduce risk. Even more exciting, I heard ideas for workable solutions submitted from all sides. This is the first step in the process of unfurling the affordable housing knot and bringing supply in line with demand. The next step is breaking the urban development process down into opportunities to increase communication, build trust and reduce risk.

In support of the New Urban Agenda under discussion in Quito, World Bank projects could facilitate this development process through output-based aid that provides a mix of technical assistance and financing through each phase of development. Under this scenario, each phase would offer vehicles to clarify project goals, create communication pathways and build capacity.

My new questions are: what do you think and where would you start?

Related Links

- Habitat III: The 3rd United Nations Conference on Housing and Sustainable Urban Development

- Habitat III – World Bank Participation

- Video Blog: Toward a “New Urban Agenda” - Join the World Bank at Habitat III in Quito

Editor's Note

Your Feedback Needed to Update the Public-Private Partnerships (PPP) Reference GuideWe are seeking your detailed input and feedback on the current version of the PPP Reference Guide (PDF), especially in the area of stakeholder engagement. Share your comments with us by November 10, 2016.

Join the Conversation